Alphabet’s (NASDAQ:GOOGL) (NASDAQ:GOOG) most recent results showcased that the tech behemoth is significantly more resilient than some investors might think. The company continues to grow despite the tough advertising landscape. Further, its Cloud division just turned profitable, and management keeps rewarding shareholders with increasing buybacks.

In fact, based on its Q1 performance and management’s commentary, Alphabet should achieve notable earnings growth this year. Coupled with the fact that shares are still trading about 30% lower from their past highs, I find the stock’s investment case quite compelling.

Accordingly, I am bullish on Alphabet stock.

Q1 Results: Positive Surprises Across the Board

Alphabet’s Q1 results positively surprised investors and analysts alike, as the company posted noteworthy improvements across all core business segments. Let’s break them down!

The Ad Business

Alphabet’s ad business can be quite vulnerable to macroeconomic headwinds. With enterprises moderating spending as a result of economic uncertainty, the potential of declining consumer spending, and rising rates, Alphabet’s ad revenues can be easily affected during such times.

And yet, the company’s performance remained robust, with ad revenues falling by just 0.2%, coming in essentially flat. This is quite impressive given that ad revenue suffered from an unfavorable foreign exchange impact and is compared to an exceptionally strong Q1 2022 when global ad spending was through the roof.

Google Search: In Google Advertising & Search, revenues grew 2% year-over-year, powered by an increase in travel and retail areas, offset partially by lower interest in finance as well as in media and entertainment. On a more anecdotal note, this result could also indicate Search’s relative strength against ChatGPT.

Of course, OpenAI’s chatbot cannot really yet compete with Alphabet’s Search as it lacks recent data. Still, given that it can be an alternative to Search on many fronts and that millions are using it, we could potentially have seen some sort of negative impact on Search’s usage in Q1, which didn’t occur.

Youtube: Since Search revenues actually grew, the segment’s revenue decline was mostly due to Youtube lagging. Specifically, YouTube advertising revenues landed $6.7 billion, a decline of 3% year-over-year. This was due to an incremental pullback in advertiser spend. That said, operationally, YouTube continues to build exceptional momentum, which should translate to significant growth once the advertising industry as a whole recovers.

YouTube Shorts continues to see strong momentum with Creators. Last year, the number of channels that uploaded to Shorts on a daily basis increased by over 80%. In fact, those posting weekly on Shorts saw the bulk of new channel subscribers arriving from their Shorts posts. Thus, with Shorts being such a fruitful place for creators to advance their online presence, they should be quite incentivized to utilize the platform, which should, in turn, drive superb engagement and grow ad revenues over time.

While management didn’t provide watch time specifics, they did last quarter when they announced that Shorts generated 50 billion+ daily views in Q4, up from 30 billion in the previous last spring. This should somewhat help investors picture the positive momentum the platform is experiencing.

Google Cloud

Alphabet’s Cloud division had a remarkable quarter, with a 28% year-over-year increase in revenue and a historic milestone for Google Cloud — its first positive operating profit. This is thrilling news because we can expect Google Cloud to soon become a profitable contributor to the company’s bottom line rather than a burden, which has been the case until now.

Overall, Google Cloud’s momentum remains quite strong. Over the past three years, Google Cloud Platform’s annual deal volume has risen almost 500%, with considerable deals worth over $250 million rising by more than 300%. Impressively, in the Q1 earnings call, management announced that approximately 60% of the world’s 1,000 largest companies are Google Cloud customers. At the same time, numerous other leading start-ups and millions of small and medium enterprises utilize Google Cloud.

Is Alphabet Stock a Buy, According to Analysts?

Turning to Wall Street, Alphabet has a Strong Buy consensus rating based on 31 unanimous Buys assigned in the past three months. At $129.03, the average Alphabet stock price target implies 23.3% upside potential.

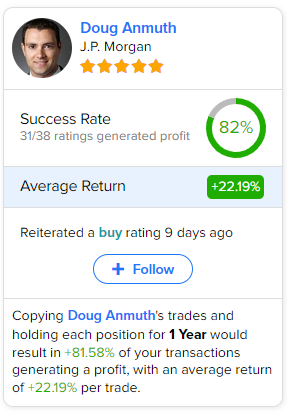

If you’re wondering which analyst you should follow if you want to buy and sell GOOGL stock, the most profitable analyst covering GOOGL (on a one-year timeframe) is Doug Anmuth of JPMorgan (NYSE:JPM), with an average return of 22.19% per rating. See below.

The Takeaway

Alphabet kicked off Fiscal 2023 on a positive note despite the undoubtedly challenging landscape in the advertising industry. Its core Search product remains as relevant as ever despite the recent surge in AI “alternatives,” and Youtube continues to gain traction, especially when it comes to Shorts’ engagement. The Cloud segment also held a positive surprise with its first profitable quarter ever.

Consequently, even though Alphabet’s earnings per share dropped by six cents year-over-year to $1.17, analysts expect that the company’s ongoing momentum will lead to notable earnings growth in Fiscal 2023. EPS is, in fact, expected to land at $5.30 this year, implying year-over-year growth of 16.2%.

Expanding share buybacks should also positively contribute here. The company repurchased $14.6 billion worth of stock compared to $13.3 billion last year. Alphabet also casually announced an authorization to buy $70 billion worth of stock moving forward, which equals approximately 5.2% of Alphabet’s current market cap.

With a forward P/E ratio just below 20 and Alphabet showing promising developments across the board, I remain bullish on the stock.