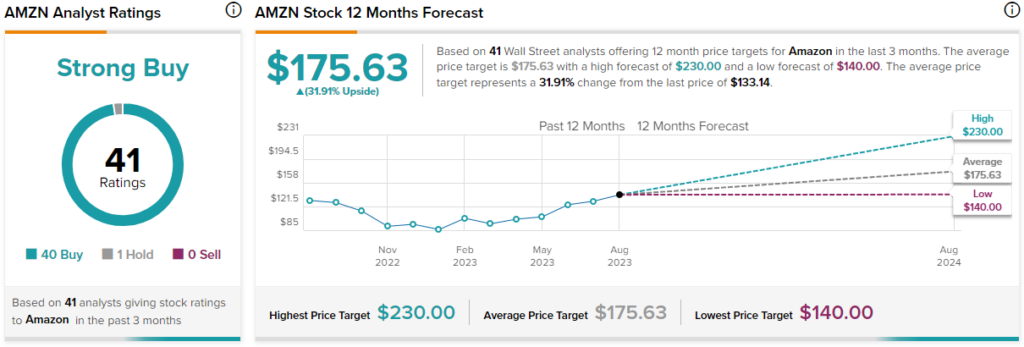

Amazon (NASDAQ:AMZN) stock certainly stands out as one of the strongest buys in the mega-cap tech scene following upbeat commentary from a wide range of analysts. Undoubtedly, the tech rally is cooling off after an incredible start to 2023. Still, the August cooldown doesn’t seem to be scaring the Wall Street community, which is overwhelmingly bullish on the name, with 40 out of 41 ratings recommending it as a Buy, with a Street-high price target of $230.00 implying a whopping 72.8% gain from current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

I share the enthusiasm of Wall Street analysts and am staying bullish on AMZN stock.

Of all the FAANG firms, Amazon stands out as the one that may have the most room to run. Despite its front-row seat to generative artificial intelligence (AI) and a return to growth in its e-commerce and cloud businesses, the stock remains down around 29% from its 2021 all-time highs, just shy of $189 per share. Arguably, Amazon appears to be a much more exciting company today, in the midst of an AI boom, than it was back then.

Of course, Amazon stock will always appear expensive on the surface, with its triple-digit price-to-earnings (P/E) ratio. Today, shares sport a 106 times trailing P/E and a 60.9 times forward P/E. That’s the richest premium of the FAANG cohort. Still, Amazon’s growth profile is so powerful that it could prove cheap when we look back a year from now.

Let’s look at what some of the table-pounding analysts covering the name have to say about what to expect for the year ahead.

Amazon is Becoming More Efficient

Piper Sandler analyst Thomas Champion is one of the latest bulls to pound the table on shares of Amazon, recently hiking his price target by $10 to $185, entailing a gain of around 39% from current levels. What’s the reason behind the upgrade?

After listening in on the company’s latest early-August conference call, Mr. Champion believes Amazon is getting more efficient at fulfilling orders. According to Champion, Amazon “may have reached a new threshold in shipping and fulfillment cost efficiency.”

Undoubtedly, the past year has been a year of cost cuts and efficiency boosts for many technology juggernauts. Amazon was a firm that really needed to lighten up, given its overinvestment in capacity and tech talent. Now that it’s had the chance to lighten the load, it’s been putting its foot on the gas to improve margins and eliminate cost inefficiencies where possible.

That’s a big deal as Amazon gets aggressive with its profitability push in a market that continues to reward improving earnings trajectories. As the company continues betting big on warehouse automation robotics, my guess is that efficiencies are going to continue moving higher over time. Further, delivery times also stand to shrink as the company looks to get operations in the perfect spot. Speedier deliveries could impress consumers enough to jump ship from another retailer.

Even Wedbush recently added Amazon stock to its “Best Ideas List,” with a $180.00 price target, implying 35% upside potential. Wedbush is bullish on Amazon’s core businesses. As online spending comes back online after the recent slowdown, I view Wedbush’s target as in line with reality.

Amazon Ups AI Exposure with Bet on Hugging Face

On the AI front, Amazon seems to be putting its foot on the gas. Its AI codewriter Code Whisperer is intriguing, as too is its Bedrock AI service (a tool for developers). Apart from its own AI initiatives, the company has been keeping an eye out for what’s influential in the AI scene. A small company called Hugging Face has been making big waves in the AI world in recent quarters, and Amazon, plus some of its tech peers, have been eager to get an investment.

Hugging Face is a machine learning (ML) tool and AI model repository developer that commands a valuation worth around $4.5 billion following the firm’s latest funding round. On the software side, Hugging Face certainly is a big deal as the AI age kicks off. It’s essentially GitHub for the AI generation. For now, a handful of big-tech AI companies recognize the potential of the technology. However, it’s unclear which firm will be able to secure the biggest slice for itself.

What is the Consensus Price Target for AMZN Stock?

As mentioned earlier, out of 41 analyst ratings, there are 40 Buys and one Hold recommendation. Meanwhile, the average Amazon stock price target is $175.63, implying upside potential of 31.9%. Analyst price targets range from a low of $140.00 per share to a high of $230.00 per share.

The Bottom Line on AMZN Stock

It’s been an efficient year for Amazon after a pretty inefficient 2022. From here, I think the firm gets even more efficient as it embraces the cost-saving potential of AI and automation robotics. Therefore, it’s no mystery as to why Wall Street loves the name.