Back in November, AMC Entertainment (NYSE:AMC) announced a $350 million share offering, which came off the back of a prior sale of 40 million shares in September. Consequently, the shares fell badly and have mostly continued to slide since. In fact, share declines have been par for the course all year, with the stock losing ~80% throughout 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On Monday, after the close, the company said it completed the $350 million at-the-market (ATM) equity offering, having issued ~48 million shares with an average price of ~$7.29 per share.

B. Riley analyst Eric Wold estimates that after commissions, fees, and expenses, AMC will pocket net proceeds of roughly $340 million.

Taking advantage of significant discounts on several tranches of its outstanding debt, management seized the opportunity to repurchase $50 million in principal amount of the 10% second lien notes due in 2026 from the market. This was done at an average discount of 19.67%, effectively utilizing approximately $40 million in cash to eliminate $50 million of outstanding debt.

Wold thinks such actions are going to be quite common as AMC works to reduce its significant debt load.

While at the end of 3Q23, the company had ~$4.66 billion of corporate debt outstanding, just ~$5 million is set to mature in 2024 with only an additional ~$98 million maturing the following year.

“With that in mind,” says Wold, “we believe the proceeds from this ATM offering (along with the ATM offering completed in mid-September) not only provide an increased near-term liquidity safety net following the resolution of the Hollywood strikes and adverse impacts on the 2024 film slate, but also provide an opportunity for the company to take advantage of potential pricing dislocations for its debt in the public market ahead of any scheduled maturities and/or refinancing efforts in the coming years.”

Considering that the Hollywood strikes and impact on the release slate have been out of AMC’s control, Wald applauds the company’s effort to “control the controllables – the overall liquidity position along with continued theater-level cost management efforts.”

As AMC saw out Q3 with ~$730 million in cash (with Wold expecting through the end of 2024 a cash burn of ~$152 million), the analyst sees the ~$290 million shot in the arm to the cash balance from the offering (net of the debt purchase) as “more than enough to get the company over the hump before the projected return to positive FCF in 2025.”

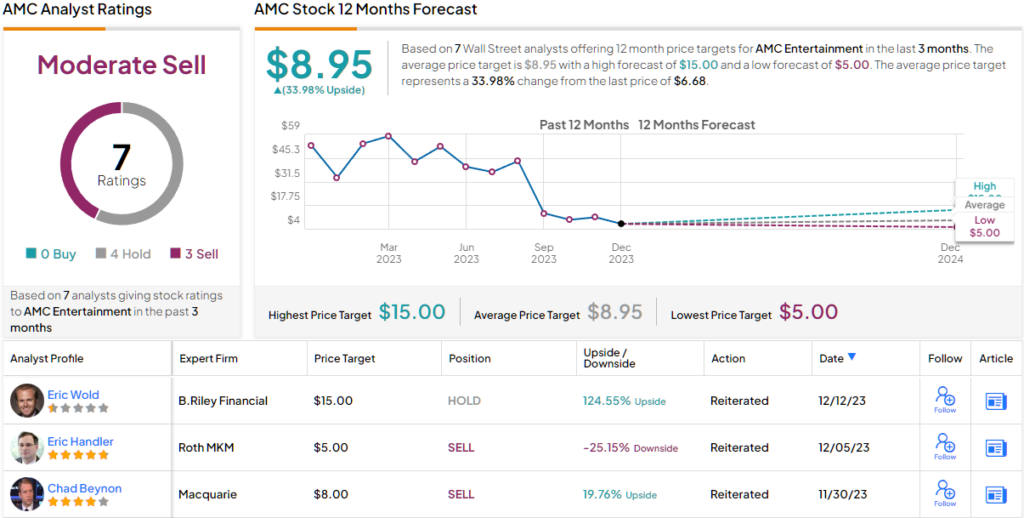

Meanwhile, Wold reiterates a Neutral rating on AMC shares, although he might as well have said Buy as his Street-high $15 price target makes room for 12-month returns of ~124%. (To watch Wold’s track record, click here)

The Street’s overall take on AMC also appears somewhat confusing. On the one hand, based on 4 Holds and 3 Sells, the stock receives a Moderate Sell consensus rating. However, the average target stands at $8.95, suggesting shares will record gains of 34% a year from now. It will be interesting to see whether the analysts upgrade their ratings or lower price targets over the coming months. (See AMC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.