Air Products & Chemicals (NYSE:APD) features one of the most impressive dividend growth track records within the basic materials sector. The multinational industrial gases and chemicals giant has rewarded its shareholders with dividends for 41 consecutive years. Such an achievement is especially noteworthy considering the inherent volatility that characterizes its field of operations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With the company posting record earnings in Fiscal 2022, guiding for another year of earnings growth in Fiscal 2023, and having ample room to continue growing its payouts, I believe that Air Products & Chemicals can be a compelling pick for dividend growth investors. Combined with the fact that shares appear to be trading at a reasonable valuation, I am bullish on APD stock.

Competitive Advantages to Sustain Earnings, Dividend Growth Momentum

Air Products & Chemicals features a tremendous earnings growth track record, which has, in turn, been able to sustain its legendary dividend growth streak.

For context, the company demonstrated remarkable performance in Fiscal 2022, with a record adjusted EPS of $10.41, representing an impressive 17% increase compared to the previous year. Looking ahead to Fiscal 2023, the company has set ambitious targets, projecting adjusted EPS to range between $11.20 and $11.50, indicating a projected year-over-year growth rate of 9% to 12%.

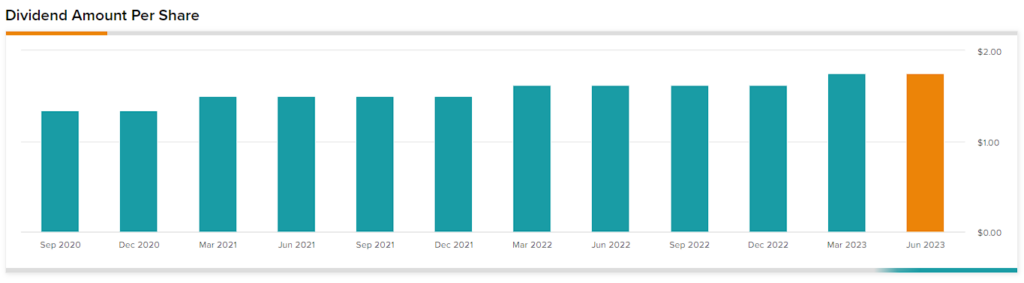

Notably, at the midpoint of this range, with an expected Adjusted EPS of $11.35, APD is poised to achieve a remarkable compound annual growth rate of 11% since 2014, reflecting a decade of double-digit sustained growth. As a result, APD has also managed to increase its dividend by a double-digit pace over the same period. From $3.02 in 2014, APD’s dividend per share has grown at a CAGR of 10% to its current annualized rate of $7.00.

Impressively, the company has been able to maintain double-digit earnings and dividend growth despite its incredibly mature operations. This is primarily due to its unique competitive advantages and moat, which allow for consistent organic growth and bolt-on, accretive M&A. Some of the company’s most noteworthy competitive advantages include the following:

Strong customer relationships: Over the years, APD has established long-term relationships with a broad range of customers, spanning from large multinational corporations to small businesses. By catering to each customer’s unique needs and building trust, the company fosters loyalty and generates recurring revenue. This makes for a great moat in a rather competitive sector.

Long-term contracts: Complementing the previous point, besides the recurring revenue from its customers, APD has also managed to establish long-term contracts with them, further enhancing its quality of cash flows. These contracts often span multiple years, providing a predictable revenue stream and creating switching costs for customers who have integrated the company’s gases and technologies into their operations.

Operational excellence: Another competitive advantage that differentiates APD when it comes to achieving superior profitability and margins is that the company focuses greatly on operational excellence and cost efficiency across its operations. Specifically, APD sets new improvement initiatives all the time, optimizing processes and leveraging economies of scale to enhance its productivity and bottom line.

Massive intellectual property: To seal the deal on its competitive advantages and overall moat, it’s crucial to mention that APD owns a vast portfolio of intellectual property, patents, and proprietary technologies. As of its most recent annual filing, APD boasts an impressive portfolio of approximately 674 United States patents and 3,245 foreign patents.

This invaluable intellectual property serves as a formidable barrier, preventing competitors from imitating APD’s innovative solutions and guaranteeing the company’s continued supremacy in the industry.

Accretive M&A: After some of the strongest competitive advantages enjoyed by APD, it becomes evident that the company’s maturity level might limit its organic growth prospects. While this claim holds some truth, APD’s management has proactively pursued a strategic approach by engaging in accretive M&A.

Its acquisitions have historically been nicely integrated into APD’s existing product portfolio, enabling the company to unlock efficiencies and leverage economies of scale. One of the biggest asset buyouts was back in 2020 when APD purchased five hydrogen production plants and the long-term supply of hydrogen from those plants from PBF Energy (NYSE:PBF) for $530 million.

These factors should continue contributing to APD maintaining its market-leading position and keep propelling its financials moving forward, as has been the case for decades now.

Dividend Growth Prospects & Valuation

As previously mentioned, APD’s exceptional competitive advantages have consistently propelled the company’s earnings and, in turn, its dividends. Looking ahead to Fiscal 2023, the company has once again provided an encouraging outlook, projecting double-digit growth in Adjusted EPS. At the midpoint of this forecast, the payout ratio stands at 61.4% based on the current annualized DPS rate of $7.00.

This indicates that APD has considerable room to comfortably expand its dividend payouts. Notably, in January, the company announced an 8% dividend increase, which, although slightly below its impressive 10-year CAGR of 10%, still represents a pleasant pace of dividend growth considering the maturity of its 41-year-old dividend growth streak.

As far as the stock’s valuation goes, APD is currently trading at 23.6 times the midpoint of management’s guidance. This multiple is modestly higher than the S&P 500’s (SPX) forward P/E of 19.8. However, I do believe that APD’s valuation premium is well-deserved given the underlying pace of earnings growth, competitive advantages, and its legendary dividend growth track record.

It certainly makes sense that investors are willing to pay a little extra for such a high-quality company. Hence, I believe that this theme will persist from here.

What is the Price Target for APD Stock?

Turning to Wall Street, APD stock has a Moderate Buy rating based on five Buys and three Hold ratings assigned in the past three months. The average APD stock price target of $329.75 implies 14.2% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell APD stock, the most profitable analyst covering the stock (on a one-year timeframe) is Duffy Fischer from Goldman Sachs (NYSE:GS), with an average return of 16.4% per rating and a 94% success rate.

The Takeaway

Air Products & Chemicals stands out as an exceptional choice for dividend growth investors within the basic materials sector. With a remarkable track record of 41 consecutive years of dividend growth, APD has demonstrated its ability to sustain earnings and dividend growth despite operating in a volatile field.

The company’s competitive advantages, including strong customer relationships, long-term contracts, operational excellence, and vast intellectual property, contribute to its consistent organic growth.

Additionally, strategic acquisitions further enhance APD’s growth prospects. With ample room to expand dividend payouts and a reasonable valuation, the stock could present an attractive opportunity for investors seeking long-term dividend growth and stability.