Many consumers are doing everything they can to resist the insidious effects of elevated inflation. Whether it’s trading down from big brands to generic alternatives or cutting nice-to-haves completely out of the equation, it’s not a mystery that consumers have favored retailers—like AMZN, COST, and WMT—that have allowed them to maximize value from every purchase.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The consumer battle with inflation is taking a major toll on all consumers, and it wages on, with the latest inflation data coming in a tad too hot to justify a June rate cut. In any case, expect the following retail juggernauts to continue faring well in this environment as they attempt to trim operating costs without cutting into the quality of their goods and services.

Let’s check in with TipRanks’ Comparison Tool to compare the three Strong Buy retail behemoths that are tough to compete against when it comes to value for one’s dollar.

Amazon (NASDAQ:AMZN)

Amazon stock has been on a red-hot run, up more than 74% over the past year alone, thanks in part to its impressive footing in the artificial intelligence (AI) race and stabilization in its digital retail business. When it comes to getting competitively priced goods shipped to one’s door, Amazon is in a league of its own. The company has set such a high bar on product pricing and rapid, affordable delivery that it’s become quite tough for retail rivals to keep up.

That’s a major reason why many U.S. customers turn immediately to Amazon if there’s something timely that they need. Though customers have felt a bit of the pinch amid inflationary woes, Amazon Prime memberships have continued to boom, with Consumer Intelligence Research Partners reporting approximately 180 million Prime members as of March 2024.

With Prime Video and other services thrown in, Prime stands out as one of the stickiest subscriptions out there, even in the era of subscription churning and cuts.

Though many other retailers have torn a page out of Amazon’s playbook with retail subscriptions and promises of free (or low-cost) delivery of a wide range of goods, Amazon has remained the top dog to beat. And at this juncture, it looks like nobody will dethrone the king. As AMZN stock looks to make higher highs, I’m inclined to stay bullish on the name.

The company has effectively used its size to its advantage, and with increased automation at the firm’s warehouses (its all-new “Sequoia” robotics system stands to augment rather than “replace” human workers), I find it likelier that Amazon will widen the gap with its much smaller retail rivals.

Finally, look for Amazon to accelerate its push into the physical realm with new “Just Walk Out” convenience stores that boast cashier-less tech.

What Is the Price Target for AMZN Stock?

Amazon stock is a Strong Buy, according to analysts, with 41 unanimous Buys assigned in the past three months. The average AMZN stock price target of $212.21 implies 17.1% upside potential.

Costco (NASDAQ:COST)

The local Costco stores have been absolutely packed of late. Between offering gold bullion amid the precious metal’s latest melt-up, $1.50 hotdogs that have defied the inflationary environment, and continuing to offer unmatched value with its Kirkland Signature brand, Costco seems to know what its customers want, even if they don’t. Indeed, consumers are starved for a deal these days. And for those willing to pay the annual price of admission, there are bargains galore to be had.

More recently, the stock corrected by around 10% following the release of an incredibly mild earnings “beat” (upside surprise of just over 2%). For those waiting for an opportune time to buy the stock on weakness, there now appears to be a chance. Personally, I’m bullish on the stock after its latest dip. Not every analyst on Wall Street is pounding the table, though.

Gord Haskett’s Chuck Grom downgraded COST stock earlier this month, citing concerns over its valuation. Even after the latest pullback, COST stock isn’t exactly cheap at 46.9 times trailing price-to-earnings (P/E), well above the discount store industry average of 33.1 times.

That said, I do believe COST stock is worth the premium price tag, given it’s been the place to shop to fight off the pest that is inflation. And since inflation isn’t over yet, Costco shoppers can be expected to keep filling up their carts with low-cost grocery essentials.

As inflation dies down and shoppers have more money to spend, look for them to spend it at Costco, as the firm looks to bring the next must-have discretionary item to storefronts.

