It’s no secret that the tech sector has been the main driver of the current bull market. Tech is heavily overrepresented in the market indexes, making up more than one fourth of the S&P 500 and an even larger proportion of the NASDAQ 100 – and the mega-cap Magnificent 7 stocks have been leading the way.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These are the 800-pound gorillas of the tech sector, known for their innovative products and their heavy investments in cutting edge technologies like artificial intelligence. With their deep pockets and deeper expertise, the Magnificent 7 tech stocks are among the leaders of the AI boom, and they’re positioning themselves to leverage the transformations that AI is sure to bring, transformations that could be far greater than any past technological breakthrough

But some of these giants might represent a better opportunity for investors than others. With this in mind, D.A. Davidson analyst Gil Luria is taking the measure of two Mag 7 shares, Alphabet (NASDAQ:GOOGL) and Meta (NASDAQ:META) – and coming down to a recommendation on which one is the superior Mag 7 stock to buy right now. Here are the details.

Alphabet

First up, Alphabet, the parent company of Google and YouTube and the dominant company in the fields of internet search and digital advertising. The company’s success has pushed it to just under a $2 trillion market cap, making it the fourth-largest publicly traded firm on Wall Street and one of just 6 trillion-dollar-plus companies.

Even on the top tier, companies have to work to maintain their position. Alphabet has been proactive at this, leveraging its tech experience and expertise to develop new tools and applications for a rapidly approaching future. Prominent among Alphabet’s projects are multiple ventures into the world of AI.

Alphabet is using AI to enhance the functionality of its internet search arm, combining generative AI with multimodal large language models to improve the capabilities of Google in both understanding requests and in delivering results. The company is also using AI tech in its online language translation services and in AI-powered text creation tools. The aim here is not solely to make Google or YouTube better, but also to develop a competitive edge against challengers such as Microsoft’s Bing search engine or against gen-AI content creators such as ChatGPT.

All of this is embodied in Alphabet’s Gemini model, the company’s strongest development of artificial intelligence. At its core, Gemini is a collection of large language models, and is designed to understand audio, images, text, video, and even code – all to give the most flexibility in the end use. Alphabet is working to integrate Gemini into all of its products, from Google to the Android operating system, and to put the model to use in chatbots, text generation, software coding – pretty much any form of content creation that an end-user can imagine. The key challenge for Alphabet will be maintaining market share as the search world shifts toward AI-powered tools.

This is an issue noted by Davidson’s Gil Luria, who thinks there are reasons for caution here, mainly due to the company’s uphill road in integrating AI technology into its products but also in the legal repercussions of its current near-absolute dominance of online search. Luria writes, “While the company has maintained an almost monopolistic grip on the global Search market for years, many would argue that this dominance is under siege with the introduction of AI-enhanced search and chatbots. The rise of models like OpenAI’s GPT, which has been tightly integrated into Microsoft’s ecosystem, highlights this vulnerability inside of Google that despite its leadership in AI research and its massive data advantage, the company has struggled over the years to translate these assets into competitive commercial products at the same pace as its competitors.”

Of more immediate importance, the analyst sees problems piling up on Alphabet’s horizon, and adds, “Shorter-term, Google will be navigating the transition from having 90% share in Search to something less than that as AI-enhanced Search becomes the new category. This transition will also become more difficult as it has to accommodate the DOJ charges that were specifically aimed at now allowing Google to sustain this monopoly during the transition.”

For Luria, this adds up to a Neutral (Hold) rating for the stock, while his $170 price target points toward a one-year upside potential upside of 7%. (To watch Luria’s track record, click here)

Alphabet, like many of the major tech companies, has picked up plenty of interest from Wall Street’s stock analysts – and there are 36 recent reviews on record for the stock. These include 27 to Buy and 9 to Hold, giving the shares a Strong Buy consensus rating. The average price target of $202.94 represents a gain of 27.5% from current levels. (See GOOGL stock forecast)

Meta Platforms

The second stock on our radar here is the world’s leading social media company, Meta Platforms. Through its main social media subsidiaries – Facebook, Instagram, Messenger, and WhatsApp – Meta can reach more than one-third of the world’s population. At the end of June this year, the company reported that its Daily Active People (DAP) across the family of platforms was 3.27 billion, an extraordinary number, and one that was up 7% year-over-year.

That huge reach supports Meta’s core money-making business, its digital advertising sales. The company reported a 10% increase in the average price per ad, as well as a 10% increase in ad impressions delivered across the company’s family of platforms in 2Q24.

In raw numbers, that translated into quarterly revenues of $39.07 billion, up 22% from the prior year and $760 million better than had been forecast. The company’s Q2 bottom line came to $5.16 per share, beating the estimates by 40 cents per share.

