It’s hard to believe, but the internet as we know it, the world wide web, has been around for almost 35 years already. It brought us the dot.com boom and bust to start the 21st Century, and now it’s bringing us the AI boom.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In a recent note from Cantor’s Deepak Mathivanan, an analyst rated by TipRanks among the top 1% of his peers, takes the measure of recent factors, especially AI, and its impact on the online sector.

“Despite strong performance over the last 18 months, we believe valuations in Internet are fairly reasonable and should benefit from upcoming rate cuts. However, positive estimate revisions, the key driver of outperformance over the last two years, are likely to moderate as top-line growth decelerates and the benefits of cost-saving initiatives abate. Looking ahead, we believe selective stock picking is the right strategy to generate alpha in Consumer Internet for the next 12-18 months,” Mathivanan opined.

‘Selective picking’ is what top analysts like Mathivanan are best at, and he follows those comments by tagging Amazon (NASDAQ:AMZN) and Meta Platform (NASDAQ:META) as two of the best internet stocks to buy right now. Let’s take a closer look at both of them, and at Mathivanan’s comments, to find out just what makes them so compelling for investors.

Amazon

The first Cantor pick we’ll look at here, Amazon, is the global leader in online retail. The company survived the original dot.com bubble 25 years ago, and today has grown far beyond its beginnings as ‘the online bookstore.’ Amazon still sells books, but its inventory of merchandise has expanded to include almost anything that anyone could want to buy. That huge inventory is supported by the company’s network of high-tech warehouses, packing and shipping facilities, and its guaranteed short-term delivery to almost any location in the world.

For customers, this makes Amazon the digital world’s most convenient single shopping location. For Amazon, it forms a profitable core business – and having that as a foundation has given Amazon the combination of confidence and deep pockets to branch out into new fields and ventures.

That branching out is seen most clearly in Amazon’s tech ventures, particularly in cloud computing. Amazon’s subscription cloud service, AWS, has proven popular with users and the addition of AI technology has expanded the service’s capabilities. In Amazon’s last reported quarter, AWS proved itself capable as an important revenue driver.

Those revenues were reported in the recent 2Q24 report, and AWS showed a 19% year-over-year increase in segment revenues, hitting $26.3 billion, or almost 18% of the company’s total quarterly top line.

In total, Amazon generated revenues of $148 billion. That was up just over 10% compared to 2Q23, although it missed the forecast by $760 million. Amazon’s bottom line earnings in Q2 came to $1.26 per share, a full 23 cents better than had been expected and well above the prior-year quarter’s 65 cent EPS.

Turning to top analyst Mathivanan and the Cantor view, we find him bullish on both the retail margins and the fast growth in cloud computing. The Cantor analyst writes, “The investment thesis on AMZN is still centered on 1) retail margin expansion, and 2) AWS acceleration. We believe there is runway in both, but the magnitude is likely to moderate compared to trends over the past two years, and the path is unlikely to be linear going forward. That said, AMZN’s dominant competitive position in two large consumer and software end-markets with its retail and cloud businesses provides a lot to be bullish about over the next 12-18 months… We still see several paths for upside to the Street’s (Visible Alpha) FY25E EBIT estimates, in addition to plenty of potential catalysts ahead.”

Taken together, this brings Mathivanan to initiate his coverage of AMZN with an Overweight (Buy) rating, and a price target of $230 that implies a 24.5% gain on the one-year horizon. (To watch Mathivanan’s track record, click here)

