Shares of fintech SoFi Technologies (NASDAQ:SOFI) surged nearly 8% on Wednesday, and investors can thank Dan Dolev at Mizuho bank for part of today’s run. This morning, the investment bank raised its price target on SoFi stock by 50%, to $9 a share, predicting the neobank will outdistance the $2 billion in 2023 revenue that it has promised.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But the other reason that SoFi stock is flying owes to another investment bank entirely.

In a deep-in-the-weeds report published by Wedbush analyst David Chiaverini, the analyst zeroed in on one particular SoFi deal that he believes looks particularly propitious for the stock. In what sounds like an arcane observation, Chiaverini observed that SoFi has begun marketing “its latest ABS deal called SCLP 2023-1S,” an asset backed security that comprises $440 million worth of loan collateral, and that SoFi will try to sell for $340 million.

With an “anticipated weighted average note coupon of 6.46%,” Chiaverini observes that SCLP 2023-1S pays “the highest note coupon of any SoFi deal to date.” What’s more, since it is being sold at a big discount to the value of the underlying collateral, the ABS will effectively pay whoever buys it annual interest of 11.2% — quite a haul even in today’s high-inflation environment.

Chiaverini further expects this ABS to attract interest (pun intended) because the FICO (i.e. credit score) of the borrowers who borrowed against the collateral in SCLP 2023-1S is quite high — 754, a number that according to Equifax qualifies as “very good.” Also very good is the income of the borrowers involved in this security — $162,000 per year on average. And when you add all those numbers up, it means the ABS in question is probably going to look really attractive to buyers of such debt, resulting in a successful sale for SoFi.

Chiaverini notes that this ABS will be SoFi’s first such consumer ABS deal sold since November 2022, which he takes as evidence that the ABS market is opening back up and could become a better source of revenue for SoFi going forward, as buyers grow more comfortable buying debt despite the looming recession and the risk of defaults that comes with it. This improves the prospect of SoFi being able to monetize more of the $5.5 billion worth of borrowings it has on its balance sheet currently.

At the same time, Chiaverini observes that SoFi’s loan balances were up 46% sequentially in Q4, giving it plenty of money available to do even more deals as the ABS market opens up.

In the analyst’s opinion, all of this adds up to a bull case for SoFi — which grew revenues 57% year over year in the most recent quarter already — continuing to grow its revenues strongly going forward. At an enterprise value 5.1 times projected 2023 sales, Chiaverini sees the stock as priced at a premium to its peers — but worth that premium. He gives the stock an “outperform” rating and assigns SoFi an $8 price target — almost as good as what Mizuho said it was worth this morning.

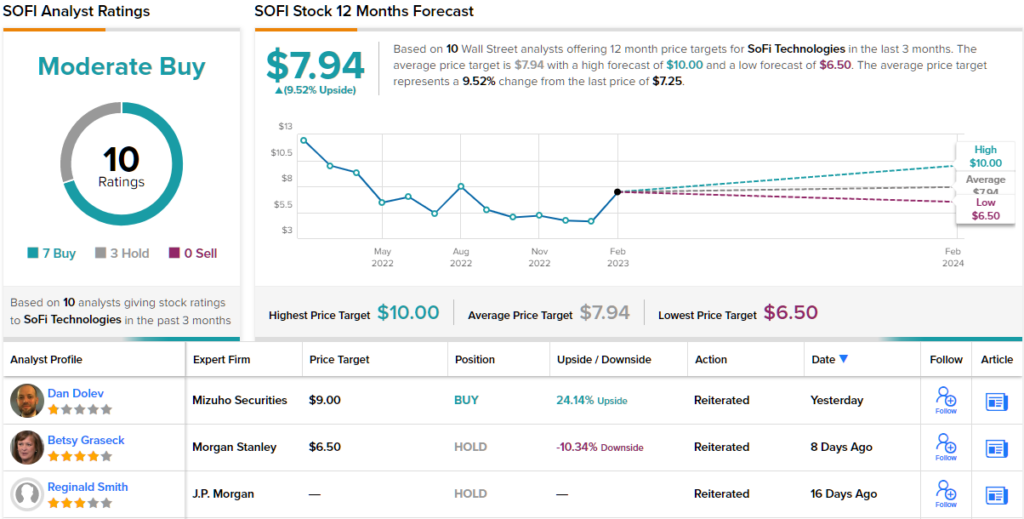

Overall, SOFI has attracted a total of 10 analyst reviews recently, including 7 Buys and 3 Holds for a Moderate Buy consensus rating from the Street. SOFI shares are priced at $7.25 and have an average price target of $7.94, giving the stock a 9.5% upside on the one-year time frame. (See SOFI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.