Meta and its founder Mark Zuckerberg have been leading the social media wave for the better part of two decades now – but the company is not resting on its laurels. Meta is also positioning itself as a leader in artificial intelligence technology. The company already uses AI to fine-tune and narrowly target its ad impressions, and also uses AI tech in translation algorithms to make the platforms accessible across languages. But in addition, Meta is also moving into generative AI and working to expand the audience for AI generally.

The company has developed an open-source AI model, Llama, and is already on Llama 3. The platform aims to make AI more flexible and more accessible; its open-source code allows users to tweak the platform to meet their own unique needs, as well as to publish improvements that everyone can use.

Meta has also released the Meta AI, an AI assistant/chatbot, across all of its social media platforms, as a direct challenge to the gen AI leader, ChatGPT. Meta AI has seen successes, and at the end of August, the company reported that the AI chatbot had already reached 400 million monthly active users and 40 million daily active users.

Meta’s AI work is taking shape in the company’s Foundation Compute and Spatial Compute technology platforms. The first of these integrates the infrastructure, models, and frameworks that the company will need to put together AI apps at the scale needed to serve an audience of billions, while the second refers to the AR, VR, and immersive environments – what the company calls its ‘metaverse’ – that will let users interact seamlessly with the AI. Llama and Meta AI are the current applications available – but Foundation and Spatial Compute are where the rubber meets the road, and Meta plans to follow that road to the next generation of AI tech.

All of this makes Meta Platforms, in analyst Luria’s view, the superior Mag 7 stock for investors to buy right now. Luria says of this company, “We see META as a top pick within the mega-cap space, with a combination of emerging leadership in the most important future technology platforms and an attractive relative valuation… Meta’s strategic positioning in AI Foundation Compute and Spatial Compute signals a forward-looking bet on the next wave of technological transformation, where scale, capital intensity, and platform control will define market leadership.”

Getting to the details, the analyst adds, “In AI Foundation Compute, Meta’s scale and access to massive datasets, high-performance infrastructure, and specialized developer talent offer a distinct advantage while similarly, in Spatial Compute, Meta’s multi-billion-dollar investments in Reality Labs and hardware platforms like Quest and Meta Ray-Bans give it the resources and ecosystem to shape this next computing paradigm, just as Apple and Google shaped mobile computing in the past decade.”

Based on this, Luria rates META stock as a Buy, and his $600 price target suggests that he sees a gain of 12% coming on the one-year horizon.

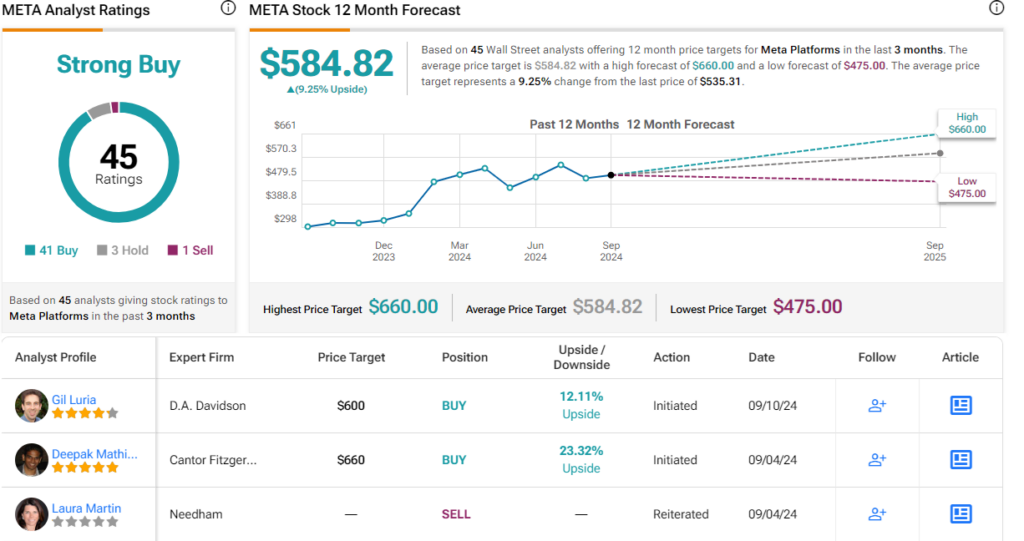

Overall, the Street is also bullish on Meta. The stock has picked up 45 analyst recommendations lately, which include 41 Buys, 3 Holds, and 1 Sell for a Strong Buy consensus rating. Going by the $584.82 average target, a year from now, shares will be changing hands for a 9% premium. (See META stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.