Shares of e-commerce giant Amazon (NASDAQ:AMZN) jumped more than 12% yesterday following the news that CEO Andrew Jassy will oversee the company’s cost-cutting initiatives. Further, the stock price jump was aided by milder inflation (CPI) numbers for October. Given the long-term growth potential, the current valuation levels present a good buying opportunity.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Yesterday, Jassy indicated that the company may consider trimming down or suspending certain unprofitable businesses. Amazon’s Alexa business, with over 10,000 employees, is also undergoing evaluation.

Let’s take a deeper look at Amazon’s stock and its long-term potential to arrive at the right investment decision.

Amazon’s Long-Term Growth Story

Amazon has a dominant position in two relatively essential business categories: Retail and Cloud. Both Retail and cloud computing have a large Total Addressable Market or TAM, presenting a significant growth opportunity.

While the retail business posts hundreds of billions in revenues year-on-year, its AWS cloud business generated $62 billion in revenues in 2021 and is growing at 35%+ even at this scale with an operating margin above 30%.

Amazon has a very strong brand, driven by its 5/10-year head start versus competition in both e-commerce and the cloud. Overall, both businesses have a long runway for growth.

Amazon’s Discounted Valuation

Notably, Amazon is the world’s first public company to lose almost $1 trillion in market value. Amazon’s market capitalization has dwindled from $1.88 trillion seen last year to $975 billion currently.

Given that Amazon houses multiple businesses under its umbrella, we believe EV/EBITDA is the better metric to evaluate Amazon’s valuation. The company is trading at a huge discount to its own historically high averages. At present, Amazon stock is trading at around 14x EV/EBITDA (on a forward basis), compared to its own five-year, historical average of 24x. This implies a huge 42% discount. Investors may want to buy Amazon stock, which may not be available at these attractive levels again.

Is Amazon a Buy, Hold or Sell?

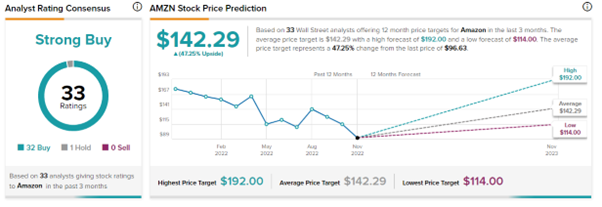

The Wall Street community is clearly optimistic about the stock. Overall, the stock commands a Strong Buy consensus rating based on 32 Buys and one Sell. Amazon’s average price target of $142.29 implies 47.25% upside potential from current levels.

Concluding Thoughts

Amazon’s stock price is down almost 45% over the past year. A combination of supply chain issues, high inflation, and macroeconomic factors has caused a sharp decline in the company’s stock price on a year-to-date basis. This could be an attractive entry point for investors. We expect the stock price to start inching up in the next couple of quarters as investors look past these near-term issues.

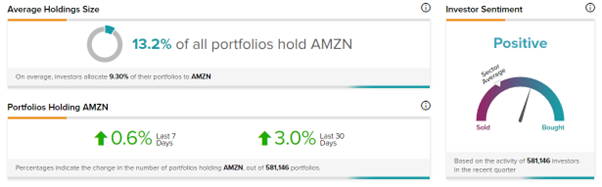

No wonder, TipRanks’ Stock Investors tool shows that investors currently have a Positive stance on Amazon, with 3% of investors on TipRanks increasing their exposure to AMZN stock over the past 30 days.

Read full Disclosure