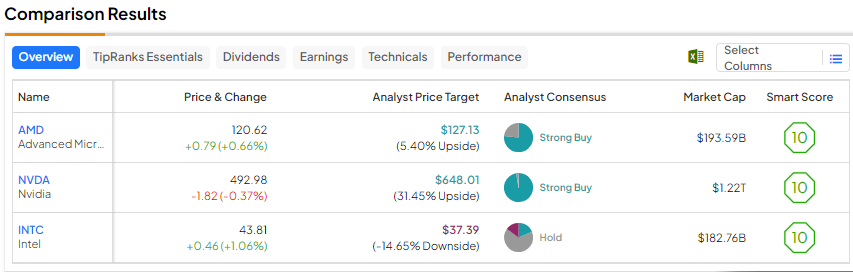

Chip companies have been in focus this year due to the massive opportunity created by the generative artificial intelligence ambitions of tech giants following the success of OpenAI’s ChatGPT. Further, after suffering for several quarters, many semiconductor companies could benefit from the gradual recovery expected in the PC market next year. Bearing this backdrop in mind, we used TipRanks’ Stock Comparison Tool to place Advanced Micro Devices (NASDAQ:AMD), Nvidia (NASDAQ:NVDA), and Intel (NASDAQ:INTC) to find the best chip stock as per Wall Street experts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Advanced Micro Devices (NASDAQ:AMD)

While Nvidia has stolen the limelight from all other semiconductor stocks this year due to the demand for its graphics processing units (GPUs) in generative AI, several analysts remain bullish about Advanced Micro Devices’ potential to grab the opportunities in the generative AI space.

The company is expected to benefit in the upcoming quarters from the demand for its latest MI300 chips and recovery in the PC market. During the Q3 earnings call, management said that it expects AMD’s Data Center GPU revenue to be about $400 million in the fourth quarter and surpass $2 billion in 2024, backed by the demand for MI300 chips. This, as per the company, would make MI300 its fastest product to ramp to sales of $1 billion.

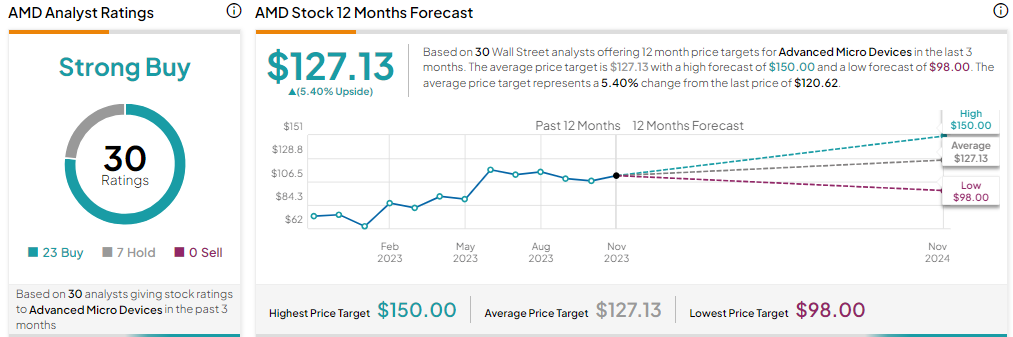

Is AMD a Buy, Sell, or Hold?

On November 13, Roth MKM analyst Sujeeva De Silva initiated coverage of AMD stock with a price target of $125. The analyst pointed out that AMD’s premium valuation of P/E (price-to-earnings multiple based on calendar year 2024 earnings estimates) of 33x, compared to the overall technology peers’ average P/E of 26x, reflects the company’s relative growth opportunity.

De Silva believes that the company’s differentiated portfolio of high-performance compute and networking processors and accelerators represent a solid investment opportunity. He added that the company is well-positioned from a product portfolio point of view to address the growing data center infrastructure market. Also, checks by the analyst’s firm reveal that AMD is poised to win further market share in the cloud server space and is making progress in the enterprise market.

With 23 Buys and seven Holds, AMD scores Wall Street’s Strong Buy consensus rating. At $127.13, the average price target suggests a modest upside potential of 5.4%. Shares have jumped more than 86% so far in 2023.

Nvidia (NASDAQ:NVDA)

This year has been a remarkable one for Nvidia. The generative AI-induced demand for the company’s advanced GPUs has helped NVDA deliver stellar results in recent quarters and triggered a 237% year-to-date rally in the stock. The company’s GPUs are being used by several tech giants to build and train generative AI models.

