Rising incidences of cancer is leading to an increase in the scope of work for research and diagnostics companies. Notably, research firm Markets and Markets projects the global cancer diagnostics market to hit $26.6 billion by 2026, witnessing a CAGR of 11.5% between 2021 and 2026.

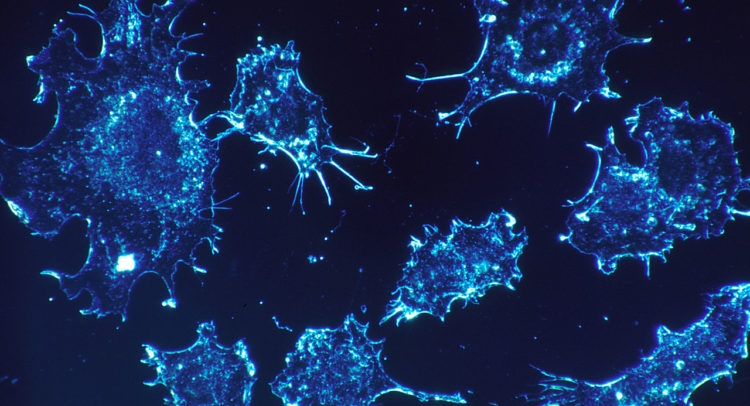

Celcuity (CELC), a leading player in this field, is currently focused on developing its next-generation cancer diagnostic discovery platform — CELsignia. The platform evaluates tumor cells for aberrant signaling in entire key pathways to ascertain the best candidates for targeted therapies.

Encouraged by this development, Needham analyst Chad Messer initiated coverage on Celcuity with a Buy rating and a price target of $50, implying a 146.3% upside potential to current levels.

Messer and his associates delved deep into Celcuity’s workflows, plans and vision, and made key observations to justify their rating.

The analyst believes that CELsignia has the potential to widen the scope of targeted therapy. Notably, aberrant signaling causes cells to turn cancerous. In many cases, multiple proteins are present in a pathway that can be mutated to cause aberrations, most of which have not been discovered. CELsignia not only gives a comprehensive and accurate view of how a patient’s cancer is progressing but also pinpoints the patients who may possess unknown gene mutations. (See Celcuity stock chart on TipRanks)

Moreover, Celcuity’s trump card, gedatolisib, is a small molecule pan PI3K/mTOR pathway inhibitor. Notably, numerous efforts to manipulate the PI3K/mTOR pathway for cancer therapy have been unsuccessful, whereas gedatolisib has already witnessed positive results from an ongoing Phase Ib trial in metastatic breast cancer. This gives Celcuity a competitive edge over its peers.

Messer said, “We believe Celcuity could prove transformative to the targeted therapy space. In the nearer term, we view the potential value creation from gedatolisib as a first-in-class pan PI3K/mTOR inhibitor as unappreciated.”

Consensus among analysts for Celcuity is a Moderate Buy based on 2 Buys. The average Celcuity price target of $40 implies 91.9% upside potential to current levels over the next 12 months.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.