The TipRanks ‘Perfect 10’ Smart Score club can be pretty tough to get into, especially in a market that’s been slammed with high rates and consumer-spending headwinds. Arguably, stocks with Smart Scores above eight are impressive enough to warrant your attention! As you may know, Smart Scores gauge stocks based on a wide range of metrics, from fundamentals to corporate insider transactions.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Indeed, a Smart Score can change at any time. That’s why it’s a wise idea for value hunters to check in regularly with TipRanks’ screeners to see what tops the list in any given week or month. This week, we’ll check in with three stocks — AMD, STZ, and SHEL — that sport Perfect 10 Smart Scores and Strong Buy consensus ratings from the analyst community.

Advanced Micro Devices (NASDAQ:AMD)

Artificial intelligence (AI) stocks have been hot for most of the year, and they could stay hot going into 2024. AMD has been a major player in the CPU and GPU scene for many years. More recently, AMD made a big splash in the APU space (the AI chip scene) with the MI300 chip.

Looking ahead, AMD is well-equipped to further improve its position in the AI race as it looks to capture a larger piece of the data center AI accelerator market, which is expected to hit $150 billion by 2027. Undoubtedly, the market seems like it’s Nvidia’s (NASDAQ:NVDA) for the taking, but make no mistake, AMD can still do well as player number two. For that reason, I am staying bullish on AMD.

At the end of the day, AI hardware is a commodity — a hot commodity, but a commodity nevertheless. As long as AMD doesn’t fall drastically behind Nvidia on the performance front over the coming years, the firm should feel the wind on its back as the entire AI market continues “skyrocketing,” as AMD CEO Lisa Su put it.

Like Nvidia, AMD has an impressive AI lineup that spans both hardware and software. Even if AMD can’t surpass Nvidia at the very highest end of APUs and GPUs, it can still do incredibly well for shareholders. I’d argue that AMD doesn’t have to beat Nvidia to keep the gains coming in strong. Total addressable markets surrounding AI are large enough that there could be many winners over the coming years.

For now, analysts’ sights are set on data center growth potential. Morgan Stanley’s Joseph Moore seems to think AMD will be a “significant outperformer” versus the sector from these levels. Notably, Moore expects the MI300 could drive $2 billion in sales next year on the back of robust demand for AI hardware.

I think Moore will be proven right for sticking with AMD stock and the potential behind the MI300. Demand for leading AI chips has been hot and will likely stay hot well into next year’s end, and it won’t be just Nvidia that will benefit.

At writing, AMD stock is off around 24% from its 52-week high of $132.83. The pressure is thanks in part to softer guidance (server guidance was flat year over year). Finally, at 7.5 times price-to-sales (P/S), AMD stock trades in line with its semiconductor industry average of 7.5 times, giving it a reasonable valuation.

What is the Price Target for AMD Stock?

AMD has a Strong Buy rating on TipRanks, with 22 Buys and seven Holds. The average AMD stock price target of $140.25 implies 37.6% upside potential.

Constellation Brands (NYSE:STZ)

Constellation Brands is an alcohol company that hasn’t been too far from new highs over the past few years. That said, shares were struggling to sustain a breakout past $250 per share up until recently, when Constellation stock finally broke through the ceiling of resistance, hitting a high of $272+. Though shares have slipped just north of 4%, it’s encouraging that the multi-year ceiling of resistance at around $250 now acts as a pretty strong level of support.

Technically speaking, Constellation stock is pretty sound. It’s not just the technicals that are sound, though. The stock has a lot going for it fundamentally (and in other aspects), as demonstrated by its perfect Smart Score rating. As such, I am sticking by my bullish stance for the year ahead.

Earlier this month, TD Cowen analyst Vivien Azer went from neutral to bullish, also raising her price target to $300, which implies more than 15% upside from today’s close of $260 per share. Azer noted the firm had a strong summer season and potential market share gains. Indeed, Constellation’s brands seem to be shining through. For Fiscal Year 2024, Azer sees just shy of 8% sales growth, which is pretty good for a low-tech, relatively defensive firm in a potentially rocky economic environment.

What is the Price Target for STZ Stock?

Constellation Brands is a Strong Buy, with 14 Buys and two Holds. The average STZ stock price target of $287.06 implies 10.2% upside potential.

Shell (NYSE:SHEL)

Shell is a European integrated oil giant that’s been steadily climbing to multi-year highs in recent months. Undoubtedly, higher oil prices are always a welcome tailwind for energy companies. Even as oil prices came back to Earth from their 2022 highs, I view Shell stock as an energy play worth holding onto for the long haul. Specifically, Shell’s long-term transition into renewables is encouraging. As such, I am staying bullish on the name.

At writing, shares trade at around 7.9 times trailing price-to-earnings, slightly higher than the oil & gas integrated industry average of around 6.9 times. I view the slight premium as worthwhile, given the firm’s generous track record of returning capital back to shareholders. The multi-billion-dollar share buybacks and dividend hikes (shares currently yield an impressive 3.58%) make Shell one of the more shareholder-friendly firms in the “big oil” space.

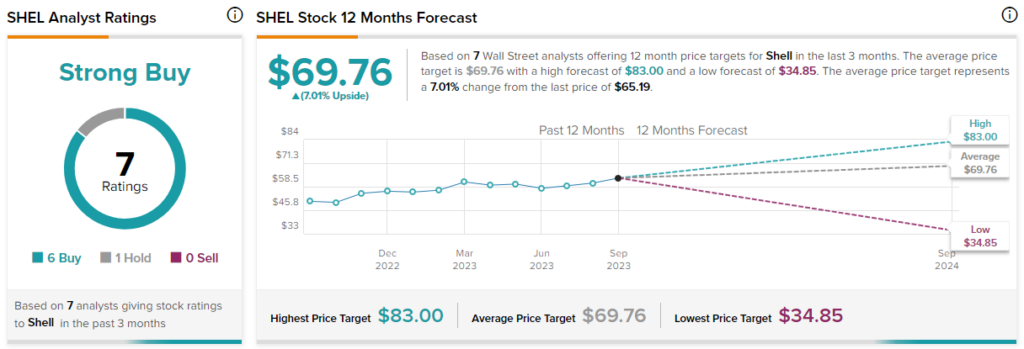

What is the Price Target for SHEL Stock?

Shell is a Strong Buy on TipRanks, with six Buys and one Hold rating assigned in the past three months. The average SHEL stock price target of $69.76 implies 7% upside potential.

Conclusion

AMD, Constellation Brands, and Shell are in an exclusive club, with flawless Smart Scores and Strong Buy consensus ratings among analysts. Of the trio, analysts expect the most upside (37.6%) from AMD stock at current levels.