Advanced Micro Devices’ (NASDAQ:AMD) Q3 results amounted to a display of strength across the board, with the semi giant delivering a report and guide that outpaced Street expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue reached a record $9.25 billion, up 35.6% year-over-year and exceeding expectations by $500 million. The results did not include any revenue from MI308 GPU shipments to China.

The Data Center segment generated $4.3 billion, beating the $4.13 billion forecast and rising 22% YoY, driven largely by strong demand for 5th Gen EPYC processors and the Instinct MI350 Series GPUs. The Client and Gaming segment also performed strongly, delivering $4 billion, up 73% YoY. Within that, Client revenue hit a record $2.8 billion, for a 46% YoY increase, fueled by record Ryzen processor sales and an improved product mix. Gaming revenue was $1.3 billion, surging 181% YoY on higher semi-custom revenue and strong demand for Radeon gaming GPUs. At the bottom line, adj. EPS came in at $1.20, beating estimates by $0.03.

Looking ahead to Q4, AMD called for revenue of ~$9.6 billion, suggesting 25% growth and above consensus at $9.15 billion. The company expects an adj. gross margin of 54.5%, in line with the analysts’ forecast.

After initially sending the stock down following the readout, investors seemed to have warmed to the print, with the shares turning positive in Wednesday’s session. Now, Cowen analyst Joshua Buchalter says investors can “look forward to the trajectory of the DC-GPU business and a long-term model update next week.”

The 5-star analyst is referring to AMD’s Analyst Day, which takes place next Tuesday (November 11). Buchalter expects key topics will likely include the long-term financial model through 2028, updated AI market share expectations across CPUs, GPUs, and DPUs, and AMD’s go-to-market strategy vs. competitors like Nvidia. Management could also provide early insights on new products, including the MI5XX GPU architecture, 6th Gen EPYC “Venice” CPUs, performance updates for the ROCm software stack plus more detail on the upcoming MI450/Helios racks. Buchalter thinks no new customer announcements should be expected due to confidentiality.

All told, Buchalter thinks AMD’s prospects are sound, with the company setup to make the most of the AI opportunity. “Overall,” the analyst summed up, “we view AMD’s forward roadmap and progress building out its software ecosystem as reinforcing our confidence it can create and capture meaningful value in AI over time. Against a very large and still early AI compute TAM, we believe AMD is laying the groundwork to cementing its position as the de facto merchant alternative to NVIDIA’s leadership position… while continuing to take meaningful share in the still-large (and profitable) CPU market.”

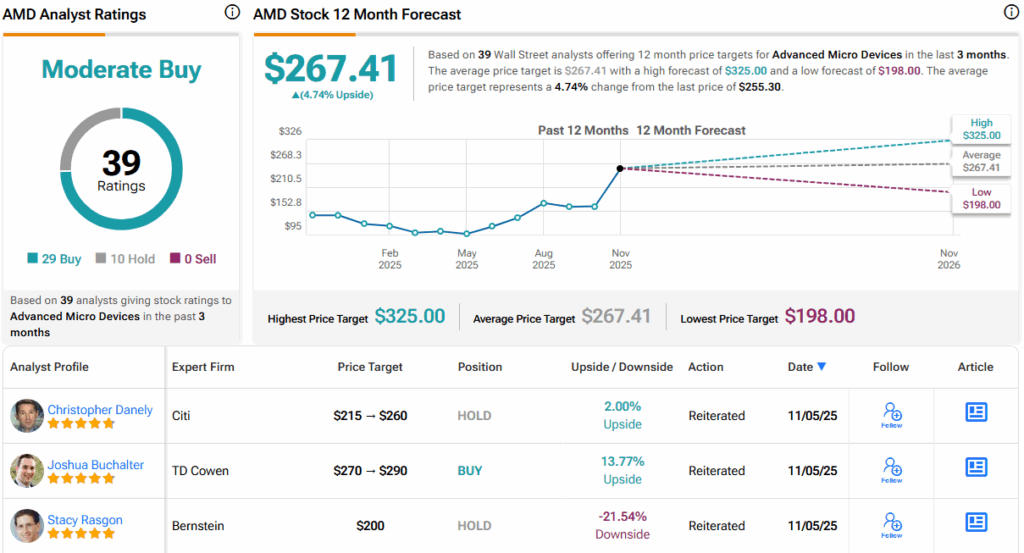

Bottom line, Buchalter reiterated a Buy rating on the shares and raised his price target from $270 to $290, implying the stock will gain 14% in the months ahead. (To watch Buchalter’s track record, click here)

28 other analysts also take a favorable view of AMD’s prospects while an additional 10 Holds add up to a Moderate Buy consensus rating. The $267.41 average target points toward one-year gains of 5%. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.