AI (Artificial Intelligence) brings enormous growth opportunities for Advanced Micro Devices (NASDAQ:AMD) stock. For instance, AMD’s CEO Lisa Su highlighted during the Q2 conference call that AI (Artificial Intelligence) offers the company a multibillion-dollar growth opportunity, spanning across multiple verticals, such as cloud computing and edge technology.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the 2023 Communacopia and Technology Conference, Su reaffirmed that AI remains the top priority for AMD. She also stated that the company is witnessing a consistent increase in customer engagement within the AI domain, keeping most Wall Street analysts in awe of AMD stock.

Investors should note that the company has increased its AI-related R&D and go-to-market investments to capture a significant market share. In addition, it is rapidly expanding its ecosystem of AI hardware and software partners. All these indicate that AMD, like Nvidia (NASDAQ:NVDA), is expected to benefit significantly from the unprecedented demand for AI platforms.

Following the Communacopia and Technology Conference, Goldman Sachs analyst Toshiya Hari reiterated the Buy recommendation on AMD stock. Moreover, his price target of $137 implies an upside potential of $25.375 from current levels. While Hari is bullish about AMD stock, let’s look at the consensus rating for AMD stock.

Is AMD a Buy, Sell, or Hold?

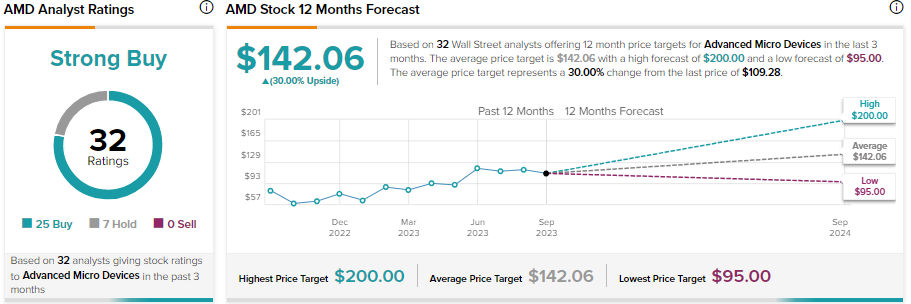

AMD stock sports a Strong Buy consensus rating on TipRanks, reflecting 25 Buy and seven Hold recommendations. Further, it has received 21 Buy recommendations from 27 Top Wall Street analysts covering the stock.

Overall, analysts’ 12-month average price target of $142.06 implies an upside potential of 30% from current levels.

Investors should note that TipRanks identifies the Top Wall Street analysts per sector, per timeframe, and against different benchmarks. The ranking is based on an analyst’s ability to deliver higher returns through recommendations. Following the ratings, TipRanks’ algorithms calculate the statistical significance of each rating, the analysts’ overall success rate, and the average return.

The Final Takeaway

AMD stock is up about 69% year-to-date. Meanwhile, the strong demand for its MI250 accelerator and the launch of MI300 in Q4 are encouraging signs for future growth. Additionally, the expected recovery in the PC segment and AMD’s focus on the high-end market are expected to bolster its growth trajectory. Further, analysts’ Strong Buy consensus rating supports its bull case.