ChatGPT has been hogging the headlines this year and that in turn has generated a big interest in AI.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But it’s not as if AI has popped out of nowhere. Alphabet (NASDAQ:GOOGL) has been hard at work on AI for about a decade and four years after Google introduced large language models, the company’s AI journey advanced recently when it made Bard – its conversational AI service and ChatGPT competitor – available in open access (meaning users can sign up to check it out) in the U.S. and the U.K..

Google Search has improved in recent years, with the help of large language models like BERT and MUM (1000x more powerful than BERT). Now, LaMDA (language model for dialogue applications) – a lightweight and optimized version powers Bard – and PaLM (pathways language model) are also starting to get lots of attention.

Google expects Bard will prove to be complimentary to Search and although it is still early days with the company warning Bard will likely make some mistakes, its accuracy is expected to improve over time.

Looking at all the AI hoopla, Monness analyst Brian White says the attention has sprinkled “some badly needed optimism on a sector struggling to recover after an apocalyptic collapse in tech stocks.”

But it is all just a part of a bigger plan at Google. Rewind to 6 years ago, and already back then, Google stated it intended to become an “AI-first company,” and more recently said that AI is the “most profound technology we are working on today.”

Add into the mix subsidiaries Google AI and DeepMind, and the 5-star analyst sees Google as a “leading player in the AI movement, leveraging AI across a deep portfolio of hardware, software, and services.”

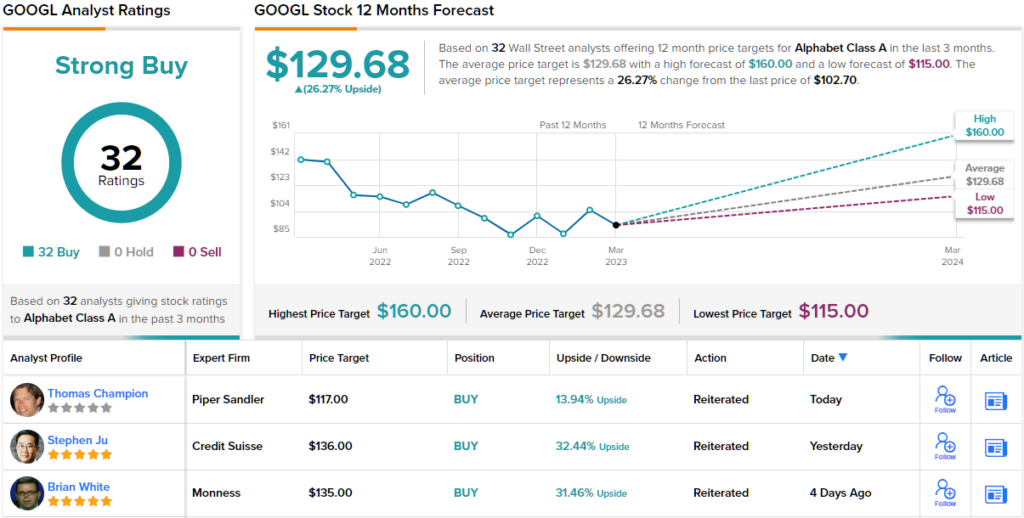

So, all busy on the GOOGL AI front, but what does it mean for investors? White reiterated a Buy rating on Alphabet shares along with a $135 price target. Should the figure be met, investors will be sitting on returns of ~31% in 12 months’ time. (To watch White’s track record, click here)

All of White’s colleagues agree here. Based on a full house of Buys only – 32, in total – the stock claims a Strong Buy consensus rating. Shares are expected to appreciate by 26% in the year ahead, considering the average target clocks in at $129.68. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.