Google’s parent company, Alphabet (NASDAQ:GOOGL), shot higher yesterday, finishing the day up 4.6%, following a Bloomberg report that Apple (NASDAQ:AAPL) may be looking to Google Gemini as the AI integrated into the iPhone. Indeed, a potential Apple-Google Gemini partnership in artificial intelligence (AI) could mirror their deal with search, which was the subject of considerable regulatory scrutiny in recent years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

And while a Google-Apple AI partnership is sure to draw the ire of antitrust regulators, I see the move as a potentially massive win for both companies as they seek to gain (further) in the AI race.

With Microsoft (NASDAQ:MSFT) leading the charge on generative AI with its OpenAI stake, Apple must find a way to make up for lost time on the AI front. Teaming up with Google is a way to catch up with industry leaders like Microsoft. Also, it may be a straightforward way to pull ahead as Apple gains access to one of the most potent large language models (LLMs), Google Gemini. Given this, I remain bullish on both AAPL and GOOGL.

Apple: Teaming Up with an AI Powerhouse Could Prove Wise

While I’m sure Apple could incorporate its own LLM into its devices, I think Google is the better option at this early phase in the AI boom. Why? As good as LLMs have become in recent quarters, they’re still not immune from hallucinating (making stuff up, seemingly out of the blue).

Only time will tell when we have a robust, hallucination-free LLM ready for the market. Regardless, given Apple’s history of releasing polished products that are truly ready for takeoff, I just don’t see Apple putting itself out there with a work-in-progress type of LLM product.

As capable and impressive as they are, even the latest versions of Google Gemini and ChatGPT-4 Turbo are technically works in progress, at least in my opinion.

Neither LLM is perfect, especially at this point in the AI lifecycle, when hallucinations still happen regularly. My guess is it could take a while before LLMs are polished enough that mistakes become incredibly rare (or maybe virtually impossible).

Perhaps we may be a few quarters or even a few years away from the error-free AI that many of us envision as a sort of holy grail in AI. Given how fast generative AI technologies are advancing (think exponential, not linear, rates), though, maybe hallucination-free LLMs are a heck of a lot closer than many of us may think.

For now, I think the masses have come to accept that the occasional hiccup is bound to happen when using even the best LLM that exists today. Users of such LLMs can simply check the sources themselves to ensure they’re not on the receiving end of a hallucination. Indeed, fact-checking can be a bit of a hassle when using LLMs like Gemini or GPT-4, but it’s a relatively small compromise. Further, it’s between that and using an old-fashioned search engine.

What Could the Future Hold for the Google-Apple AI Partnership?

I don’t think Apple has anything to really gain by rushing an LLM product to market right now, especially given that today’s LLMs are prone to errors, negative headlines, lawsuits, public outrage, and all sorts of negativity.

When the perfect time comes (perhaps when LLMs have a bit more polish), though, I think Apple could have the option to replace Google Gemini with its own LLM, just like when it gave Intel (NASDAQ:INTC) the boot from Mac devices when it was ready to launch on the back of its very own Apple Silicon.

In these early stages of the AI boom, Apple stands to benefit from all the positives of AI by using Gemini without having to deal with the downsides. If something goes awry, it’s the Gemini LLM, not Apple, that’s to blame. In the meantime, look for Alphabet to gain traction as Gemini introduces itself to Apple’s golden install base, which is billions of users strong.

Indeed, Gemini in iPhone could ultimately help Google and Apple surpass Microsoft in the LLM race. It will be interesting to see how a potential Google-Apple partnership evolves. Nevertheless, if any deal is inked, I expect that GOOGL stock could face a considerable valuation multiple expansion, perhaps one closer to that of its top AI peer, MSFT stock, even if Alphabet is forced to pay Apple a hefty sum.

Even after surging 4.6% in a day, GOOGL stock still seems to have room to run at just 25.4 times trailing price-to-earnings (P/E) if it’s to catch up to MSFT stock’s 37.7 times trailing P/E multiple.

Is GOOGL Stock a Buy, According to Analysts?

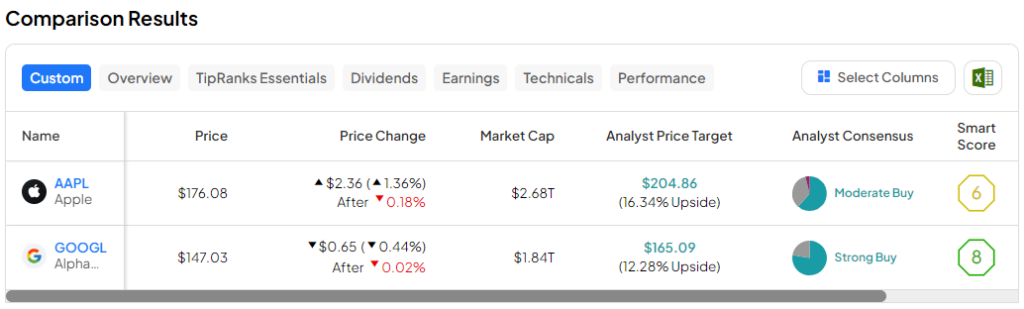

Alphabet stock is a Strong Buy, according to analysts, with 28 Buys and eight Holds assigned in the past three months. The average Alphabet stock price target of $165.09 implies 12.3% upside potential.

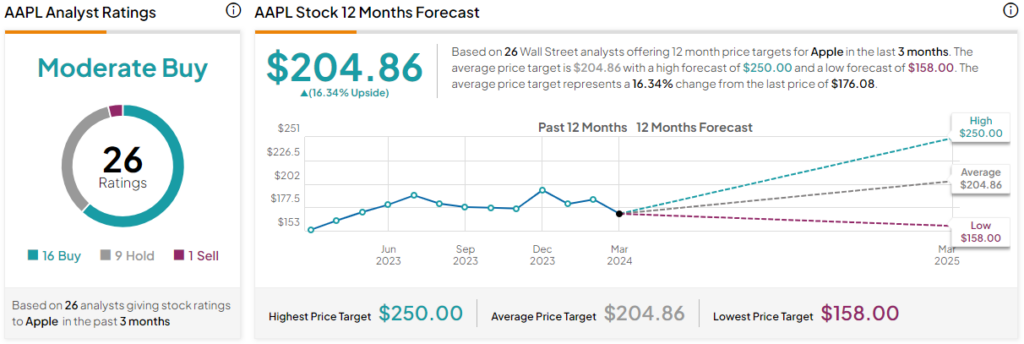

Is AAPL Stock a Buy, According to Analysts?

Apple stock is a Moderate Buy, according to analysts, with 16 Buys, nine Holds, and one Sell assigned in the past three months. The average Apple stock price target of $204.86 implies 16.3% upside potential.

The Bottom Line

It seems like a Google-Apple Gemini AI deal would be a win for both firms in a bid to pull ahead in the generative AI race. It’s important to note, however, that all we have is a report from Bloomberg about potential talks between the two companies.

The chatter about the chatter means that nothing is set in stone yet, even though recent market action suggests a dotted line has already been signed. In any case, look for Apple to go on the hunt for an AI partner as it seeks a “backstop” in this still-early (and less-than-polished) stage of generative AI.