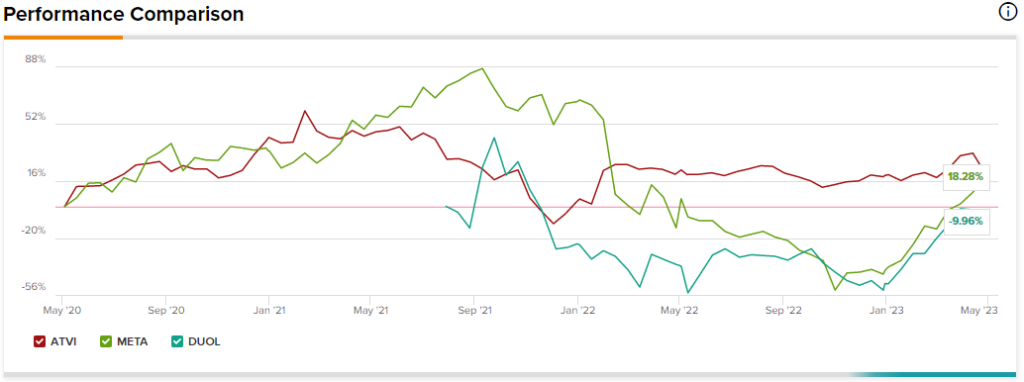

The tech sector got upended last year as the pains of every rate hike were felt almost immediately. As banks drag while tech does its best to hold up the market, many investors may find that now’s as good a time as any to rotate back into the top-ranked tech stocks as a bit of weight falls off their shoulders with every better-than-expected quarter this earnings season. Therefore, let’s use TipRanks’ Comparison Tool to check in with three Strong-Buy stocks that have exposure to either the rise of video gaming or the “gamification” of things.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

1. Activision Blizzard (NASDAQ:ATVI)

Activision Blizzard was dealt a tough blow recently as U.K. regulators shot down the proposed Microsoft (NASDAQ:MSFT) deal. Shares of the video game heavyweight plunged by double-digit percentage points on the news, and the odds of a successful deal with Microsoft have fallen considerably.

Still, Activision Blizzard is a wonderful firm, even outside the hands of the mighty software behemoth. Activision Blizzard has stellar franchises and games that seem to be excelling relative to peers. For these reasons, I remain bullish on ATVI stock, especially after the latest plunge.

Undoubtedly, the gaming space has felt the pinch of macro headwinds in recent years. Activision has not been spared from the headwinds, but it has shown signs it can hold its own and take share from rivals. The latest iteration of Call of Duty: Modern Warfare II was a huge success.

In the FPS (first-person shooter) world, there’s plenty of room for competition, but it’s a “winner takes most” scenario. And right now, Modern Warfare seems to be winning big-time at the expense of other shooters (think Battlefield).

It’s not just FPS where Activision thrives. Its mobile-gaming business, King and PC-centric Blizzard are also doing great jobs of finding a spot with consumers.

For now, most of the attention will be on the fate of the Microsoft deal. Activision Blizzard CEO Bobby Kotick thinks the U.K. block of the $69 billion deal makes no sense. I’m in agreement. The deal appears to be a win for consumers.

As Microsoft looks to iron out wrinkles for regulators, the odds of a successful deal could creep higher again, but now, it’s up in the air, and I believe ATVI stock will likely remain range-bound in the $73-$77 level for the short term.

What is the Price Target for ATVI Stock?

Activision Blizzard has a Strong Buy rating, with 17 Buys and one Hold. The average ATVI stock price target of $92.64 implies 23.1% upside potential.

2. Meta Platforms (NASDAQ:META)

Meta Platforms isn’t normally a firm you’d associate with gaming. The company has its hands in many pies that extend beyond social media, from the Metaverse to artificial intelligence (AI). Undoubtedly, Meta has endured a lot of criticism for its expensive metaverse push, as there has not been much to show for the billions spent.

Even as Meta moves from the “metaverse” keyword to “AI” in conference calls, don’t expect the firm to lose sight of its long-term vision, which sees the firm becoming a significant player in the future’s VR-powered digital worlds. Meta needs a killer application if it is to make a mark on the Metaverse. Specifically, a killer game exclusive to its version of the Metaverse. Until it reveals one, however, I’m shifting to more of a neutral position on the stock. It’s had a 170% rally off the bottom, and I think profit-taking is only prudent.

Meta has already invested a great deal in games and metaverse experiences, including the likes of Horizon Worlds. The firm even has a foundation with casual games integrated into Facebook. That said, these offerings clearly haven’t moved the needle in the gaming universe.

Until Meta can pick up its “game” (forgive the pun), its metaverse may not be able to change the world in the way Mark Zuckerberg envisions. In any case, expectations remain low. If Meta can test its luck by looking to acquire a video game firm, as Microsoft is seeking to do, I do believe Meta’s metaverse hopes could find a second wind.

At 28.5 times trailing price/earnings (P/E), Meta is pricer than its five-year historical average of 23.1.

What is the Price Target for META Stock?

Meta has a Strong Buy consensus rating based on 40 Buys, five Holds, and two Sells. At writing, the average META stock price target of $277.00 implies 16.9% upside potential.

3. Duolingo (NASDAQ:DUOL)

Shares of the free language-learning app Duolingo have been falling, giving back a portion of their massive year-to-date gains. Year-to-date, the stock’s still up 70%.

Duolingo incorporates elements of gamification (points, levels, etc.) in its language-learning platform. As the firm better monetizes its business while incorporating new tech like AI (via ChatGPT) to give personalized feedback, I am also impressed by its longer-term prospects. Though shares could still be in for more of a cooling-off period, I am bullish.

I believe language learning and AI are a match made in heaven. Duolingo’s head of AI, Klinton Bicknell, stated he was “blown away” by GPT-4’s capabilities.

Duolingo is poised to make a deeper dive into the AI waters, and I do see a pathway toward sustained profitability. For now, though, the 13.8 times price-to-sales multiple seems to bake in a lot of positivity, specifically surrounding the applicability of AI, so this is something to keep in mind.

What is the Price Target for DUOL Stock?

Duolingo stock also averages a Strong Buy, with six Buys and two Holds, and the average DUOL stock price target of $132.38 implies 9.8% upside potential.

Conclusion

AI has taken center stage, but don’t let the hot trend distract you from other areas within tech that may be richer with value. Currently, tech firms with gaming exposure may be worth watching here as the worst of headwinds look to pass.