On paper, semiconductor stalwart Advanced Micro Devices (NASDAQ:AMD) produced a reasonably solid report for the first quarter. However, the company is competing against technology juggernaut Nvidia (NASDAQ:NVDA) in multiple advanced arenas, most notably artificial intelligence. Therefore, investors needed more than just a solid print. Unfortunately, the generative AI space may be overhyped, warranting a cautious approach. Therefore, I am bearish on AMD stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Hitting Certain Right Notes Wasn’t Enough for AMD Stock

When looking at Advanced Micro’s Q1 earnings results without broader context, it appears that the company did enough to assuage its shareholders. Analysts were looking for earnings per share of 62 cents, which the company met. On the top line, experts projected sales of $5.47 billion. Instead, the tech firm posted $5.48 billion. Further, as TipRanks reporter Vince Condarcuri mentioned, the revenue tally represented a 2.2% increase from the year-ago quarter.

Notably, AI-related endeavors undergirded the top-line expansion. “Data Center revenue jumped by 80% year-over-year to $2.3 billion. The main driver of this segment was AMD’s MI300 AI accelerator. The MI300 is a competitor to Nvidia’s H100 chip and costs about 33% less. It also tends to be better suited for memory-intensive tasks, such as simulations,” wrote Condarcuri.

Moreover, Advanced Micro CEO Dr. Lisa Su mentioned that widespread AI deployment was driving demand. In response, the company ramped up its Data Center business to “enable AI capabilities across our product portfolio.”

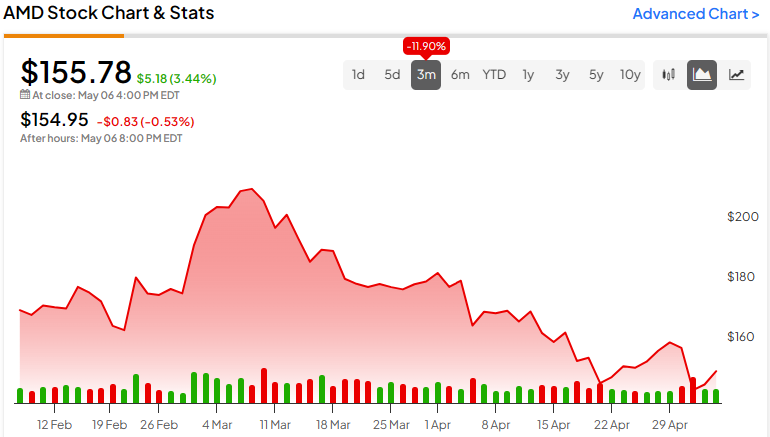

Looking ahead to Q2, management believes that revenue will land between $5.4 billion and $6 billion. Analysts previously modeled for sales to reach $5.69 billion. From a bird’s-eye view, the tech giant appeared to be saying the right things. However, investors disagreed, with AMD stock slipping sharply following the earnings report.

Harsh Realities Cloud the Q1 Report

Although Advanced Micro delivered many encouraging statistics, Q1 wasn’t a perfect print. In particular, the company suffered from lower revenue in its Gaming and Embedded business unit. Per AMD’s earnings conference call, it disclosed that total revenue declined 11% sequentially because the aforementioned unit offset its data-center-focused GPU sales.

That’s a problem for two reasons. First, Nvidia represents the clear leader in GPU sales associated with the AI ecosystem. Yes, it’s true that many experts have projected generative AI to command a valuation of $1.3 trillion by 2032. However, the tech arena is not a democracy.

With Nvidia’s technical edge, it’s possible that it can take the lion’s share of the AI hardware market, leaving everybody else fighting for scraps. Since those are expensive scraps, investors may not be in the mood for “good enough.” Conspicuously, while AMD stock is down almost 9% in the trailing month, NVDA is up nearly 5%.

In other words, Advanced Micro needs to take the fight to Nvidia. Delivering an 11% sequential quarterly revenue decline wasn’t what the market wanted.

Second and more importantly, AI could be overhyped. While the evolution of AI and machine learning has offered groundbreaking solutions, they’re still works in progress. Last year, Harvard Business Review warned that what it termed the AI hype cycle has been distracting companies. Though AI is undoubtedly a powerful tool, it’s not a miracle worker.

A huge vulnerability regarding AI is that it’s not always accurate. As academic researchers have pointed out, large language models are prone to “hallucinate” – in other words, make stuff up. In certain contexts, the consequences for such false information are rather minimal; perhaps a school teacher gives a failing grade to a student.

However, there’s much talk about computers taking over human jobs. Whether we’re talking about legal guidance or accounting or some other service, accuracy is critical. If it turns out that generative AI is incapable of an acceptable level of accuracy, then the whole innovation is rather pointless.

Rethinking AMD’s Valuation

If AI’s capabilities are found wanting, then Advanced Micro will need to rely on its other business units to pick up the slack. However, it’s these units that are underperforming, which may be why investors are spooked about AMD stock. The underlying company has too many eggs in one basket, and that basket may undergo a valuation adjustment.

For Fiscal 2024, analysts, on average, anticipate revenue of $23.88 billion. However, it’s possible that if AI doesn’t live up to the hype, Advanced Micro could hit the lower end of the spectrum, which sits at $22.71 billion.

Right now, AMD stock trades at 10.4x trailing-year revenue. That’s well above the semiconductor sector’s average multiple of 4.05x. Now, let’s just assume the AI industry falters. AMD could find itself trading at an even higher multiple of 10.7x or worse.

Is Advanced Micro Devices Stock a Buy, According to Analysts?

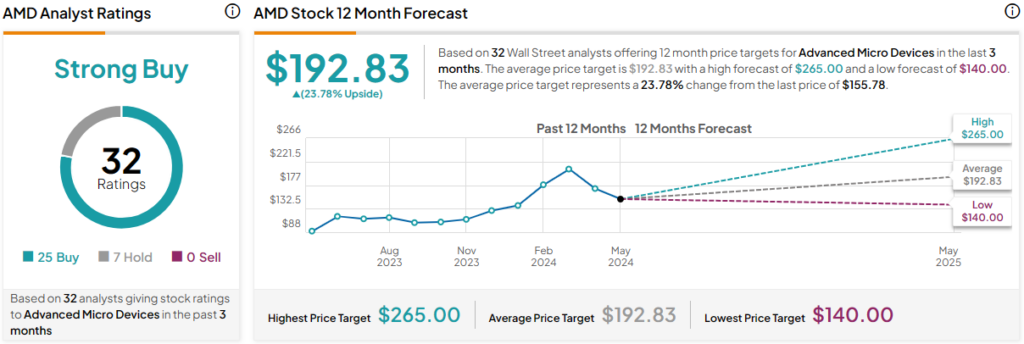

Turning to Wall Street, AMD stock has a Strong Buy consensus rating based on 25 Buys, seven Holds, and zero Sell ratings. The average AMD stock price target is $192.83, implying 23.8% upside potential.

The Takeaway: AMD Stock Was Good but Not Good Enough

At first glance, Advanced Micro appeared to deliver satisfactory results for its Q1 earnings report. However, investors were looking for more amid Nvidia’s dominance in the AI space. In addition, AI runs the risk of being overhyped, requiring AMD to shore up its other business units, something it failed to do in the last quarter. With the possibility that the company could suffer a negative valuation adjustment, AMD stock presents risks for investors.