Energy is everywhere, in everything we do; we can’t avoid it. The sheer ubiquity of the sector is one major factor drawing investors to it. After all, energy companies will always be able to find customers for their products, and will never lack for sales. Energy companies have also been seen as a hedge against inflation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The energy sector has been riding high this year, with the S&P 500 energy index up 61% year-to-date. So the question for investors is, do energy stocks have more room to run? According to some Wall Street pros, the answer to that is ‘yes.’

Opening up the TipRanks database, we identified two energy stocks that have recently been picking up plenty of analyst love. These stocks have earned Strong Buy ratings from Wall Street’s pros, and at least one of them may show an upside better than 60% going into next year. Let’s take a deep dive in, and find out just why these two energy firms are impressing the Street.

Denbury Inc. (DEN)

First up, Denbury, is both a hydrocarbon extraction company and a clean energy firm – demonstrating convincingly that one company can fill both of those niches. On the first, Denbury focuses on tertiary recovery, or enhanced oil recovery, in major production fields; on the second, the company is a leader in carbon capture, utilization, and storage technologies. Denbury uses its carbon capture tech to build up reserves of carbon dioxide, which can be used in enhanced oil recovery operations. In short, the company uses its carbon reserves by pumping them into the ground to push out recoverable oil.

All of this adds up to both a significant oil operation and a significant carbon capture system. So far this year, Denbury is producing some 47,500 barrels of oil equivalent daily, of which 97% or more is petroleum. The oil is extracted using both conventional and enhanced oil recovery (EOR) tech; the latter, which accounts for 28% of the company’s production, injects approximately 4 million tons of industrial-capture CO2 annually into the oil wells. Denbury is a world-leader in EOR, and is planning an expansion of its Cedar Creed Anticline field with new production to go online during 2H23.

In the recently reported third quarter of this year, revenue rose by 28% year-over-year to $439.49 million, while Denbury showed a net income of $250 million, up dramatically from the $82 million reported in 3Q21. On a per-share basis, the non-GAAP EPS of $1.90 marked a y/y jump from 74 cents. These gains reflect increases in the price of oil, and increasing demand for carbon capture and sequestration technologies. Both the top-and bottom-line figures beat Street expectations.

Stifel analyst Nate Pendleton likes what he sees in Denbury; specifically, he sees this company as an energy firm for the future. He writes, “Denbury embodies the energy transition. Not only is the company an upstream oil and gas producer that uses CO2 to produce hydrocarbons today, but Denbury is also developing carbon capture and storage (CCS) projects along the Gulf Coast. The company’s management team has unparalleled experience in delivering successful CO2 EOR projects over the last two decades.”

“Looking forward, management is leveraging their CO2 handling and subsurface expertise to build a network of integrated CCUS solutions, which offers investors a differentiated investment opportunity,” Pendleton added.

All of the above combined with a compelling valuation prompted Pendleton to rate DEN a Buy. On top of this, the analyst’s $144 price target suggests the stock has room for a robust 64% upside over the coming year. (To watch Pendleton’s track record, click here)

Wall Street is in broad agreement with the Stifel outlook on this stock – all 5 of the recent analyst reviews are positive, for a unanimous Strong Buy consensus rating. With an average price target of $118.80 and a current trading price of $87.61, the shares have an average upside potential of ~36% on the one-year time horizon. (See DEN stock forecast on TipRanks)

Vistra Energy (VST)

The second stock we’ll look at is Texas-based Vistra Energy, a utility company in the electricity business. Vistra’s services include power generation, transmission, and distribution, and the company has reported consistent year-over-year gains at the top line over the past year.

The most recent quarterly report shows the story. Vistra had $5.15 billion in revenues, up from $2.99 billion in the year-ago quarter – for a gain of 72%. In net income, the company reported a total of $678 million, of which $667 million was listed as net income from ongoing operations. EPS in the quarter came in at $1.79, a dramatic increase from the year-ago quarter’s 1 cent.

Of interest to investors, Vistra reported having $3.44 billion in total liquidity at the end of 3Q22. This total included $535 million in cash assets, with the remainder consisting of available credit facilities. The company has built up its liquid assets even as it has pursued an active program of capital return to shareholders. As of November 1 this year, Vistra has spent $2.05 billion on share repurchases, representing 63% of the $3.25 billion repurchase authorization anticipated to be used by the end of next year. The company also pays out a regular dividend, which was declared for 4Q22 at 19.3 cents per common share. The dividend has been raised in each of the last 4 quarters. At its current rate, it yields an above-average 3.15%.

In his coverage of Vistra for Wolfe Research, analyst Steve Fleishman takes an upbeat view, writing: “We worried expectations had run up, but VST cleared the bar in our view. The year is fully on track, and despite a big retrace in commodities from the peaks of summer – VST still issued 2023 EBITDA guidance above consensus and at the top-end of its own soft range. The 2024-2025 ranges are still intact and the decision to hedge aggressively looks smart.”

Looking forward from this stance, Fleishman gives VST shares an Outperform (i.e. Buy) rating, and his price target of $32 implies a one-year upside potential of ~35%. (To watch Fleishman’s track record, click here)

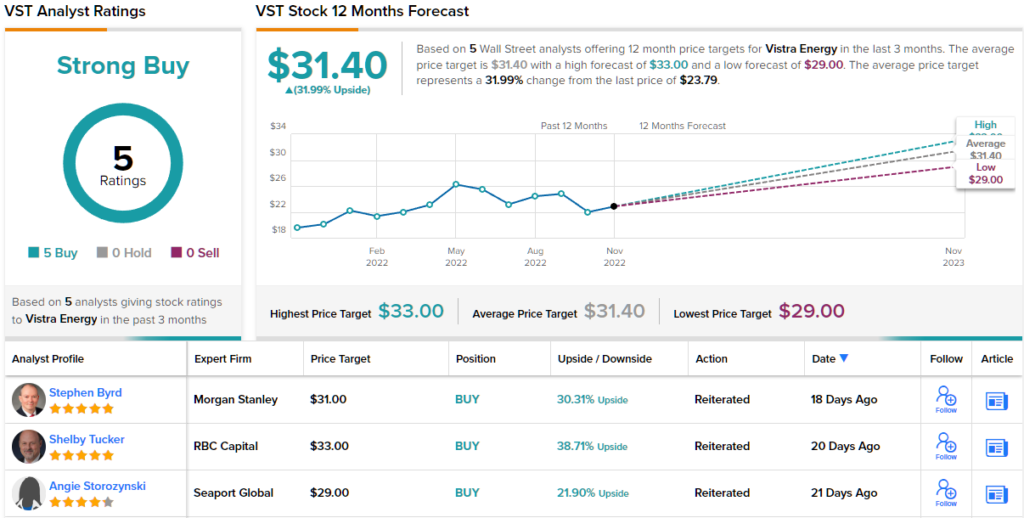

The bulls are definitely running for Vistra, which has a unanimous Strong Buy consensus rating based on 5 recent analyst reviews, all positive. The stock is priced at $23.79 and its $31.40 average price target suggests ~32% upside gain in the next 12 months. (See VST stock forecast on TipRanks)

To find good ideas for energy stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.