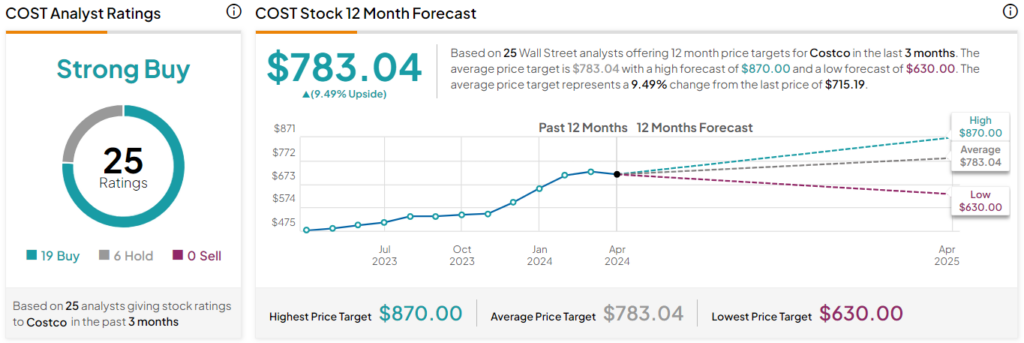

What Is the Price Target for COST Stock?

Costco stock is a Strong Buy, according to analysts, with 19 Buys and six Holds assigned in the past three months. The average COST stock price target of $783.04 implies 9.5% upside potential.

Walmart (NYSE:WMT)

Walmart is a grocery-heavy retail behemoth that’s been steadily moving higher lately. Its shares are now up 21.2% over the past year, thanks in part to the rush toward lower-cost grocery items. As the company continues investing in its technological capabilities, the firm finally looks like a worthy match for Amazon. For now, I’m inclined to stay bullish.

Undoubtedly, many retailers have succumbed to the Amazon effect, whereby consumers expect rapid (and free) delivery of items at the very best prices — but not Walmart, a firm that’s managed to keep up with Amazon. Walmart remains America’s top grocery shopping destination, with its incredibly low prices and pretty speedy deliveries of its own with the Walmart+ service.

Though Walmart may not be on the absolute cutting edge of artificial intelligence (AI) and automation like Amazon, I see a great deal of runway for the firm to drive higher-margin growth as it keeps its tech cap on. Moving ahead, I’d look for Walmart to make a big splash with its advertising business (Walmart Connect) as it looks to gain access to the invaluable data from the recently acquired smart TV firm Vizio (NYSE:VZIO).

At writing, shares trade at a rather lofty 31.2 times trailing price-to-earnings (P/E). That’s quite high for Walmart. That said, if you seek one of the market’s top inflation fighters, the stock looks to be well worth the premium of admission.

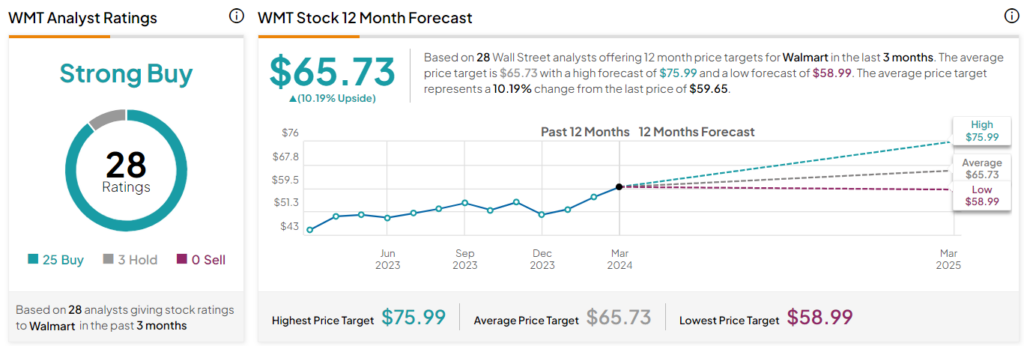

What Is the Price Target for WMT Stock?

Walmart stock is a Strong Buy, according to analysts, with 25 Buys and three Holds assigned in the past three months. The average WMT stock price target of $65.73 implies 10.2% upside potential.

The Takeaway

The following retail giants have helped many consumers dampen the heavy blow of inflation. With hot inflation data coming in, I’d not bet against the three retail juggernauts, even as their valuations remain a tad on the swollen side. Of the trio, analysts expect the greatest gains to be had from Amazon (17% upside) for the coming year.