Following the robust performance in the first half of the fiscal year, expectations are high from Nvidia’s fiscal third-quarter results, scheduled to be announced on November 21. Analysts expect the company’s Q3 FY24 revenue to surge 173% year-over-year, backed by solid Data Center business. This revenue growth estimate reflects further acceleration in NVDA’s top-line growth compared to 101% in Q2 FY24. Wall Street expects adjusted EPS to jump to $3.37 in Q3 FY24 from $0.58 in the prior-year quarter.

What is NVDA’s Price Target?

At the recently held Supercomputing 23 event, Nvidia unveiled its HGX H200 AI accelerator, which is an upgrade to the H100. Bank of America analyst Vivek Arya noted that the H200 is compatible with its predecessor H100 installations, which will facilitate faster time to market and is in fact “critical,” given that hyperscalers do not need to invest to reconfigure their existing hardware platform to the upgraded offering.

Arya believes that upgrade simplicity enhances the competitive portfolio that Nvidia holds. Calling NVDA his “top pick,” the analyst reiterated a Buy rating on the stock with a price target of $650 on November 13.

Including Arya, 37 analysts have a Buy recommendation for Nvidia while only one analyst has a Hold rating. The average price target of $648.01 implies 31.5% upside potential.

Intel (NASDAQ:INTC)

Intel shares have rallied more than 21% over the past one month and are up 66% year-to-date. The company’s better-than-projected third-quarter performance impressed investors. The company’s adjusted EPS increased nearly 11% to $0.41 per share, easily exceeding analysts’ adjusted EPS estimate of $0.22.

Despite an 8% decline in Q3 2023 revenue to $14.2 billion, adjusted EPS increased due to the company’s expense discipline. After losing market share to rivals like AMD in recent years, Intel is now focusing on improving the competitiveness of its offerings and streamlining its business. The company also aims to improve its profitability and is targeting cost savings of $8 billion to $10 billion by 2025.

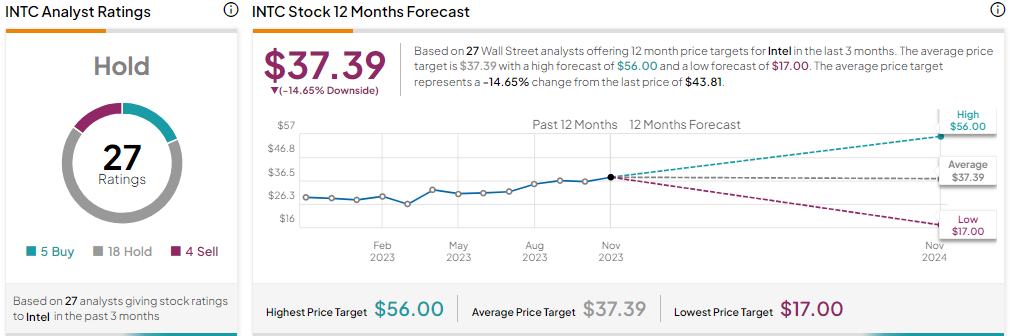

What is the Prediction for Intel Stock?

Mizuho analyst Vijay Rakesh recently upgraded Intel stock, citing many upcoming server product rollouts and foundry customer announcements. That said, most analysts remain cautious about Intel, including Morgan Stanley analyst Joseph Moore.

In late October, Moore raised his price target for Intel to $39 from $35 and reiterated a Hold rating on the stock. While the analyst acknowledged that Q3 was a good quarter for Intel mainly due to PCs, he thinks that the “data center malaise” continued in the quarter. Consequently, he kept his second-half estimates essentially unchanged. While Moore expects the recent results to benefit the stock over the near term, he contends that for Intel the “focus is the roadmap, not numbers.”

Overall, Wall Street’s Hold consensus rating on INTC stock is based on five Buys, 18 Holds, and four Sells. The average price target of $37.39 implies a possible downside of 14.6% from current levels.

Conclusion

Analysts are bullish on Advanced Micro Devices and Nvidia, while they are sidelined on Intel, as many think that there is much more to be done for the company to improve its competitiveness in the chip market. Despite the phenomenal year-to-date rally in Nvidia shares, Wall Street continues to see higher upside potential in the stock than in AMD and Intel.