Accenture (NYSE:ACN) will report its fiscal third-quarter financial results on June 22 before the market opens. Ahead of the company’s Q3 earnings release, several analysts remain optimistic about the company’s long-term growth potential based on ACN’s plans to invest $3 billion into its Data and AI practice over the next three years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Overall, Wall Street expects ACN to post earnings of $3.01 per share in Q3 compared with $2.79 per share reported in the prior-year period. Meanwhile, revenue is expected to rise by 2.1% from the year-ago quarter to $16.5 billion.

Q3 Earnings: Here’s What Analysts Expect

From a note to investors dated June 14, Citi analyst Ashwin Shirvaikar believes that Accenture is well-positioned in the current economic scenario. The analyst sees ACN’s diversified offerings, strategic acquisitions, favorable forex movements, and AI-related demand boom to be key driving factors.

Thus, Shirvaikar assigned a Buy rating on the stock and raised his price target to $358 from $306.

Echoing Shirvaikar’s sentiment, analyst Bryan Bergin from TD Cowen raised his price target on Accenture to $325 from $300 and maintained a Buy rating on the stock. Bergin does not expect a considerable upside for the company’s shares following the release of the Q3 print. However, he expects shares to remain stable based on a combination of factors.

Furthermore, providing his predictions regarding Accenture’s Q3 performance, Piper Sandler analyst Arvind Ramnani expects the company’s bookings and revenue in its managed services business to continue growing. Lastly, the analyst anticipates ACN to tighten its outlook for Fiscal 2023.

Interestingly, Ramnani boosted his price target for ACN stock to $316 from $250 while also upgrading the stock’s rating to Hold from Sell.

It is worth highlighting that apart from analysts Bergin and Shirvaikar, three more analysts reiterated a Buy rating on the stock in the past eight days.

Technical Indicators Ahead of the Results

Prior to the fiscal Q3 earnings release, most technical indicators indicate that ACN stock is a Buy. According to TipRanks’ easy-to-understand technical analysis tool, the stock’s 50-Day EMA (exponential moving average) is 292.66, while the stock’s price is $317.4, making it a Buy. Further, ACN’s shorter duration EMA (20-day EMA) also signals an uptrend.

What is the Price Target for ACN Stock?

Wall Street’s Moderate Buy consensus rating on Accenture is based on 11 Buys and four Holds. Following the impressive year-to-date rally, the average ACN stock price target of $332.93 suggests upside potential of just 4.9%. The stock has gained 18.4% so far in 2023.

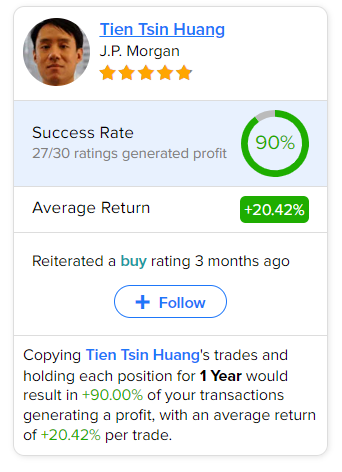

Remarkably, JPMorgan analyst Tien Tsin Huang is the most accurate and profitable analyst for ACN. Copying the analyst’s trades on this stock and holding each position for one year has resulted in 90% of transactions generating a profit, with an average return of 20.42% per trade.