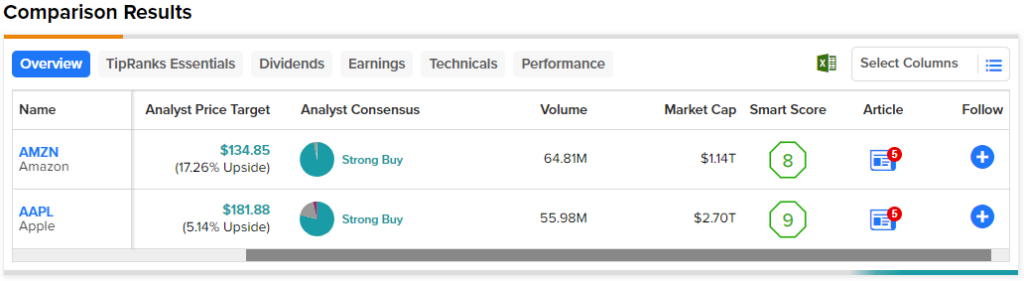

In this piece, I evaluated two big tech stocks, Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL), using TipRanks’ comparison tool to determine which is better. Of course, Amazon and Apple need no introduction. Amazon has exploded 34% year-to-date, bringing its one-year return to 3.5%. Meanwhile, Apple is up 38.7% year-to-date and 21% over the last year. Notably, Apple is trading close to its record high, while Amazon is significantly off its all-time high.

Technology stocks have been broadly outperforming those in other sectors. Although tech names make up several of the highest-weighted names in the S&P 500 (SPX), it has gained about 8% year-to-date versus the tech-heavy Nasdaq’s (NDX) 26% year-to-date gain. Thus, investors might be wondering whether there’s any near-term upside left, so a closer look is in order.

Amazon (NASDAQ:AMZN)

Amazon has faced some issues recently that may be restraining its stock. However, given its long-term stability, a bullish view looks appropriate, as the current restraints on its stock price appear to have created a nice entry point for investors.

It’s long been a challenge to estimate Amazon’s valuation because it has so many moving parts. In addition to the e-commerce business the company is so well-known for, it also has recurring revenue in the form of Prime subscriptions.

Additionally, the Amazon Web Services platform serves numerous companies. Amazon also has its own devices and other branded products for sale on its platform and is developing various technologies, including Alexa, its digital assistant backed by artificial intelligence.

Notably, hedge funds unloaded 10 million shares of Amazon in the last quarter, which is one driver of the sell-off. Still, the company’s Retail segment generated $343 million in operating losses for the first quarter, a massive improvement from the $2.85 billion it lost in the year-ago quarter. Amazon Web Services continues to generate Amazon’s profits, although its operating expenses have risen, just as they have at other tech companies.

Amazon’s net income margin fell into the red for 2022, at -0.5%, but it began to recover in the first quarter, coming in at 0.8% for the last 12 months. As things stand now, it looks like Amazon is starting to recover, which is why its stock is up so much year-to-date. However, it looks like there will be more room to run in the near term.

Even if Amazon shares stagnate temporarily, I believe that buying and holding them for the long term will likely generate solid returns because this company isn’t going anywhere.

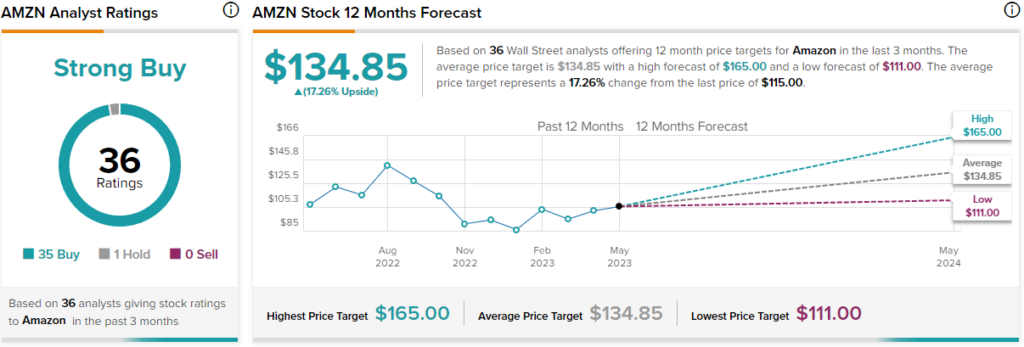

What is the Price Target for AMZN Stock?

Amazon has a Strong Buy consensus rating based on 35 Buys, one Hold, and zero Sell ratings assigned over the last three months. At $134.85, the average Amazon stock price target implies upside potential of 17.3%.

Apple (NASDAQ:AAPL)

On the one hand, Apple is one stock many investors buy and hold for the long term. However, on the other, the iPhone maker is trading close to its record high, making Amazon look like the better value option. Since a better entry point appears likely in the near future, a neutral view seems appropriate for Apple, but only in the short term.

Like Amazon, Apple is a stable, steadily-growing technology company. Of course, it’s far more profitable, as it isn’t saddled with an e-commerce business that often loses money and retains ultra-low profits when it’s in the green. However, Apple is trading at a price-to-earnings (P/E) multiple of 29.2 versus its five-year average P/E of 25.4, making it look slightly overvalued.

While hedge funds widely sold Amazon, they gobbled up over 16 million shares of Apple in the last quarter. Warren Buffett‘s Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) also bought more Apple shares in the last quarter.

What is the Price Target for AAPL Stock?

Apple has a Strong Buy consensus rating based on 22 Buys, five Holds, and one Sell rating assigned over the last three months. At $181.88, the average Apple stock price target implies upside potential of 5.1%.

Conclusion: Bullish on AMZN, Short-Term Neutral on AAPL

At this stage, it’s hard to go wrong with either Amazon or Apple. Many investors consider Amazon and Apple as both stocks they would buy and hold for the long term. Neither company looks like they’re in danger, as they are both stable and growing, but Amazon looks slightly better than Apple in terms of its valuation.

Of course, though, a recession or general downtick in investor sentiment for tech stocks could create better entry points for both.