Although a certain allure exists in going against the grain, ahead of broader economic uncertainties, it may be best to consider a proven stalwart like e-commerce and technology firm Amazon (NASDAQ:AMZN). With pundits debating about the equity market’s forward direction, Amazon enjoys a rare unanimous “Strong Buy” assessment, meaning every analyst covering the stock is bullish on it. I, too, am bullish on AMZN stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

AMZN Stock Continues to Deliver the Goods

At a time when consumers may be pulling back from unnecessary discretionary spending, Amazon continues to bolster investor confidence. With another strong earnings report in the bag, AMZN stock has been on a solid run.

According to TipRanks contributor Abdulrasaq Ariwoola, Amazon reported earnings per share of $0.94 during its third quarter of Fiscal Year 2023. This figure easily beat the consensus estimate of $0.59 per share. On the top line, Amazon rang up sales of $143.1 billion, representing a 13% year-over-year increase. As well, this remarkable tally beat Wall Street’s target by $1.54 billion.

Drilling down into the granularity of the income statement, Amazon Web Services (AWS) raked in $23.1 billion, which admittedly was a bit lower than the anticipated haul of $23.2 billion. However, the company’s Advertising business unit grew to $12.1 billion, beating the consensus view of $11.6 billion.

Moving forward, management anticipates Q4 revenue to land between $160 billion and $167 billion. Assuming Amazon delivers at the top of the range, the performance would represent an 11.9% lift from Q4 2022’s sales of $149.2 billion. Given Amazon’s impressive earnings track record, it may be tough to dismiss such a prospect.

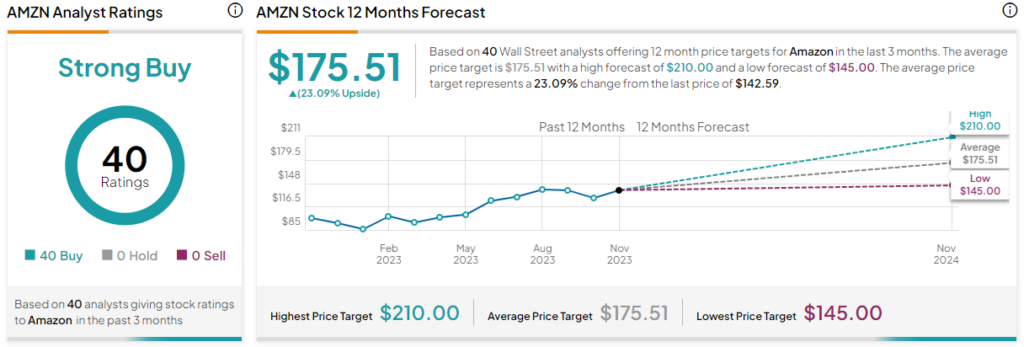

Unsurprisingly, AMZN stock enjoyed a unanimous strong buy assessment to start the week of Nov. 12. However, it’s the magnitude of the universal view that raised eyebrows. With 40 out of 40 experts bullish on AMZN, you’d have to have a compelling reason not to consider it.

Strong Fundamentals Bolster’s the Amazon Narrative

As remarkable as AMZN stock has been, one counterargument sticks out: the assumed viability of the consumer economy. Although the Federal Reserve threw its weight at the inflation problem, prices remain too high. Subsequently, an overall robust labor market doesn’t help matters. Yes, people have jobs, but more dollars now chase after fewer goods. Still, that just makes Amazon’s strong fundamentals even more astonishing.

According to data compiled by the U.S. Census Bureau, e-commerce transactions represented a record 16.5% of all sales during Q2 2020. That’s hardly a shocker, given the initial impact of the COVID-19 crisis and the resultant restrictions against non-essential activities.

As society reopened and trends such as revenge travel took over, the aforementioned metric dropped to 14.4% in Q2 2022. However, online shopping again soared, with the stat jumping to 15.4% one year later. During this period, Amazon’s revenue increased by 10.8% from $121.2 billion to $134.38 billion.

In nominal terms, the U.S. Census Bureau reports that e-commerce retail sales swung from $258.16 billion to $277.58 billion. That’s a 7.52% increase, implying that when the broader e-commerce sector moves, Amazon simply takes a greater portion of the pie.

In turn, stakeholders of AMZN stock should be encouraged. Mature businesses tend to rest on their laurels. However, Amazon continues to push for – and successfully attains – more growth.

Can Amazon Benefit from an Economic Downturn?

Adding to the bull case, Amazon might also benefit from a possible economic downturn, specifically regarding travel spending. To be sure, if travel spending fades, it does have a chance of negatively impacting AMZN stock. After all, if consumers tighten their belts, they might do so across the board.

However, it may actually help Amazon. As scientific research indicates, people tend to mitigate negative emotions through retail therapy. That was evident during COVID-19, and a similar dynamic may materialize if travel spending falters. Essentially, consumers may trade down their entertainment desires from exotic vacations to retail pleasures, which would, of course, benefit Amazon.

Analysts Love Amazon Stock

Turning to Wall Street, AMZN stock has a Strong Buy consensus rating based on 40 unanimous Buy ratings assigned in the past three months. The average AMZN stock price target is $175.71, implying 23.1% upside potential.

Conclusion: AMZN Stock Wins the Stability, Not the Beauty Contest

Some investments scream for attention, much like an exotic car. It may be a great ride, but eventually, you’ll be stuck with a hefty repair bill. On the other hand, you have established blue chips like AMZN stock. While it’s not exactly alluring today, it still consistently delivers the goods, thus winning the stability race. Under current market conditions, that may be the theme for long-term success.