Amazon (NASDAQ:AMZN) shares might be trailing all of its Mag 7 peers in the market this year, but that scenario is unlikely to repeat in 2026.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Mizuho’s Lloyd Walmsley, an analyst ranked among the top 1% of Street stock experts, the AMZN bull case is alive and kicking, and rests on an anticipated inflection for its cloud business.

AWS, which made up 17% of revenue and 58% of EBIT in 2024, is positioned to benefit from both added capacity and rising inference demand in 2026. “We see AWS revenue growth accelerating as more capacity comes online, particularly the Project Rainier EC2 UltraCluster, and Anthropic sees rapid growth in its business,” the 5-star analyst explained.

Walmsley thinks AWS’s cloud ecosystem gives it a “solid foundation” to keep evolving at pace in the GenAI era, with a complete three-layer stack – spanning infrastructure, platform, and applications – already in place. Although 2024 marked the beginning of faster inference adoption, highlighted by rising capex and the launch of its Trainium 2 silicon, limited capacity in the first half of 2025 created some near-term growth headwinds. “We believe the improving supply as well as the better cost efficiency from ASICs should help accelerate revenue growth in 2H25 and beyond,” Walmsley said on the matter.

The analyst believes AWS has been at a “distinct disadvantage” in the GenAI race vs. Azure and GCP. It was slower to recognize the opportunity and lacks the same scale advantages in training foundation models on its own infrastructure – advantages that Microsoft enjoys through its partnership with OpenAI and that Google has leveraged by operating as an “AI-first” company and quickly turning its models into products.

But the shift toward inference should play to AWS’s advantage. In recent years, AI spending has been dominated by training – largely driven by frontier labs – which has left AWS at a relative disadvantage compared to Azure and GCP. Longer term, however, the inference market is expected to far surpass training. Gartner projects that inference will reach parity with training in 2025, edge ahead with 55% of AI spending in 2026, and climb to 60% by 2027. Meanwhile, Gartner reckons inference spending will rise more than sixfold, from $3.4 billion in 2024 to $20.6 billion in 2026, compounding at 98% between 2024 and 2028. “We believe these estimates could prove conservative given some of the ramps that we are seeing in GenAI companies like Anthropic and OpenAI,” Walmsley added.

Walmsley estimates AWS generated about $3.6 billion in AI revenue in 2024 and could reach roughly $8 billion in 2025 – though the analyst acknowledges there is a wide margin of error here. That number could potentially double again in 2026 to nearly $17 billion, with a long growth runway as AI applications broaden and inference demand scales. If Amazon captures something close to its historical cloud share in inference – which may be an optimistic assumption – AWS could generate as much as $34 billion in inference revenue by 2028, against Walmsley’s estimate of $189 billion in total AWS revenue for 2027, the outer year of his forecast.

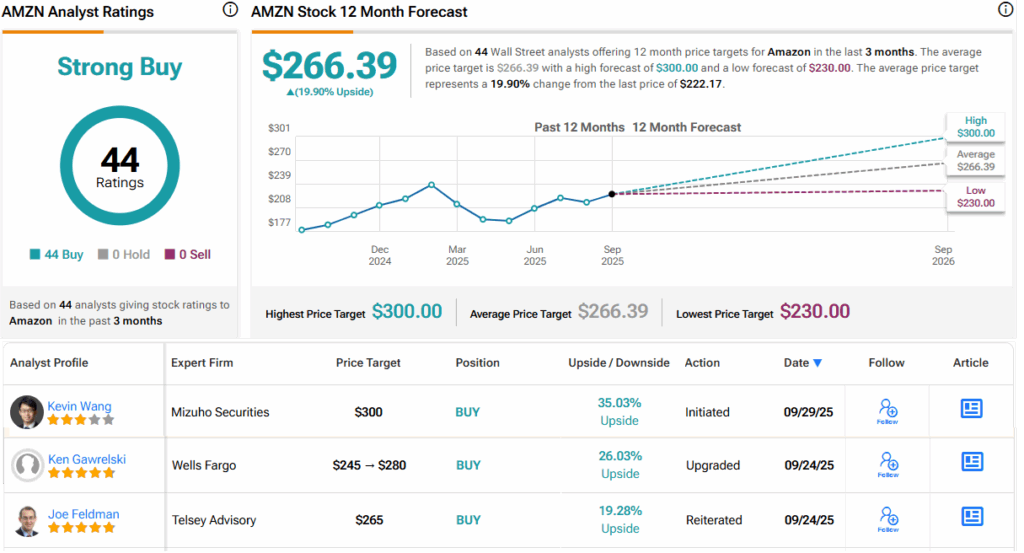

So, what does this all ultimately mean for investors? Walmsley initiated coverage of AMZN with an Outperform (i.e., Buy) rating, backed by a $300 price target. There’s potential upside of 35% from current levels. (To watch Walmsley’s track record, click here)

Amazon gets plenty of coverage on Wall Street and all of it is positive; the stock claims a Strong Buy consensus rating, based on a unanimous 44 Buys. At $266.39, the average target factors in a one-year gain of 20%. (See Amazon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.