Shares of Alphabet (GOOG)(GOOGL) stumbled into the third-quarter earnings season, posting underwhelming numbers. The headline was that revenue growth slowed to just 6%. Analysts were already expecting a muted quarter, calling for 9% in top-line growth. Whenever a firm with a low bar set ahead of it stumbles, there’s a bit of cause for concern. Recession fears have worked their way into markets all year. With such a rough number that saw the slowest growth in over two years, Alphabet’s number is sure to send shockwaves rippling through firms reliant on digital ads and perhaps the tech sector. Nonetheless, growth concerns may be overdone.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

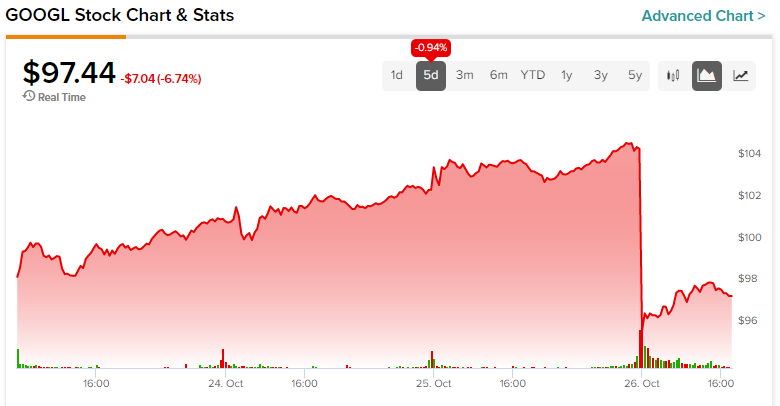

Investors were quite upbeat going into the Alphabet earnings. The stock market had added to an impressive winning streak, with tech stocks leading the charge higher on hopes a so-called “Fed pause” could happen in a matter of months. However, now, GOOGL stock is selling off.

Alphabet Stock Sinks Following Rough Q3-2022 Earnings

Though markets may be more optimistic when it comes to the Fed’s next course of action regarding interest rates, it will be quarterly earnings that dictate where stocks head from here. Alphabet’s quarter marked a disappointing start to the third-quarter earnings season. As other FAANG companies clock in their results, the stage may be set for investor sentiment in the fourth and final quarter of the year.

Undoubtedly, Alphabet’s ad slowdown is largely tied to macro headwinds. As macro storm clouds pass, questions linger as to whether Alphabet can get back on the growth track. The company has found ways to resist the effects of a secular slowdown in growth. Though single-digit growth may be a red flag for some that signal Alphabet’s glory days are over, I’d argue that Q3 was more of a pothole ahead of a recession year.

Nobody knows how deep the pothole goes, but in due time, I think Alphabet will be back to commanding the double-digit growth that investors have been spoiled with for many years. There was no sugar-coating the latest results, but I think the post-earnings reaction was overdone, opening a window of opportunity for dip buyers.

I remain bullish on GOOGL stock.

Alphabet Doesn’t Have a Growth Problem

Alphabet has its hand in many pies, searching for its next big growth driver. Search, Cloud, and YouTube remain the main pillars of Alphabet’s growth. Amid intensifying macro headwinds, each pillar seems unlikely to walk away from a recession unscathed. Post-recession, I expect Search, Cloud, and YouTube will be back to doing the heavy lifting again. However, questions linger as to what to make of Alphabet’s other endeavors it had to pull the plug on.

Alphabet knows it has to take chances in other growth categories to continue powering impressive growth numbers while its other businesses mature. The company has spent considerable sums on overly-ambitious projects like game-streaming service Google Stadia only to have to shut everything down and stomach a loss.

Google also recently announced the tough decision to axe its next-gen Pixelbook laptop. Undoubtedly, such bets are less meaningful in a low-rates environment when the risk of rolling the dice on high-reward bets is low. With rates rising and a recession looming, Alphabet needs to act like the behemoth that it is rather than looking to preserve its “startup” spirit.

Fortunately, Alphabet has the luxury of being able to adapt as tech startups look to take one on the chin amid what could be a funding drought. Alphabet CEO Sindar Pichai wants to use a recession as an opportunity to be 20% more productive. Undoubtedly, the goal may entail significant cuts to the workforce and other project cancellations to improve the efficiency of its capital structure.

As Alphabet looks to tighten the purse strings, I don’t think investors should make too much of its impact on growth. If anything, focusing on productivity and efficiency should help jolt the bottom line in a recession year.

Alphabet’s three growth pillars (Search, Cloud, YouTube) still have many years of growth left in the tank. The company need not rush into new projects as cash becomes harder to come by. Indeed, failed efforts like Google Stadia may serve as a learning opportunity for a firm with a history of rushing into projects only to pull the plug years later. Indeed, perhaps it’s a perfect time for Alphabet to leave its startup roots behind.

Is GOOGL Stock a Buy or Sell, According to Analysts?

Turning to Wall Street, GOOGL stock comes in as a Strong Buy. Out of 30 analyst ratings, there are 30 unanimous Buys. The average Alphabet price target is $132.60, implying upside potential of 36.2%. Analyst price targets range from a low of $186.00 per share to a high of $114.00 per share.

Conclusion: Don’t Fear Alphabet’s Growth Slowdown

Alphabet’s beginning to feel the heat of a recession. The weakness in ad growth is not unique to Google. As the worst recession headwinds pass, I suspect Alphabet will be back to being a market leader again.

In the meantime, expect productivity efforts to help minimize the pain from the hostile macro environment.