Technology giants Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) will release quarterly earnings after the market closes on Thursday, February 1. Analysts’ consensus ratings reflect that Wall Street favors AMZN over AAPL ahead of their upcoming earnings.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In particular, AMZN’s quarterly numbers should benefit from solid holiday sales numbers, stabilization in its cloud business (AWS), and its focus on reducing costs. After the Q4 earnings release, its stock price could rise further.

On the other hand, Apple offered lower-than-expected holiday sales guidance as its hardware sales are under pressure. If the company reports weak hardware sales in Q1, its share price may take a hit to some extent. Consequently, analysts are more bullish about AMZN stock.

With this backdrop, let’s look at the Street’s forecast for their upcoming earnings.

AMZN: Q4 Expectations

Analysts expect AMZN to report revenue of $165.96 billion in Q4, up over 11% year-over-year. Solid holiday sales, durable growth in the advertising segment, and strength in its cloud business should drive its top line.

Meanwhile, leverage from higher sales and cost reductions will likely cushion its earnings. Wall Street projects that the e-commerce giant will post EPS of $0.8 in Q4, up from $0.03 in the prior-year quarter.

Is Amazon Stock Expected to Go Up?

AMZN stock has gained over 60% in one year. Despite this notable growth, Wall Street is bullish about its prospects.

Ahead of Q4 earnings, Telsey Advisory analyst Joe Feldman increased AMZN’s price target to $185 from $165. The analyst expects the company to benefit from solid holiday sales, the stabilization of AWS, and its focus on profitability.

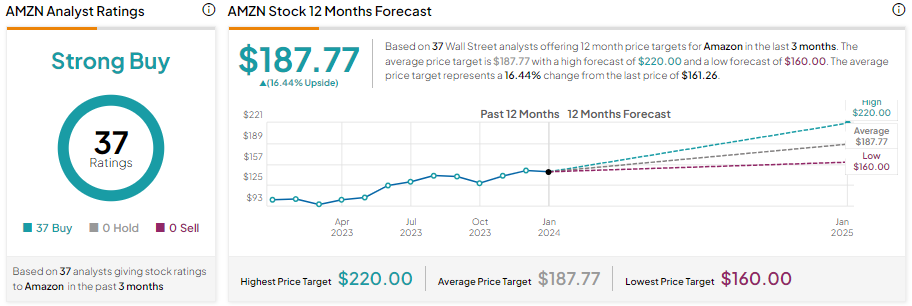

Including Feldman, AMZN stock has 37 unanimous Buy recommendations for a Strong Buy consensus rating. Analysts’ average price target of $187.77 suggests a further upside potential of 16.44%.

It’s worth highlighting that options traders are pricing in a +/- 6.57% move on earnings, slightly lower than the previous quarter’s earnings-related move of 6.83%. The expected move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement. Learn more about TipRanks’ Options tool here.

AAPL – Q1 Expectations

Analysts expect Apple to report revenue of $117.99 billion in the first quarter of Fiscal 2024. This is roughly in line with the company’s prior-year sales of $117.22 billion. Softness in iPhone demand and an expected year-over-year decline in iPad and Wearables, Home, and Accessories will likely hurt AAPL’s top-line growth rate. However, strength in the Services business could continue to drive sales.

Wall Street projects that AAPL will post earnings of $2.1 per share, up from $1.88 reported in the prior-year quarter. The analysts expect Apple’s bottom line to benefit from cost reductions.

Is Apple a Buy, Hold, or Sell?

Apple stock has gained nearly 35% over the past year, despite ongoing pressure on its product sales. Goldman Sachs analyst Mike Ng reiterated a Buy recommendation on AAPL stock on January 24. However, he lowered AAPL’s price target to $223 from $227. Further, the analyst lowered his EPS estimates. The analyst sees short-term headwinds from lower product sales and tough year-over-year comparisons.

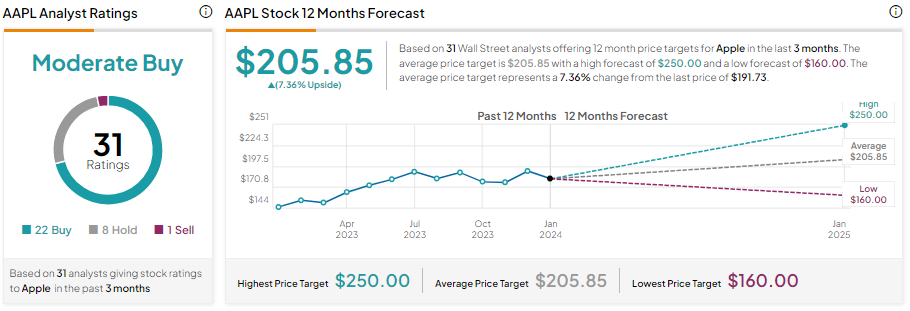

Overall, Apple stock has received 22 Buy, eight Hold, and one Sell recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $205.85 implies an upside potential of 7.36% from current levels.

Meanwhile, options traders are pricing in a +/- 3.70% move on earnings, higher than the previous quarter’s earnings-related move of -0.52%.

Bottom Line

Both the tech giants, AMZN and AAPL, possess solid fundamentals that can drive long-term growth. However, analysts favor AMZN stock over AAPL ahead of the quarterly print. Further, AMZN stock has outperformed AAPL over the past year and offers a higher upside potential from current levels.