It’s almost time for another market giant to announce its Q3 financial report. After the bell rings to bring today’s trading activity to a close, Amazon (NASDAQ:AMZN) will step up to the earnings plate.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

On the back of a strong display in Q2, is another home run of a report on the way? That is entirely possible, says Morgan Stanley’s Brian Nowak.

“Near-term,” says the analyst, “we think the set-up into AMZN’s 3Q23 print is positive, with expected upward revisions to forward EBIT estimates driven by durable strength in topline retail sales as AMZN gains share of retail at its highest pace since pre-Covid (recent Prime Day data points have also been strong) and drives continued incremental efficiencies from its logistics network regionalization (improving throughput, inventory placement, etc.).”

The above is complemented by Nowak’s confidence in AWS’s continued steady growth, as confirmed by a recent MS survey of CIOs, which indicates that IT and software expectations for 2023 align with previous forecasts. Additionally, the potential for AWS to improve on expectations of 12% growth presents an opportunity that can inspire investor confidence in a reacceleration of growth in the mid-to-high teens range for 2024. AWS’s “strong structural positioning in AI” can further help boost the bull case here.

Based on all the above, even when taking into account near-term headwinds such as higher fuel costs, Nowak’s estimates for Q3/Q4 EBIT remain 7%/12% above those on the Street.

And with the stock having retreated some distance from its 52-week highs, giving it an attractive valuation, combined with expectations that have been pushed lower as the print approaches, investors are left with an “attractive setup heading into 3Q23.”

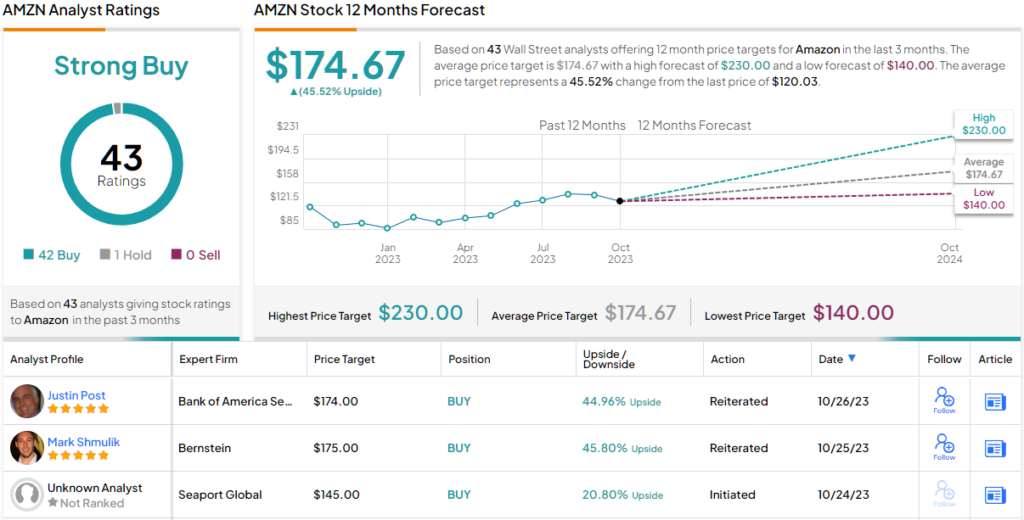

The upshot of all the above is that Nowak rates Amazon shares an Overweight (i.e., Buy) alongside a $175 price target. The implication for investors? Upside of ~46% from current levels. (To watch Nowak’s track record, click here)

Overall, Wall Street’s confidence on the tech giant speaks for itself; AMZN has received a whopping 42 buy ratings and just a single Hold (i.e. neutral). The $174.67 average price target is roughly the same as Nowak’s objective. (See Amazon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.