ChatGPT’s introduction of generative AI sparked an AI boom that continues to reverberate through the markets today. One thing is already clear: much of the conversation around AI centers on its capabilities, and those capabilities are nearly endless. AI has the potential to bring greater efficiency to a wide range of fields, likely extending to far more applications than we can currently imagine.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While AI may interact with us through software, it still relies on a physical backbone – processor chips, server stacks, and device interfaces that bring it to life. Bernstein analyst Mark Newman understands this dynamic and has been closely watching the AI hardware sector.

“Hardware stocks have historically lagged overall tech in large part because hardware companies have struggled to grow. That said, hardware stocks offer high dispersion, creating opportunities for near-term Alpha generation, while the potential for AI re-rating and broader growth reacceleration offer longer-duration opportunities,” Newman opined.

“Although near-term concerns of an AI-bubble persist,” the analyst added, “we see huge upside in the long-term for IT hardware. While there is a huge range of outcomes, we land at $1.3T for enterprise inference in the 2030 base case (67% 25-30E CAGR).”

Putting these themes into action, the Bernstein expert looks closely at Apple (NASDAQ:AAPL) and Super Micro Computer (NASDAQ:SMCI), two companies with strong positions in AI-capable hardware. Let’s dive in and find out which one the analyst has selected as the right AI hardware stock to buy right now.

Apple

First up, Apple needs little introduction – it is a household name everyone is familiar with. The tech giant got its start in the 70s, when it helped to launch the very idea of personal computing, and later its early Macintosh computers introduced the mouse pointer and the GUI that are now ubiquitous. Today, the iPhone and iPad, along with the MacBook line, have a devoted following, giving the company a user base one billion strong.

The company was the first on Wall Street to reach a one trillion dollar market cap; its current market cap of ~$3.8 trillion makes it the third-most valuable publicly traded company in the US and the company generated over $391 billion at the top line in its fiscal year 2024.

As noted, Apple has a large and loyal customer base; this stems from a business model decision made by the company as far back as the 1980s, when its Mac computers introduced a series of innovations that quickly made them popular with graphics and publishing professionals – but that also made them incompatible with other computer operating systems. Since then, Apple has built an entire ecosystem based on its own devices, their quality and capabilities, and their users’ loyalty. The model has worked, and supports Apple’s reputation for quality and its solid position as a leader in the world of personal technology.

Apple hasn’t just leaned on its product sales. The company has created an array of services to back them up, including the Apple Store, streaming music and TV, cloud computing, and even an online payment service. The company is supplementing its services with AI technology, and recently released the latest updates to its Apple Intelligence.

While the company has developed its ecosystem as its own entity, it does communicate with the larger digital world. Apple has created the Safari web browser, and has received multi-billion-dollar payments from Google to ensure that Safari defaulted to Google as the search engine of choice. Apple dodged a bullet here recently when a federal judge allowed Alphabet to keep paying to have Google Search set as the default search engine.

Turning to Apple’s recent financial results, we find that the company last reported for fiscal 3Q25, the period that ended this past June 28. Apple generated record June quarter revenues of $94 billion, up 10% year-over-year and ahead of the forecast by $4.88 billion. Apple’s EPS, of $1.57, was up 12% year-over-year and came in 14 cents per share better than had been expected.

Bernstein’s Newman likes what’s on offer here and sees a path to future gains. The analyst writes, “As the gateway to the Intelligence Revolution, Apple is well positioned to reap rewards from AI. We believe that the Google remedies decision not only clears a significant downside risk, but opens the path for Apple to leverage Gemini’s AI, ruling out the most severe downside cases… We continue to view Apple’s core asset – the most lucrative and sticky 1 billion users as highly attractive, which provides significant potential upside from AI if executed well. With >2.35B devices and ~1B unique users currently onboarded on Apple’s platform, an ever-growing installed base and above-industry margins, the value of the Apple brand and its ecosystem speaks for itself.”

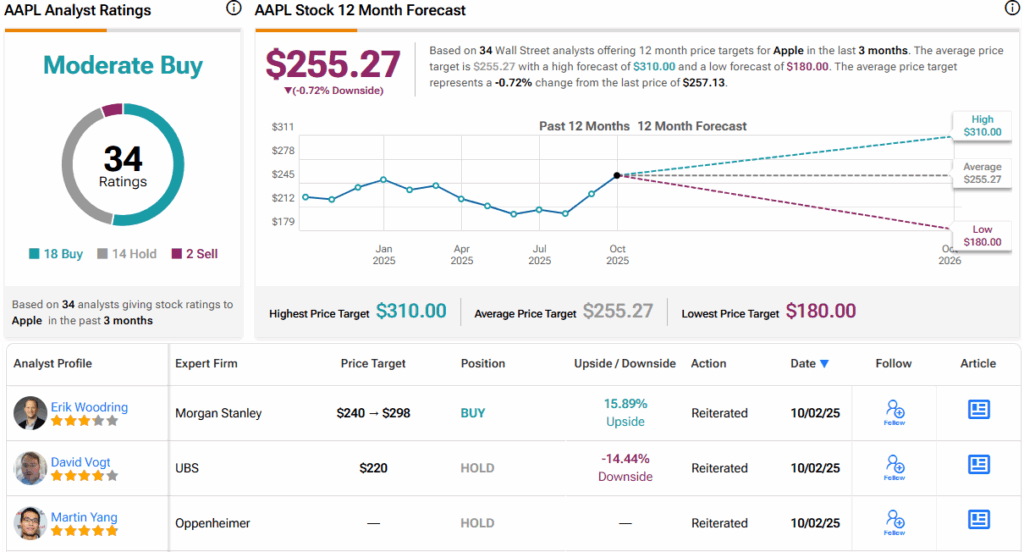

Newman goes on to rate AAPL shares as Outperform (i.e., Buy), with a $290 price target that implies a one-year upside potential of ~13%. (To watch Newman’s track record, click here)

