Amazon (NASDAQ:AMZN) has had a strong start to 2023, with shares climbing 21% since the beginning of the year. This impressive performance has left investors wondering whether the stock has more room to grow.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Mizuho analyst James Lee, although Amazon is likely to face challenges along the way, he believes the stock is a Buy and has assigned it a price target of $135. This would reflect ~33% gains should the stock ultimately reach this target. (To review Lee’s track record, click here)

Taking a “deep dive” into Amazon’s several businesses, and trying to make heads and tails of all the moving parts, Lee admits that Amazon faces some difficulties in 2023 — and maybe even difficulties that investors are unaware of. Take AWS for example — Amazon’s fastest growing business over the past several years, and the only Amazon segment to produce an operating profit in 2022.

Lee warns that his peers on Wall Street have “not fully factored-in the business dynamic of shifting to long-duration contracts that could impact short-term unit prices” at AWS, and are being overoptimistic when they say AWS will grow its revenues a strong 13% this year. The problem, you see, is that as Amazon’s corporate clients try to cut costs to weather the current economic downturn, they’re consolidating their buying of AWS cloud services at the HQ level, and signing long-term AWS contracts that grant price discounts. This is as opposed to permitting individual departments to sign pay-as-you-go shorter term contracts that yield higher profit margins for Amazon.

Now, the plus side of this trend is that it’s likely to boost backlog for AWS — and of course, lock in customers for long-term commitments to provide Amazon with recurring AWS revenue. These are obviously good things. The downside, however, is that when you factor in the discounts Amazon is doling out, it’s going to be hard for AWS to grow operating income by analysts’ expected 7% this year.

Hence, 2023 earnings could be weaker than investors expect.

That’s the bad news from AWS. The good news lies elsewhere — at Prime Video for example. Here, Amazon’s Prime service made hay while the Covid shined during the pandemic, attracting work-from-home viewers to watch shows developed for Prime Video. The good news and the bad news, though, was that these viewers watched a lot of Amazon content during the pandemic, so Amazon had to keep making more content to satisfy the demand — and that cost money.

Now that Covid is waning, Lee believes Amazon customers will have less time to watch TV. As a result, the content that Amazon puts on Prime Video should last longer before it’s consumed and needs to be replaced with fresh content. This should permit Amazon to cut spending on content — saving perhaps $1 billion this year.

At the same time as this is happening, Lee forecasts savings on capital spending across Amazon — down about $4.1 billion year over year — even as Amazon saves about $1.5 billion in payroll costs from its recently announced layoffs of 9,000 workers.

When all’s said and done, Lee comes up with a projection of 7.5% total sales growth at Amazon this year — $552.6 billion — with a net profit of $13.5 billion versus last year’s net loss. That may not sound like much, given Amazon currently carries a $1 trillion market cap and a 75 current P/E ratio. On the other hand, Lee thinks Amazon will nearly double its income to $26.6 billion next year.

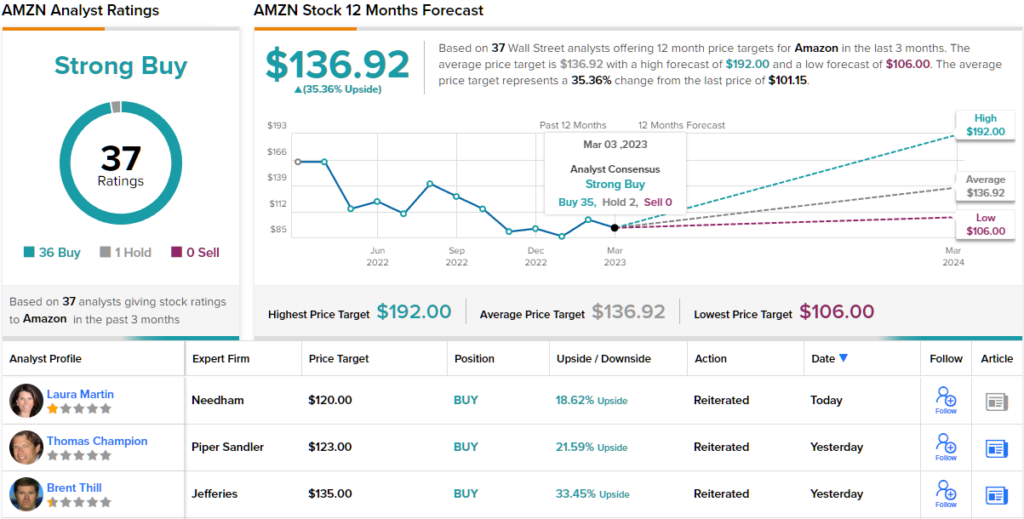

His advice: Buy the stock now, before that income doubles. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.