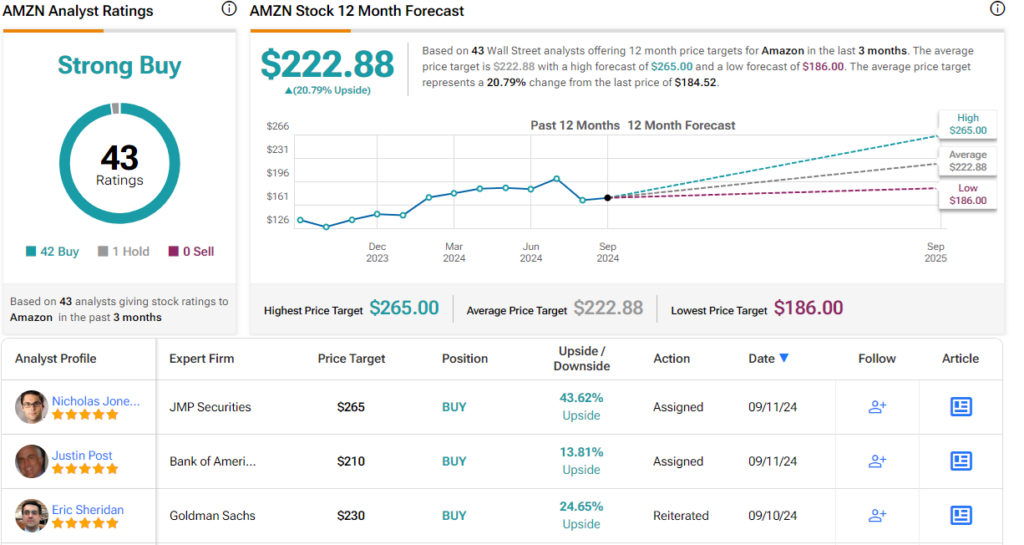

Overall, this online retail giant has picked up 43 recent analyst reviews – and their 42 to 1 breakdown favoring Buy over Hold supports a Strong Buy consensus rating. The stock’s current trading price is $184.52 and its $222.88 average target price points toward a one-year upside potential of 21%. (See AMZN stock forecast)

Meta Platforms

Meta Platforms, the second stock we’ll look at here, is described by Mathivanan as a ‘top pick’ among the internet stocks. The company is as well-known as Amazon, and has been a leader in the social media field since its founding as Facebook back in 2004. In the years since, the company has expanded through the acquisition of additional platforms, and today Meta is the parent company of Facebook, Instagram, Messenger, and WhatsApp. Through these platforms, the company can reach out to touch nearly half of the total global population.

The company’s core social media activity drives its primary source of revenue – the digital advertising business based on the aggregated data mined through social media. Meta’s scale can be seen in its revenue stream – in 2023, the company generated a total of $134.9 billion at the top line.

That revenue generation underwrites Meta’s other operations, primarily its development work in artificial intelligence. AI tech is the shiny new thing, and has been driving much of the tech boom in the last couple of years – and Meta is working hard to both build itself a niche in generative AI and to develop the AI applications of the future. The company has applied AI tech to its social media model, and uses the technology to fine-tune its digital advertising strategies. This is probably Meta’s most recognizable AI venture – we see it whenever we log into one of Meta’s platforms and see ads, posts, and other recommendations that are based on our recent social media and web browsing histories.

For the future, Meta is working on an open-source AI model, dubbed Llama, that is intended to make AI flexible – and to make Meta an AI provider for the widest possible customer base. The open source nature of Llama acknowledges that every customer is unique – and so will have unique additions to make to the AI.

On the financial side, Meta reported its results from 2Q24 at the end of July. The company’s revenue for the quarter came to nearly $39.1 billion, just over the top end of the previously published guidance, up 22% year-over-year, and $760 million better than had been anticipated. At the bottom line, the company’s EPS came to $5.16, 40 cents per share over the forecasts.

Checking in again with Jefferies analyst Mathivanan, we find that he is unabashedly upbeat on Meta, writing of the company, “Why Overweight META? We believe 1) the business has plenty of levers to capture share gains and generate healthy top-line growth above a mid-teens CAGR over the next 2-3 years, 2) while the ROIC of AI spend is debated, Street (Visible Alpha) estimates have capex spend growing steadily but assume minimal revenue benefit at +13% FY24E-26E CAGR (vs. digital ads +10-12% growth) – which provides upside scenarios to EPS/FCF, and 3) valuation at 20x FY25E EPS embeds AI skepticism and some probability of a recession already. Overall, we see a stock with further potential for upward estimate revisions and an attractive valuation.”

That Overweight (Buy) rating is accompanied by a $660 price target that implies a one-year upside of 29%.

Zooming out, it’s clear that the Street is generally bullish on Meta. The stock has 45 recent reviews, and the breakdown of 41 Buys, 3 Holds, and 1 Sell gives META its Strong Buy consensus rating. The stock’s $511.83 trading price and $584.82 average price target together suggest a 14% gain in the next 12 months. (See META stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.