Semiconductor company Advanced Micro Devices (NASDAQ:AMD) will release its third-quarter financial results on Tuesday, October 31. Analysts see a sequential and year-over-year improvement in its top and bottom lines in Q3, led by new product ramps across the Data Center and Client segments.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In a note to investors dated October 16, TD Cowen analyst Matt Ramsay said, “After a 1H23 characterized by the dramatic shift in spending towards GenAI, we view headwinds as beginning to ease as evidenced by the company’s 3Q guidance issued on the prior earnings call.” Encouraged by the company’s forward guidance, Ramsay is bullish on AMD stock and has a price target of $135.

With this backdrop, let’s look at Wall Street’s consensus estimates for AMD’s third quarter.

AMD – Q3 Expectations

Wall Street expects AMD to post revenue of $5.70 billion in Q3, which compares favorably to the prior-year quarter’s revenue of $5.57 billion. Moreover, analysts’ Q3 revenue projection shows a sequential improvement and is in line with the company’s guidance.

During the Q2 conference call, AMD’s management said that the Client and Data Center segments will register double-digit growth on a quarter-over-quarter basis in the third quarter. This is expected to boost the company’s overall revenue. However, the Gaming and Embedded divisions may continue to face challenges.

On the bottom line, analysts expect AMD to post earnings of $0.68 per share, compared to an EPS of $0.67 in the prior-year quarter. Moreover, AMD’s Q3 EPS is expected to show a sequential improvement. Notably, it reported an EPS of $0.58 in the second quarter.

As analysts see improved financial performance from AMD in Q3, let’s look at their recommendations ahead of Q3 earnings.

Is AMD Stock Expected to Rise?

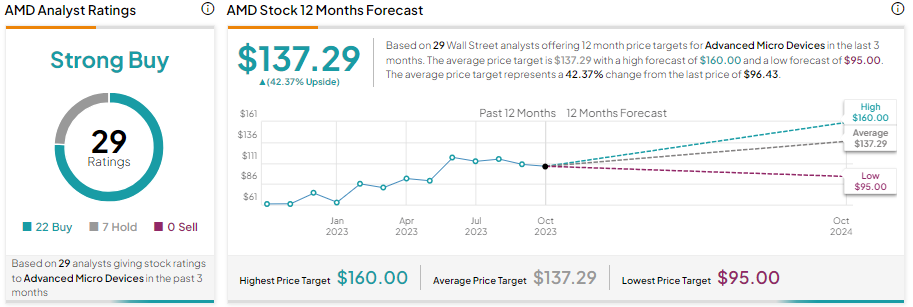

Analysts see considerable upside potential in AMD stock over the next 12 months. Further, they remain bullish on the stock ahead of earnings.

AMD stock has received 22 Buys and seven Holds for a Strong Buy consensus rating. Meanwhile, the average AMD stock price target of $137.29 implies 42.37% upside potential from current levels.

Insights from Options Trading Activity

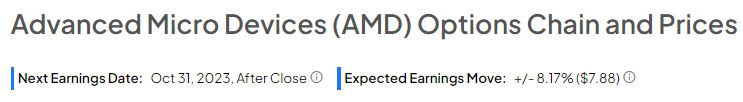

Options traders are pricing in a +/- 8.17% move on earnings, greater than the previous quarter’s earnings-related move of -7.02%.

Bottom Line

AMD’s third-quarter financials are expected to get a boost from the easing of headwinds in the Data Center and Client segments. Moreover, new product launches will support its earnings growth. Over the long term, AMD sees multibillion-dollar growth opportunities led by strong demand for AI (Artificial Intelligence). These positives are reflected in analysts’ bullish outlook on AMD stock.