While AI leader Nvidia (NASDAQ:NVDA) reported stellar Q1 earnings, computer processor and graphics card maker Advanced Micro Devices (NASDAQ:AMD) relatively underperformed, only meeting expectations. This led to a decline in the stock price, post-earnings. However, investors must note that NVDA is a few quarters ahead of AMD. AMD is showcasing impressive growth in its AI-driven Data Center revenues, which will ultimately flow into margins and profits. Therefore, I am bullish on AMD stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AMD’s Muted Q1 Earnings Failed to Impress Investors

On April 30, AMD reported Q1 EPS of $0.62, in line with analysts’ estimates. The figure came in a mere 3.33% higher than the Q1FY23 figure of $0.60 per share. Q1 revenues grew 2.2% year-over-year to $5.47 billion, also roughly in line with consensus estimates. Robust Data Center segment revenues somewhat offset the weakness in the Embedded and Gaming segments, but the overall Q1 results were lackluster.

Crucially, Data Center revenue growth continued to impress, growing an impressive 80% year-over-year during the quarter, driven by the launch of its latest MI300 AI accelerators, Ryzen, and EPYC processors. Disappointingly, however, Gaming revenue fell 48% year-over-year due to a decline in gaming chip sales. Further, adjusted gross and operating margins were uninspiring, standing at 52% (78.4% for Nvidia) and 21%, respectively.

Next, AMD’s revenue guidance met street expectations. For Q2, total revenue is expected to be around $5.7 billion (+/- $300 million). Positively, however, management raised the outlook for data center GPU sales, which are now expected to come in at $4 billion versus $3.5 billion guided earlier. The firm’s adjusted gross margin is forecast to be approximately 53%.

AMD’s AI Product Roadmap Presents Strong Growth Potential

A relatively underwhelming Q1 print and fears of AI demand waning have led to a 28% decline in AMD’s stock from its all-time high of $227 in March 2024 to around $164 currently.

However, investors should note that AMD is the closest competitor to NVDA. It is well known that AMD’s GPUs are a cheaper alternative to NVDA’s GPUs. Given the clear gap between demand and supply due to limited manufacturing capacity, the surge in the popularity of AI creates an opportunity for AMD chips to fill in the gap.

For instance, Microsoft (NASDAQ:MSFT) recently announced that its cloud computing customers using Azure can opt for AMD’s MI300 chips along with NVDA’s H100 GPUs. This will give customers an alternative in case of overall supply constraints or clients’ individual budgetary constraints. Notably, AMD’s MI300 accelerator, which competes with NVDA’s H100 chips, costs 33% less.

While Nvidia is currently leading in the AI and GPU markets with over 80% market share, AMD’s competitive pricing and performance improvements could help it gain market share over time. It is worth noting that MI300 is reckoned as the fastest-ramping product in the history of AMD. Launched just two quarters ago, it has already crossed the $1 billion sales milestone.

It’s no wonder, then, that AMD’s management has been consistently increasing the outlook for MI300 sales for the past three quarters. There is a strong likelihood that the sales increase trend will continue for the upcoming quarters as well.

It’s important to note that AMD has a wider variety of offerings compared to NVDA. While NVDA is well-known for its powerful GPUs for data centers, AMD caters to a wider range that includes CPUs for PCs and GPUs for the gaming industry. During COVID-19, the PC market saw roaring demand. Now, it’s time again for users to move to new PCs with upgraded technology. AMD is a key supplier to the high-end PC market and is bound to benefit from the uptick in demand for PCs.

Further, both NVDA and AMD continue to unveil their newest products, including accelerators and processors. While AMD launched its MI300 accelerators in December 2023, NVDA launched its Blackwell GPUs in March 2024.

In response to NVDA’s pace of innovation, AMD’s CEO Lisa Su also announced an annual cadence of new product launches at the Computex show held on June 2. The product roadmap looked impressive with newer launches year-on-year expected to incrementally add to revenues and profits.

Notably, AMD has consistently undertaken acquisitions to enhance its data center offerings. For instance, it acquired Xilinx in February 2022 and Pensando Systems in May 2022. Moreover, the acquisitions have not yet been integrated to their full potential and are expected to yield a $10 billion cross-selling opportunity, as cited by management. With its acquisitions, its total addressable market continues to grow, having increased to $300 billion currently from just under $80 billion in FY2020.

AMD’s Valuation Is Not Cheap but Still Appears Reasonable

Surprisingly, AMD is trading at a high forward P/E multiple (47x), slightly higher than the AI prodigy Nvidia, which is trading at a forward P/E of 45x. What could be the reason for AMD’s high valuation despite lagging behind NVDA’s inspiring results? The answer is clear: AMD will likely follow in NVDA’s footsteps in the next few years, as its AI growth story is just beginning.

Now, let’s consider whether it’s worth buying AMD at current levels. Wall Street analysts expect AMD’s EPS to be approximately $5.59 in FY2025 (with expectations of around $6.50 in FY2026). If AMD keeps the same forward P/E multiple of 47x by then, its share price will be about $275, or 68% higher than the current price.

Putting it differently, AMD shares are trading at a P/E of 28x its FY2025 EPS estimate, implying a 35% discount to its five-year historical average of 43x.

Therefore, it makes sense to consider buying AMD stock at current levels, given the strong growth fundamentals in the AI space.

Is Advanced Micro Devices Stock a Buy, According to Analysts?

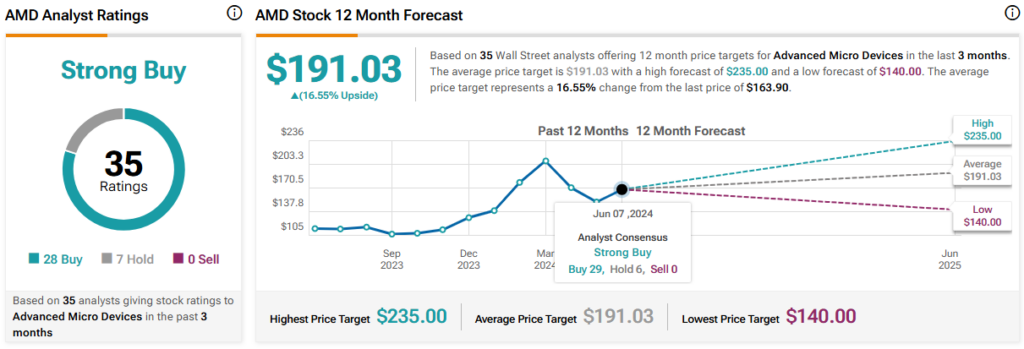

The sentiment among Wall Street analysts is decidedly positive regarding Advanced Micro Devices stock. The stock boasts a Strong Buy consensus rating, with 28 Buy recommendations and seven Holds. AMD stock’s average price target of $191.03 implies 16.6% upside potential from current levels.

Conclusion: Consider AMD for the Long-Term AI Potential

There is a clear-cut demand for AI across a broad range of industries as companies look to build their own data center infrastructure. This implies that strong growth in sales for AI chips, GPUs, and CPUs will continue for at least some years. AMD’s advancements in AI and data center solutions position the company well for future growth, and its competitive pricing will help it gain market share over time.

Furthermore, AMD has a strong foothold in the AI market for PCs and will likely continue to win market share. The impending PC upgrade cycle with AI-enabled PCs will add to sales and margin growth for AMD in the coming quarters. Given my bullish stance, I view the current share price weakness as a buying opportunity.