Alphabet’s (NASDAQ:GOOGL) (NASDAQ:GOOG) ad business has undoubtedly been feeling the pressure of macro headwinds lately, and with OpenAI’s chatbot continuing to experience impressive usage, it seems like Alphabet’s Google Search can add ChatGPT to its list of headwinds. Notably, amid tech’s remarkable year-to-date recovery, shares of Alphabet have been lagging the pack with around 7.2% gains year-to-date, well below the 15% gains posted by the Nasdaq 100 (NDX). However, despite these factors, I remain bullish on GOOGL stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Even if Google Search and ChatGPT aren’t direct substitutes, one can’t help but imagine more people are heading over to ChatGPT for their questions over Google. Indeed, it’s a critical moment for Google, and its latest Bard AI reveal is not off to a smooth start, with errors showcased in a recent ad.

If Google is to continue to be the “front page of the internet,” Bard AI needs to match ChatGPT’s capabilities. All the while, ChatGPT will be inching closer to its next big iteration as enterprise software behemoth Microsoft (NASDAQ:MSFT) integrates the AI alongside its broader software suite.

It’s hard not to be impressed with Microsoft and its “early lead” in the AI wars. Recent action in MSFT stock (up about 20% from its January low) suggests it’s taking the ball and running with it. Meanwhile, GOOGL stock’s year-to-date rally has ended in a correction of around 12% off its February peak, thanks partly to a botched Bard AI demo.

ChatGPT Will Put Google Search’s Moat to the Test

It’s been a rough patch for Google amid macro-induced ad softness. Still, despite the pressure, Google Search’s dominance has been a reason to stick by the name despite any slowed growth. Google Search has a wide moat protecting its share of economic profits, and this moat has been put to the test over the decades.

Microsoft’s Bing has tried to take share away from Google Search, but with limited success. Now that Bing has ChatGPT by its side, Microsoft may finally have what it takes to break Google’s moat and take some serious share away from the search top dog.

Undoubtedly, many users have been blown away by the capabilities of OpenAI’s chatbot in recent months. Further, as Microsoft slaps an AI alongside its other software products, usage could swell from here. And as usage increases, so too will the dataset that could help fuel future updates.

From an outsider’s perspective, Google seems to be right in hitting “Code Red” to get Bard ready for prime time. More ChatGPT users could translate to fewer Google searches at a time when ads are already feeling the heat.

The sooner Google can put a “chat” feature on its search platform, the better. Microsoft already has such a button on Bing, though Bing Chat is only available to a limited number of users, with an option for new users to go on the waitlist.

Despite Google’s recent fumbles and critics taking aim at Alphabet CEO Sundar Pichai, I think Google still has a moat that’s wide enough to prevent Bing from having its way. At the end of the day, Alphabet has a bigger dataset and more users that have Google as their default home page. People don’t always want to switch search engines, even if a competing product has more impressive capabilities.

Only time will tell if Google Search can hold up to the growing number of ChatGPT prompts. I’d argue that Google’s next quarter or two could be in a spot to take a short-term hit to the chin due to competition brought forth by ChatGPT.

Once Bard is ready to go, though, I don’t think GOOGL investors should worry about the floodgates opening anytime soon. Arguably, Google’s dataset and focus on AI could help it make Bard leapfrog over ChatGPT.

It’ll be a race with no clear finish, but I think it’s very unfair to count Google out of the game just because of ChatGPT’s early success. The first mover may have an advantage, but whether it retains such an edge is the million-dollar (or should I say billion-dollar) question. In the meantime, I see Google as having all the tools to one-up Microsoft in what’s turning into a fierce AI battle.

Is GOOGL Stock a Buy, According to Analysts?

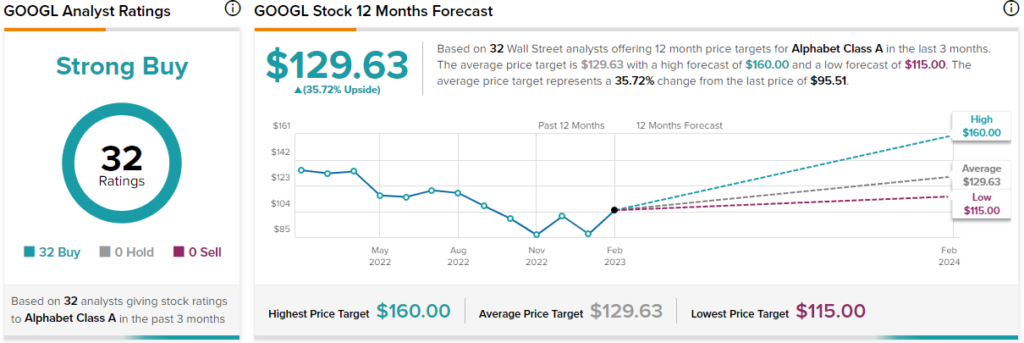

Turning to Wall Street, GOOGL stock comes in as a Strong Buy. Out of 32 analyst ratings, there are 32 unanimous Buy recommendations.

The average Alphabet stock price target is $129.63, implying upside potential of 35.7%. Analyst price targets range from a low of $115.00 per share to a high of $160.00 per share.

Takeaway: Google Will Feel Pressure, but ChatGPT is No Existential Threat

Over the next few quarters, Google’s moat could be chipped away at by ChatGPT and the new Bing. Google Search may even lose a bit of business, as the number of Google searches falls at the expense of ChatGPT prompts. Once Google and Bard AI are ready, though, the tides could easily turn right back in its favor.

In any case, I’d be a buyer of both Microsoft and Alphabet, as many winners may be minted by the rise of conversational AI. Look for the two rivals to strive to one-up one another over the coming years as the conservational AI market matures.