Overall, Apple has picked up a Moderate Buy rating from the Street’s consensus, based on 34 recent reviews that include 18 to Buy, 14 to Hold, and 2 to Sell. At a current price of $257.13, however, the $255.27 average target leaves no room for upside. (See AAPL stock forecast)

Super Micro Computer

Next on our list is Super Micro Computer, a true AI hardware company. Super Micro was founded in 1993, and today is one of the world’s major producers of advanced, high-speed, high-performance computer systems and high-efficiency computer servers. This is exactly the kind of hardware that forms the backbone of AI data centers and cloud computing providers. Super Micro is also well known as a producer of enterprise-scale server stacks, GPU systems, and solid-state memory solutions. In short, this company designs and builds the hardware that makes AI possible.

Super Micro itself is a large-scale enterprise. In its 30-plus years of operation, the company has built itself into a $31 billion leader in its field, and in its last fiscal year – 2025, which ended on June 30 – it generated $22 billion in total revenue. The company has 6 million square feet of assembly space in its network of manufacturing facilities, and it has active operations in more than 100 countries. Super Micro prides itself as a leader in ‘green’ computing, designing its products for maximized efficiency while working to minimize the environmental impact of its manufacturing processes.

As part of its commitment to a greener environment, Super Micro has made modularity a key design priority in its products. The company’s servers and other components and subsystems are intended to be replaced as needed, a feature that extends the overall lifetime of the company’s computing hardware, minimizing waste and reducing long-term costs.

All of this is good, but Super Micro Computer has faced headwinds in recent years, from auditing and governance issues and recently to slowing revenue growth and missed expectations in earnings. In fiscal 4Q25, the last period reported, the company’s top line came to $5.8 billion, for 9% year-over-year growth and missing the forecast by $156 million. The firm’s bottom-line figure, the non-GAAP EPS of 41 cents, missed the forecast by 3 cents per share.

In his coverage here for Bernstein, Newman explains more about the company’s difficulty in maintaining growth and hitting the estimates on earnings. He says of this high-end computer hardware company, “Super Micro is the purest way to play AI servers in our coverage, but a recent run of top and bottom-line misses and accounting issues keeps us on the sidelines. SMCI is a near pure play in servers with 75% of revenues coming from AI servers and has enjoyed significant growth from the AI boom. As one of the major growth stories in AI servers, SMCI delivered over 100% growth in recent quarters, and is still guiding to significant double-digit growth going forward. However, we are concerned about the company’s ability to sustain market share… Moreover, we have doubts on whether SMCI’s earnings growth can continue. SMCI has now missed vs consensus for five quarters in a row, and we worry that SMCI’s strong revenue performance is unsustainable.”

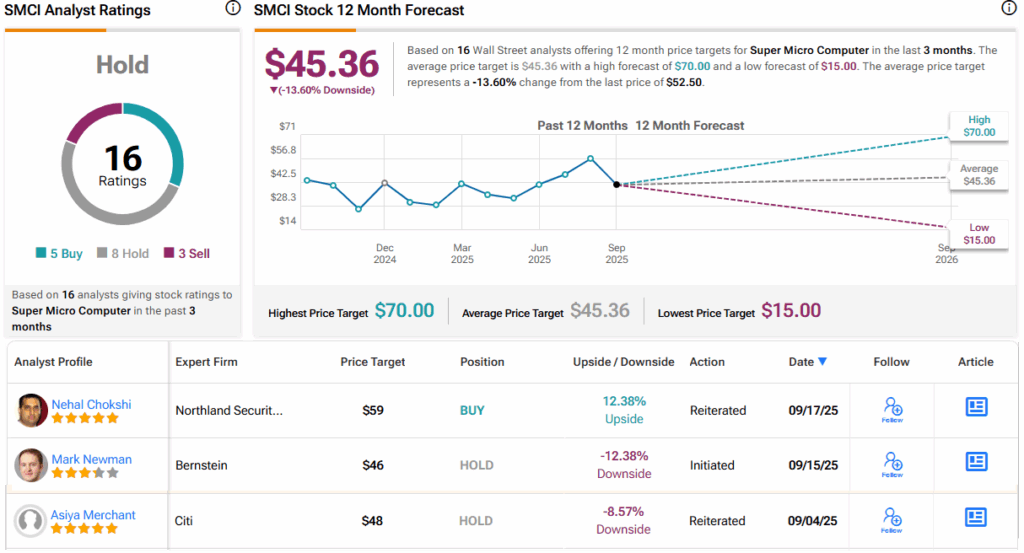

Newman’s doubts translate to a Market Perform (i.e., Hold) rating and a $46 price target that indicates a 12% downside from current levels.

Overall, this stock’s analyst consensus rating is a Hold, based on 16 recent analyst reviews that break down to 5 Buy, 8 Hold, and 3 Sell ratings. The shares have an average price target of $45.36 and a current trading price of $52.5, suggesting that the stock will tumble 14% by this time next year. (See SMCI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.