Thanks to a stronger dollar, European designer goods brands are on a roll. Enticed by the attractive deals, more and more Americans have been shopping for high-end brands in European countries. As a result, luxury goods companies like Hermes (OTC: HESAF) and LVMH Moet Hennessy Louis Vuitton (GB: 0HAU) (OTC: LVMUY) posted upbeat Q3 results driven by robust sales growth. However, given their premium valuations, they do not suggest attractive buying opportunities.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Louis Vuitton reported organic sales growth of 19% in Q3, which is impressive given the weak global macro environment. Concurrently, Hermes reported Q3 sales growth of 24% on a constant-currency basis to €3,136 million, driven by strong growth across all its business segments and regions.

It is well-known that European luxury goods are priced higher in the U.S. to account for import duties, cost of transport, etc. However, with the strengthening of the dollar, the gap between the prices in the U.S. and Europe has widened significantly. This attracted American shopaholics to Europe in large numbers.

As a result, high-end luxury brands delivered strong sales growth in the most recently reported quarter.

On the pricing side, however, the luxury goods makers are in a fix. They cannot bring down the prices in the U.S. as that may bring down their brand value, nor can they increase the prices in European locations, given weaker spending and the potentially negative impact on sales.

Let’s take a look at what the Wall Street community thinks of these high-end European luxury stocks from an investment point of view.

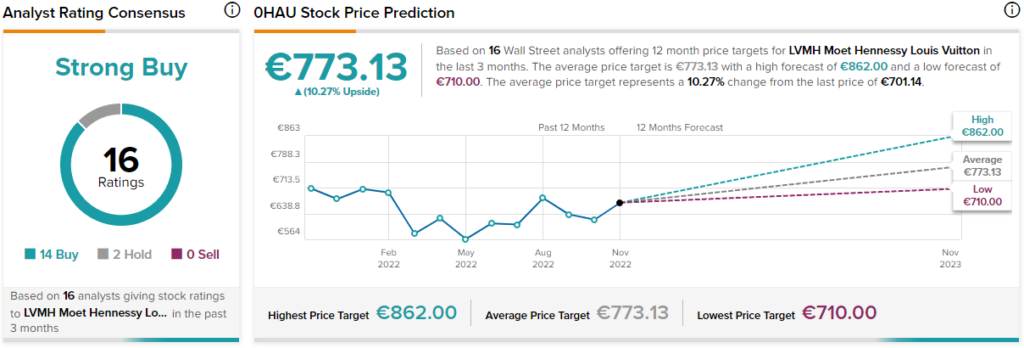

Is LVMH Stock Worth Investing In?

The Wall Street community is clearly optimistic about Louis Vuitton stock. Overall, the stock commands a Strong Buy consensus rating based on 14 Buys and two Holds. Louis Vuitton’s average price target of €773.13 implies 10.3% upside potential from current levels.

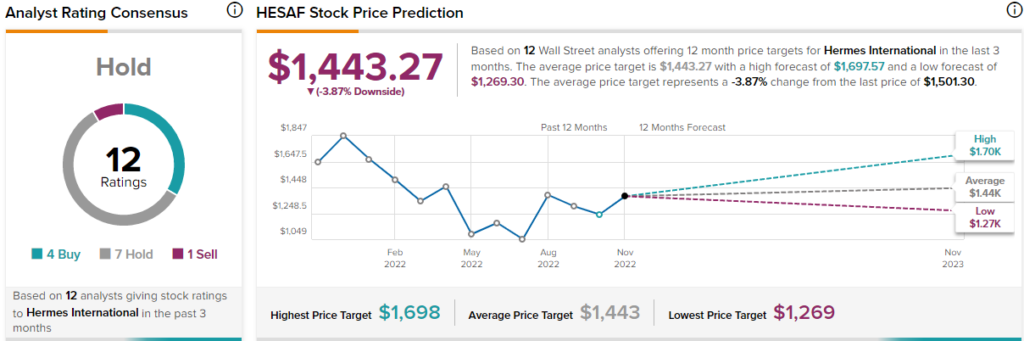

Is Hermes Stock a Good Buy?

As per TipRanks, Hermes stock has received four Buys, seven Holds, and one Sell recommendation for a Hold consensus rating. Hermes’ average price target of $1,443.27 implies 3.87% downside potential from current levels.

Takeaway: Strong Results, High Valuation

Both stocks have registered strong gains, especially in the last month following upbeat Q3 results and double-digit sales growth.

In terms of valuation, both Hermes and Louis Vuitton are trading at a premium compared to the peer group and their own historical averages. Hermes is currently trading at a P/E ratio of 48x, while Louis Vuitton has a P/E ratio of 26.7x. Both are higher than the industry PE ratio of 19x. Given the relatively higher P/E numbers, investors may want to remain on the sidelines.