While most real estate-related stocks and shares of REITs have declined notably over the past year in the face of rising interest rates, some have held their ground relatively well.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

One such REIT is Alpine Income Property Trust (NYSE: PINE), whose qualities have led to shares trading relatively flat since investors started selling off equities in bulk. Combined with the stock’s dividend yielding a hefty 5.9%, Alpine has most certainly outperformed the majority of its sector peers over the past year.

Its most recent results also came in robust, and the dividend was once again increased, while shares are trading at a valuation that offers a notable margin of safety. Accordingly, I am bullish on the stock.

What are Alpine’s Unique Qualities?

Alpine is quite a special REIT in that its operations are very lean while it also enjoys tremendous cash flow visibility.

A Lean Operating/Shareholder Structure

Alpine’s portfolio is quite diversified, including 146 net leased retail and office properties spread across 104 markets in 35 states. The trust was formed as recently as August 2019 and has zero employees. It is instead externally managed, resulting in quite lean and frictionless operations.

Another cheerful point regarding its structure is that the publicly-traded REIT CTO Realty Growth (NYSE: CTO) owns both the external manager and 22.3% of Alpine’s common stock. Accordingly, Alpine’s operations are slick while, at the same time, endorsed by a high-quality sponsor whose interests are entirely aligned with those of common shareholders.

Cash-Flow Visibility

Regarding the point made about Alpine’s cash-flow visibility, the REIT’s performance is molded to remain robust for years, supported by multi-year leases, implanted rent hikes that are contractually secured, and low-cost financing due to a reputable manager.

At the end of Q3, Alpine’s weighted-average remaining lease term stood at 7.7 years, while the property portfolio was 100% occupied.

It’s also worth noting that Alpine enjoys a quality and diversified tenant base, which also ensures rent collection. Specifically, no state and no tenant constitute more than 18% and 12% of Alpine’s total annual base rent, respectively. Further, 76% of Alpine’s annualized base rent is sourced from tenants (or the parent of a tenant) that are credit rated.

Q3-2022 Results: Another Solid Quarter in the Books

Backed by the qualities just mentioned, Alpine latest results came in strong, remaining undaunted despite the tough real estate environment.

Revenues came in at $11.5 million, up 41.1% year-over-year. Revenue growth was powered by Alpine’s ever-lasting acquisition spree. During Q3, the company continued to execute this strategy, purchasing nine net lease retail properties for $36.7 million, featuring a juicy weighted average going-in cash cap rate of 7.1%.

In fact, it’s worth mentioning that the weighted average lease term of the acquired properties stands at 7.5 years, in line with the rest of the company’s property portfolio. Again, cash-flow visibility is a key focus of the manager.

After a $234 million straight-line rent adjustment, AFFO rose by a softer but still remarkable 18.3% to $5.7 million. Further, after accounting for the issuance of common stock, which the company utilized to raise funds to partway assist with these property purchases, AFFO/share rose by a milder yet vigorous 13.5% to $0.42.

With Alpine’s results coming once again better than expected, management boosted its Fiscal 2022 outlook, expecting AFFO/share to land between $1.74 and $1.76, from $1.58 and $1.63 previously. At the midpoint, this implies year-over-year growth of 10%. Again Alpine’s unique qualities are illustrated in this performance metric during such a treacherous market environment.

Is Alpine’s Dividend Trustworthy?

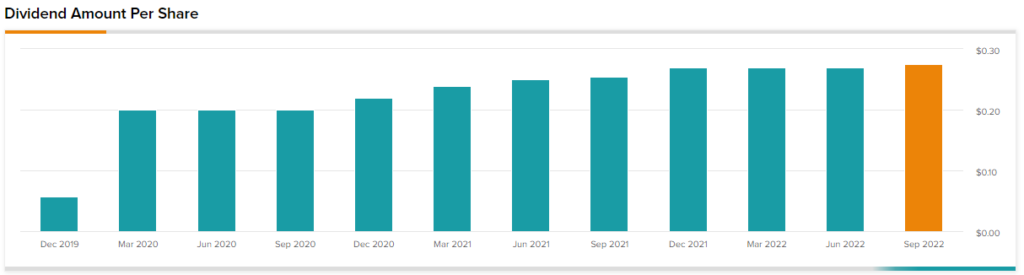

In late August, Alpine hiked its dividend by 1.9% to a quarterly rate of $0.275. Not a great increase, but considering the stock already yields 5.9%, we can’t really complain.

Further, Alpine’s payout ratio stands at just under 63% at the midpoint of the manager’s FFO/share outlook, which, fused with the trust’s cash flow visibility, should stimulate income-oriented investors’ interest in the stock.

There is certainly enough room for the company to keep growing the dividend gradually, especially considering the average length of Alpine’s leases and that 37% of Alpine’s annualized base rent comes from leases with contractual rent increases embedded in them.

Is PINE a Good Stock to Buy, According to Analysts?

Turning to Wall Street, Alpine Income Property Trust has a Strong Buy consensus rating based on three unanimous Buys assigned in the past three months. At $21.33, the average Alpine Income Property Trust price target implies 13.8% upside potential.

Takeaway: A Robust REIT for Income Generation

Alpine Income Property Trust comes with unique qualities capable of partially mitigating a chunk of the underlying risks REITs are currently encountering in the face of macroeconomic restlessness.

The company’s Q3 results were very strong, its thoughtful property acquisition strategy works, the hefty dividend is well covered, and its multi-year leases should shield investors from unpleasant market shocks.

At a forward P/AFFO ratio of 10.5x and a 5.9% yield, the stock offers a wide margin of safety against a further correction in the markets as well.