American Airlines (NASDAQ:AAL) is set to announce its second-quarter 2023 earnings results on July 20 before the market opens. The recovery in air travel demand to pre-pandemic levels during the to-be-reported quarter might have supported AAL’s performance. Additionally, the decline in fuel prices, which is seen as a positive factor for the airline industry this year, has likely contributed to the company’s bottom-line expansion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Overall, the Street expects AAL to post earnings of $1.58 per share in Q2 compared with $0.76 in the prior-year period. Meanwhile, revenue expectations are pegged at $13.74 billion, representing a year-over-year jump of 2.4%.

In a research note to investors last week, Barclays analyst Brandon Oglenski noted that U.S. travel demand has been strong this summer, even amid macro uncertainty. Furthermore, the analyst expressed optimism that AAL’s Q2 results could be positively impacted by solid yields and lower jet fuel prices.

Oglenski raised his price target on AAL stock to $18 from $15 while maintaining a Sell rating on the stock.

Technical Analysis on AAL Stock Indicates a Buy

Ahead of the Q2 earnings release, most technical indicators indicate that AAL stock is a Buy. According to TipRanks’ easy-to-understand technical analysis tool, the stock’s Moving Averages Convergence Divergence indicator is 0.76, making it a Buy. Further, AAL’s Price Rate of Change is 10.58, which also signals an uptrend.

What is AAL Stock’s Price Target?

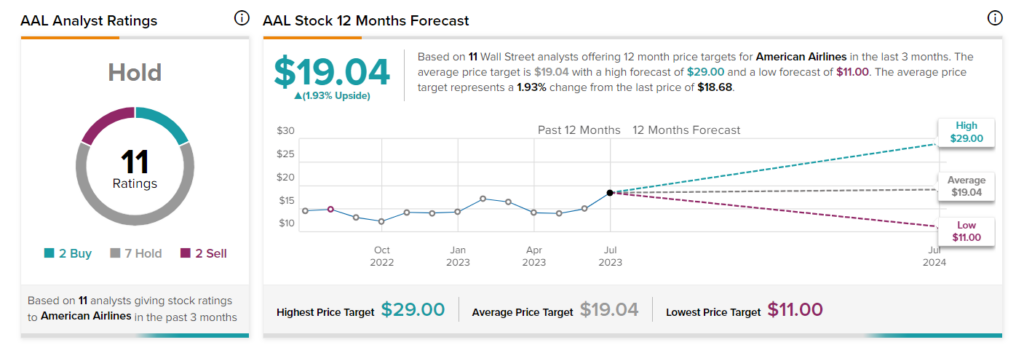

Overall, Wall Street is sidelined on the stock, with a Hold consensus rating. This is based on two Buy, seven Hold, and two Sell recommendations assigned in the past three months. The average AAL stock price target of $19.04 implies 1.9% upside potential from here. Shares of the company are up 46.6% year-to-date.