Maurice Patrick is a Managing Director at Barclays Capital, with around 20 years of experience in the telecom industry – often bullish on his sector, there are two stocks in particular he has highlighted as good investment options.

Before joining Barclays in 2009, Patrick worked with JP Morgan and Bear Stearns. He also worked with telecom companies before starting his journey as an analyst.

As per the TipRanks star rating system, Patrick is a four-star rated analyst with a success rate of 52%. He is ranked 1,897 out of 7,938 analysts on TipRanks and 3,235 out of a total of 20,818 experts on the site.

The TipRanks Expert Centre has a list of such analysts, and the stocks they have rated. The analysts range across different sectors, and investors can check through their recommendations for better returns.

He has an average return of 3.9% per rating. However, Patrick’s best rating generated an 88% return in 2021. The stock was Airtel Africa (GB:AAF) and Patrick had a Buy rating on it.

Let’s discuss the two telecom stocks in detail.

BT Group: Defensive stock

BT Group (GB:BT.A) is a British multinational telecommunications company which is the biggest provider of fixed-line, broadband, and mobile services in the UK.

Despite the market uncertainty, the shares of BT performed better than the market in the first-half of this year. The stock is up by 4% in the year to date.

Even though BT is the leader in the telecom industry, the UK market is mature so it is hard to find new customers. The company is fighting this with a cost-saving plan and expansion of its fibre and 5G networks.

BT has always been a safe-haven income investment. The company announced a full-year dividend of 7.7p per share, which leads to a total shareholder return of 22.7%.

The one concern investors have is the debt burden on the company. As of March 31, 2022, the company’s net debt was £18 Billion up from £17.8 Billion in 2021. This could hurt the dividends in the long-run.

It will be interesting to see the quarterly results of the company next week.

View from the city

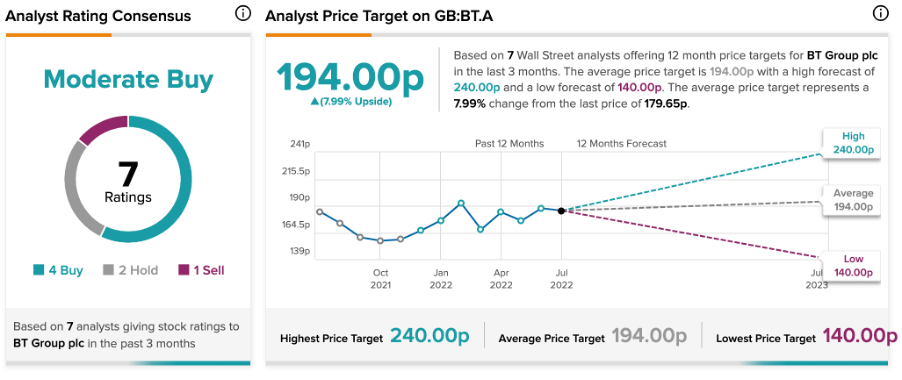

According to TipRanks’ analyst rating consensus, BT Group stock is a Moderate Buy. The company has seven ratings, including four Buy, two Hold, and one Sell.

The average price target is194.0p, which implies upside potential of 8%.

However, Patrick is more bullish on this stock and has a target price of 240p, which is 34% higher than the current price. His success rate on this stock is 53%, with a profit of 9.3%.

Gamma Communications: Stable growth ahead

Gamma Communications (GB:GAMA) is a leading provider of communications and software services in the UK and Dutch markets.

Even though the stock is not a large cap, there are a lot of movements in the price. Gamma’s stock is down by 32% YTD.

In its last results for the year ended December 2021, the company posted a 14% growth in revenues and gross profits. Gamma’s growth is a result of a growing demand for its products by enterprises in today’s digital-oriented world.

The company expects to drive further growth from its UK direct business from new project wins, which will be reflected in the second half of 2022. This segment will grow at a 10% year-on-year rate.

This year, the company increased its dividends to 8.8p. Even though the dividend is below the industry standard, if the company can sustain it, it makes investors happy. The company’s debt is at £3.3 Million which is down from £5.9 Million last year.

Considering the debt and earnings growth prospects, investors should not worry about sustainable dividends.

View from the city

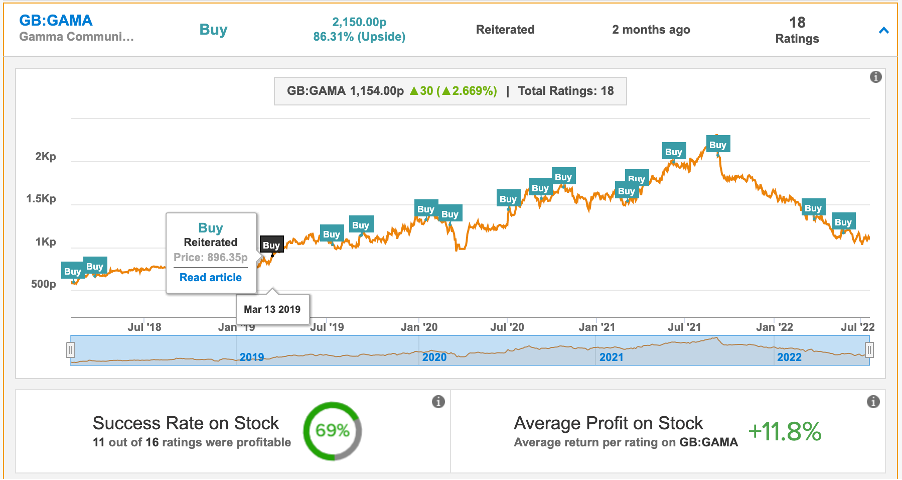

According to TipRanks’ analyst rating consensus, Gamma stock has a Moderate Buy rating based on two Buy ratings. The average price target is 2,150p, which is 86.31% higher than the current price.

Patrick has a 69% success rate on the stock and an average profit of 11.8%.

Conclusion

Patrick is optimistic about the stocks considering their solid future ahead and stable dividend values.