AMC Entertainment’s (NYSE:AMC) recent Q1 results were a generally solid affair with the headline numbers coming in ahead of expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue increased by 21.5% year-over-year to $954.4 million, beating the Street’s forecast by $22.73 million. The adjusted net loss narrowed from the year ago period’s $266.3 million to $179.7 million, the result of which was adj. EPS of -$0.13, offering a better showing than the -$0.18 anticipated by the analysts.

Elsewhere, non-GAAP Operating Cash Burn for the quarter came in at $139.4 million vs. the $223.9 million seen in 1Q22, while adjusted EBITDA of $7.1 million represented a big turnaround from the EBITDA loss of $61.7 million in the same period a year-ago.

Attendance reached 47.62 million, a sequential improvement on Q4’s 39.07 million with the U.S. market accounting for 32.36 million (compared to 25.79 million last quarter). The company also highlighted the gains made in the high-margin food/beverage segment, with concessions per cap reaching $7.99 vs. $7.52 last year.

So, all in all, a decent readout. However, scanning the print, the results have done little to alter Wedbush analyst Alicia Reece’s bear thesis. On the plus side, Reece expects the company to at least hold on to its 22% U.S. market share this year and thinks that, over time, European box office will improve as AMC “updates its circuit in the region.”

However, given the stock’s retail following, the shares are simply priced too high. This is despite basing her model on a “generous 13x EV/EBITDA multiple on our FY:25 EBITDA estimate.”

“We value AMC at a premium multiple relative to its pre-COVID historical range of 7 – 9x due to its majority retail ownership who value AMC shares significantly higher than AMC’s peers,” Reece further explained.

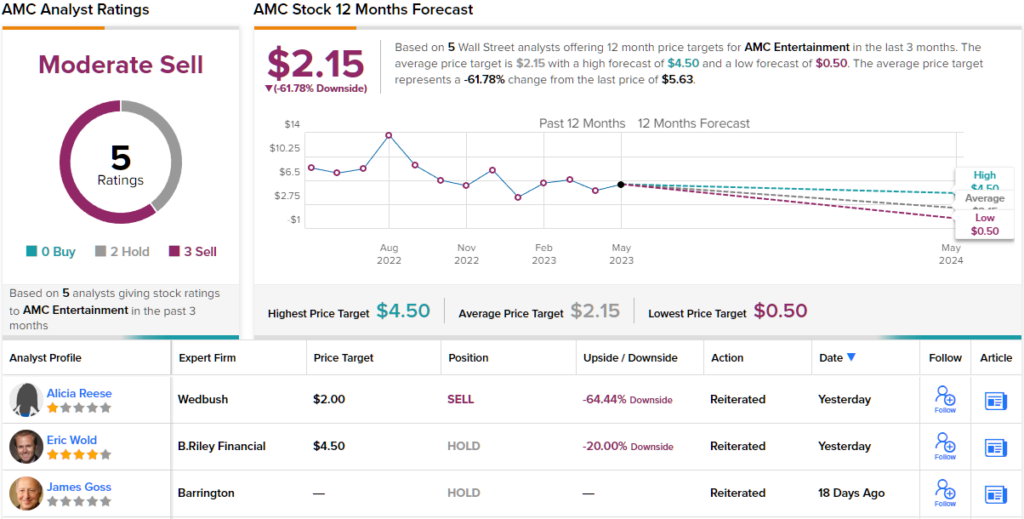

All told, Reece sticks to an Underperform (i.e., Sell) rating and keeps the $2 price target as is. This suggests the shares will slide by 66% over the coming year. (To watch Reece’s track record, click here)

4 other analysts have recently chimed in with AMC reviews and these break down into 2 Holds and Sells, each, making the consensus view here a Moderate Sell. The $2.15 average target is a tad above Reece’s objective but still implies shares will be changing hands for ~62% discount a year from now. (See AMC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.