Is it a good time to consider investing in Amazon (NASDAQ:AMZN)? The answer is — it’s complicated. Today, we’re discussing one green flag but also one bright red flag for Amazon stock, which I’m neutral on for the time being.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Amazon is, by far, the most famous e-commerce platform in the U.S. The company also provides cloud-computing services through AWS (Amazon Web Services). It’s a gigantic company, and short-selling AMZN stock would probably be irrational and dangerous.

Plus, there’s an upcoming event that might tempt you to consider backing up the truck to load up on Amazon stock right now. However, there’s a threat to Amazon’s e-commerce business, and you’ll be surprised to discover where that threat is coming from. So, be sure to get the full story before putting all of your chips on Amazon stock.

Why One Analyst Thinks Amazon Stock is a “Prime” Pick

Later, we’ll take a look at how Wall Street’s analysts generally feel about Amazon; by and large, they’re quite positive. A typical bullish rating came from DBS Bank analysts, who initiated their coverage of AMZN stock with a Buy rating and a $150 price target. Among other considerations, the DBS Bank analysts cited growth in the membership base of Amazon’s Prime subscription service. They also stated that Amazon maintains a 39% share of the U.S. e-commerce market.

Indeed, Amazon is so dominant in that market that the company’s annual Prime Day event is akin to football’s Super Bowl. Prime Day for 2023 is coming up soon, on July 11 and July 12, and surely it will feature plenty of sales and bargains for eager online shoppers.

The customers won’t be the only beneficiaries, though. JPMorgan Chase (NYSE:JPM) analyst Doug Anmuth expects Amazon to generate $7 billion in revenue from the Prime Day event, representing a 12% year-over-year increase if that actually happens. I feel that Anmuth’s prediction is reasonable, as inflation is starting to cool down and unemployment remains fairly low, so people should have disposable income to spend this year. In any case, Anmuth reiterated his Overweight rating on AMZN stock while publishing a price target of $145 on the shares.

Microsoft’s New AI Feature Could Pose a Problem for Amazon

I just revealed a green flag for Amazon stock, but to be fair and balanced, I feel it’s important to point out a red flag, as well. I’m not referring to Amazon’s lofty valuation (GAAP trailing 12-month P/E ratio of 309.59x versus the sector median P/E ratio of 16.71x), though value-focused investors could certainly point this out. Nor am I referring to the U.S. Federal Trade Commission (FTC)’s plans to sue Amazon over the company’s alleged favoritism toward certain online merchants.

Rather, I’m alluding to a threat from Microsoft (NASDAQ:MSFT). No, Microsoft isn’t starting up an e-commerce marketplace to compete directly against Amazon (at least, not as far as I know). However, Microsoft is reportedly adding a generative-AI-based shopping assistant called Buying Guide to its Bing search engine and its Edge internet browser.

Many people simply go to Amazon’s website or app to start shopping online, but Microsoft’s Buying Guide could change that habit. It offers price-comparison capabilities and can point potential buyers to product reviews, as well as provide intelligent suggestions about what to buy next. In other words, Buying Guide uses generative AI to perform some of the functions that Amazon does.

If this new feature from Microsoft diverts shoppers away from Amazon, naturally, this would have a negative impact on Amazon’s revenue. So far, though, this consideration hasn’t prevented analysts from giving AMZN stock favorable ratings. With that in mind, let’s see how analysts generally rate Amazon shares.

Is AMZN Stock a Buy, According to Analysts?

Turning to Wall Street, AMZN stock comes in as a Strong Buy based on 37 Buys and one Hold rating. The average Amazon stock price target is $141.09, implying 8.2% upside potential.

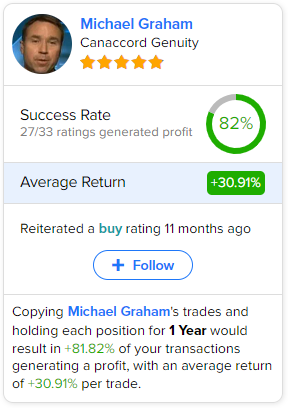

If you’re wondering which analyst you should follow if you want to buy and sell AMZN stock, the most accurate analyst covering the stock (on a one-year timeframe) is Michael Graham of Canaccord Genuity, with an average return of 30.91% per rating and an 82% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Amazon Stock?

It’s not a terrible idea to think about owning a few shares of Amazon prior to Prime Day. After all, Amazon is sure to rake in lots of revenue due to this famous event. Yet, there’s no need to over-leverage yourself on AMZN stock today, as Microsoft’s Buying Guide could pose a serious threat to Amazon’s dominance in U.S. e-commerce.