The holiday season is a crucial sales period for both brick-and-mortar retailers and e-commerce players like Amazon (NASDAQ:AMZN). Despite macro pressures, the National Retail Federation (NRF) estimates holiday spending in the November to December period to increase between 3% and 4% to $957.3 billion and $966.6 billion. In particular, the NRF expects online and other non-store sales to grow between 7% and 9% to $273.7 billion and $278.8 billion. Wall Street analysts are bullish about Amazon’s holiday quarter and expect the solid momentum in the company’s recent performance to continue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Solid Performance

Amazon impressed investors with its robust third-quarter results, with sales rising 13% year-over-year to $143.1 billion. The company’s retail business experienced robust momentum, as witnessed in the 13% rise in North America segment sales and 16% growth in International segment sales. The 12% rise in the company’s Amazon Web Services (AWS) cloud computing business also boosted the top-line growth.

The company guided for Q4 2023 sales in the range of $160 billion to $167 billion, reflecting year-over-year growth between 7% and 12%. This guidance slightly lagged the Street’s expectation of $167.2 billion. Regardless, Wall Street remains bullish on AMZN stock and sees further upside.

Analysts Optimistic about Amazon

On November 6, Jefferies analyst Brent Thill reiterated a Buy rating on Amazon stock with a price target of $175, given his optimism about Amazon’s holiday sales.

Thill said that third-party estimates indicate that U.S. holiday sales growth could decelerate to 4% from 6% last year. However, e-commerce sales growth is expected to accelerate to 9% from 7% in 2022. In fact, a survey of nearly 1,000 customers by the analyst’s firm also revealed slower overall holiday retail sales growth but accelerating e-commerce sales.

The survey results support Thill’s view that Amazon will be “a key holiday beneficiary” and “appears to be a clear winner in holiday ecommerce sales.”

Last week, Tigress Financial analyst Ivan Feinseth increased his price target for AMZN stock to $210 from $204 and reaffirmed a Buy rating. The analyst’s bullish view is based on Amazon’s artificial intelligence (AI)-driven capabilities, the ongoing expansion of Prime Membership services, growth in online sales, and the growing advertising revenue.

Is Amazon a Buy, Sell, or Hold?

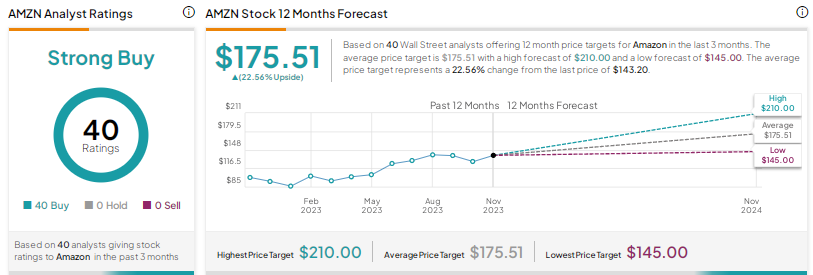

Overall, Wall Street is highly bullish on Amazon stock, with a Strong Buy consensus rating based on 40 unanimous Buys. The average price target of $175.51 implies 22.6% upside potential. Shares have risen 70.5% year-to-date.

Conclusion

Despite macroeconomic challenges, Amazon is expected to deliver strong sales in the holiday season. NRF estimates and other third-party surveys also indicate faster growth in e-commerce sales than overall retail sales in the holiday period, which bodes well for Amazon. Beyond the holiday quarter, analysts are also bullish on the company’s long-term prospects, thanks to its dominant position in e-commerce, solid prospects of AWS, the rapidly growing advertising business, and continued focus on cost cuts to improve profitability.