Consumers took Amazon’s (NASDAQ:AMZN) Prime Day shopping bonanza with a huge dollop of enthusiasm. According to Adobe Analytics, the 2-day event generated record sales of $12.7 billion, representing a 6.1% increase compared to the $11.9 billion in sales recorded last year. Amazon also pointed out the first day amounted to the best sales day in its history.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The strong performance merits a recalibration of Q3 estimates, says Baird analyst Colin Sebastian. As a result of “strong Prime Day volumes,” Sebastian has raised his Q3 consolidated revenue estimate by $2 billion. The 5-star analyst now sees Q3 revenues hitting $138.2 billion, an 8.7% year-over-year increase.

The data shows that this year’s event was marked by the strong participation of a younger demographic, with 26% of Prime Day shoppers aged between 25 and 34 years old compared to 21% last year. Additionally, 42% of shoppers said they had spent more this year than in 2022 (26% spent less). As far as products go, non-discretionary items were very popular, with home and personal goods accounting for 71% of sales.

While the event shows that consumers are not afraid to spend and the strong numbers run counter to recession concerns, looking ahead, Sebastian thinks issues including employment trends, dwindling savings, resetting mortgages, student debt payments and geo-political “gyrations” are all “potential headwinds” in 2H23. It also might be that the strong turnout indicates some “pull-forward of spending.”

“The popularity of promotions and shift towards non-discretionary may be evidence of more cautious consumers, although a more positive interpretation of the strong Prime Days growth would be as an early indicator of consumer shopping intent ahead of Back-to-school and holidays,” Sebastian summed up.

So, how does this all translate to investors? Sebastian reiterated an Outperform (i.e., Buy) rating, although the price target gets a bump, and moves from $130 to $150. Should the figure be met, investors will be pocketing returns of 11% a year from now. (To watch Sebastian’s track record, click here)

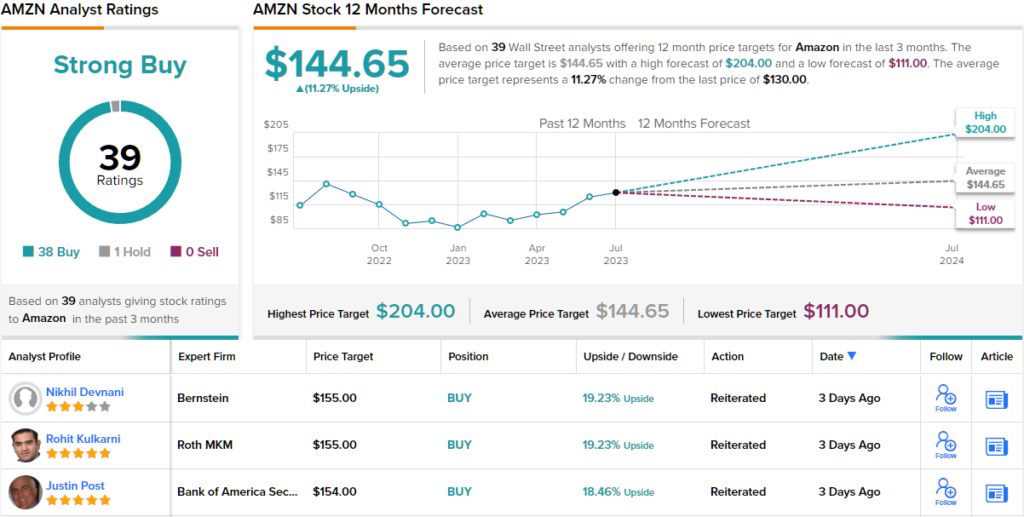

Over the past 3 months, 39 analysts have chimed in with AMZN reviews, and barring one skeptic, all are positive, naturally making the consensus view here a Strong Buy. That said, considering the shares are up by 53% since the turn of the year, the $144.24 average target leaves room for 12-month gains of a modest 11%. (See Amazon stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.