Shares of theater chain AMC Entertainment (NYSE:AMC) continue to lose significant value and hit a new 52-week low on December 28, Wednesday, despite multiple moves under the leadership of CEO Adam Aron to revive the company. AMC stock has plunged nearly 86% year-to-date as investors remain concerned about the company’s future amid a challenging macro backdrop and growing competition from streaming platforms.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

AMC’s Recent Actions Failed to Revive Investors’ Hopes

AMC entered the pandemic with high debt resulting from an acquisition spree. The company and its peers were crushed during the COVID-19 pandemic as outdoor entertainment came to a standstill. The pandemic also delayed movie schedules. As a result, theaters faced a significant lack of blockbusters following the reopening of the economy. The release calendar is expected to improve next year and beyond.

AMC recently announced its plan to raise $110 million through the sale of its AMC Preferred Equity (APE) units to Antara Capital. Also, Antara will exchange $100 million of AMC notes for 91 million APE units, a move that will reduce AMC’s debt. AMC also proposed a reverse stock split at a 1-to-10 ratio to avoid a penny stock status and the conversion of APE units into AMC common stock. However, investors seem unimpressed with these decisions. Even CEO Aron’s tweet this week about requesting the board to freeze his 2023 pay didn’t stop the stock from declining further.

Speaking to MarketWatch, Wedbush analyst Alicia Reese stated that AMC’s CEO has made several moves over the last one and a half years to “assuage” frustrated investors. Reese also highlighted that one of the issues that impacted the stock was that the company’s executives, including Aron, started to sell their shares last year.

AMC shares were caught up in a meme stock frenzy in early 2021, which led to a spike in the stock that was not backed by financial performance. Management made the best of this opportunity by issuing additional shares to raise capital. However, the offloading of shares by the management, including the CEO, in late 2021 didn’t go down well with investors. Aron offloaded $40 million AMC shares from November 2021 but said he was done with selling following a $7.1 million stock sale in January this year.

Overall, investors seem worried about the direction of the firm due to company-specific issues and a tough macro backdrop.

Is AMC a Buy or Sell Today?

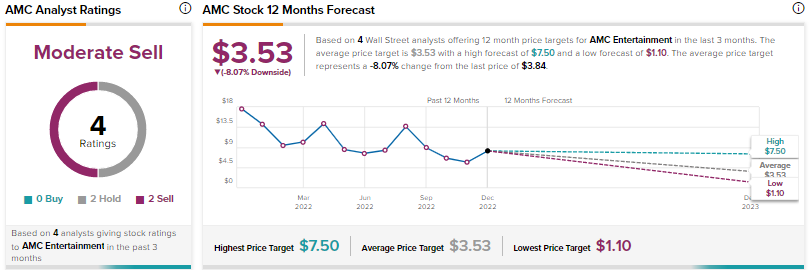

Wall Street has a Moderate Sell consensus rating on AMC stock based on two Holds and two Sells. The average AMC stock price target of $3.53 indicates further downside potential of 8.1%.

Conclusion

AMC’s massive debt, cash burn, and absurd decisions (like investing in a gold mine) have impacted investor sentiment about the beleaguered theater chain. Wall Street is currently not hopeful of a rebound in the stock in the near future.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.