The big takeaway from Microsoft’s recent quarterly update revolved around the slowdown in the growth of its cloud computing platform Azure, as reflected in the December quarter’s results and the guidance for the current quarter.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The conclusion is that the declaration is set to bleed over to other cloud services, not least segment leader Amazon’s (NASDAQ:AMZN) AWS.

“Sentiment was already bearish on AWS,” said Oppenheimer analyst Jason Helfstein, “with investors looking for slowing revenue over the next three quarters, largely confirmed after MSFT earnings and conversations with industry checks.”

In light of Microsoft’s comments, Helfstein has lowered expected AWS FY23E revenue growth by 130 bps to 17% year-over-year compared to the Street’s 21% estimate and down from the 29% growth anticipated in FY22E. Despite the negative sentiment, Helfstein went on to reassure, “AWS remains in a strong position to capitalize on secular growth.”

While Helfstein also thinks Microsoft’s guidance erred on the cautious side, further standing in AWS’s stead is the fact its revenue is “levered” to IaaS (usage) compared to Azure’s heavier exposure to the “more volatile” PaaS (seat licenses).

As for the bigger picture around Q4, Helfstein is calling for revenue to be up 5% year-over-year, 1% lower than the Street and the guide’s midpoint, with AWS/Advertising revenue up 22%/20%, respectively, vs. consensus at 23%/17%.

Helfstein sees gross profit rising 12% from the same period a year ago (consensus has 11%) and expects operating income to decline by 10%, bettering the Street’s forecast of an 18% drop.

“Positively,” the analyst said, “we believe ecommerce revenue has stabilized, and margins should improve from organic scale and announced headcount reductions.”

All told, Helfstein maintained an Outperform (i.e., Buy) rating on AMZN shares, backed by a $130 price target. The implication for investors? Upside of 27% from current levels. (To watch Helfstein’s track record, click here)

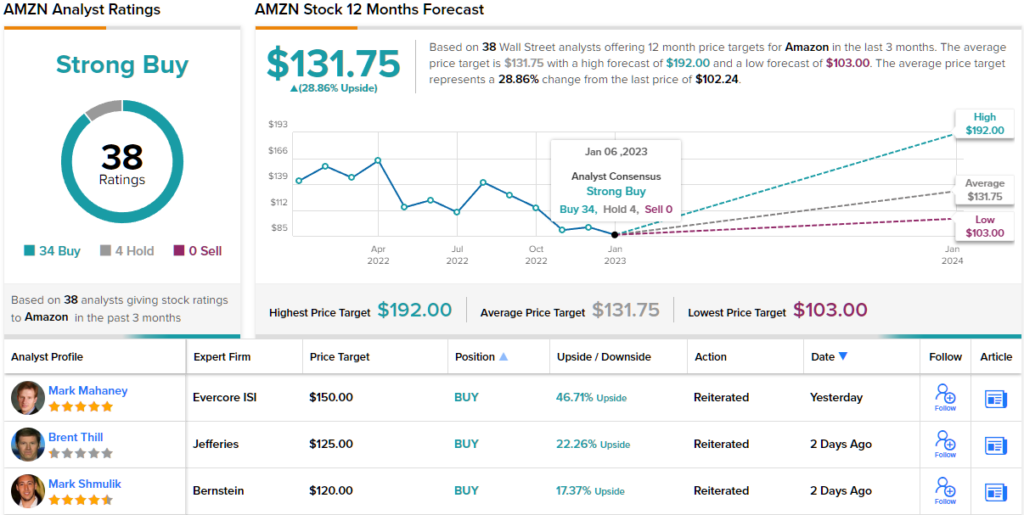

Most on the Street are thinking along the same lines; based on 38 Buys vs. 4 Holds, the analyst consensus rates the stock a Strong Buy. The $131.90 average target closely resembles Helfstein’s objective and is set to generate returns of ~29% over the coming year. (See Amazon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.