While the Street waits in anticipation for Apple to deliver its March quarter earnings on Thursday, it is not the only big name with an interesting report on deck this week. Today, after the close, Advanced Micro Devices (NASDAQ:AMD) will deliver its 1Q23 statement.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Looking ahead to the print, Rosneblatt analyst Hans Mosesmann expects the semiconductor giant to meet Street expectations. However, that probably won’t be the case with the company’s outlook, with Mosesmann believing there is “downside risk to our flattish 2Q23 sales growth assumption on continued data center inventory adjustment on project push-outs.”

That, however, does not reflect badly on AMD specifically, given the overall broad data center weakness seen in showings from from Marvell and Intel. Mosesmann thinks Q2 will most likely turn out to represent a data center “bottom.”

And while Mosesmann is readying for a disappointing guide, the 5-star analyst thinks this expectation is “largely reflected in the shares today.”

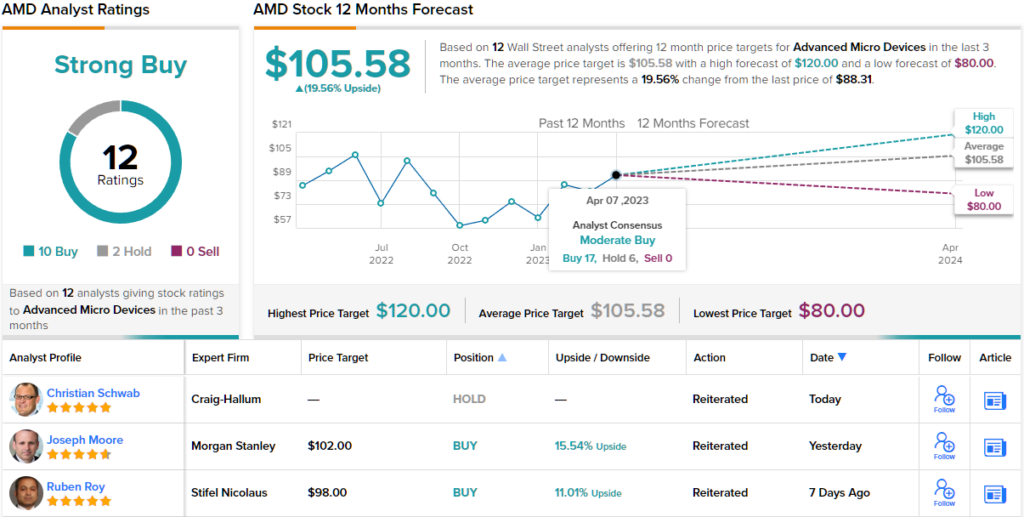

That’s an interesting take, given the shares have already rallied 36% year-to-date. Mosesmann, though, thinks they have plenty more room to run. Along with a Buy rating, his Street-high $200 price target suggests the shares will post additional growth of 126% over the next year. (To watch Mosesmann’s track record, click here)

Morgan Stanley analyst Joseph Moore holds the same view regarding Cloud digestion, stating that it will continue to have a detrimental impact in Q2 due to the high inventory levels and the persistent state of spending in digestion mode.

However, Moore cites the shares’ rally as the reason why 90% of his conversations around what’s coming have tended to lean on the downbeat side with an “obvious negative event” about to take place, at least on the data center front.

That, however, could be partially offset by a recovery in PCs and beyond Q2, Moore sees data center and PCs “continuing to recover through 2h.”

Interestingly, despite trimming some estimates on a weak data center outlook, to bring AMD’s valuation more in line with its peers, ahead of the readout, Moore has raised his price target from the prior $87 to $102. This suggests the shares will climb 15.5% higher in the months ahead. Moore’s rating stays and Overweight (i.e., Buy). (To watch Moore’s track record, click here)

Turning now to the rest of the Street, where based on a total of 10 Buys and 2 Holds, the stock garners a Strong Buy consensus rating. Shares are expected to appreciate ~20% over the one-year timeframe, considering the average target currently stands at $105.58. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.