Shares of tech giant Alphabet (NASDAQ: GOOGL) surged last week despite the company missing second-quarter analysts’ expectations. Several analysts felt that the company fared better than certain other advertising-dependent businesses. Alphabet shares are down nearly 21% year-to-date due to fears of an economic downturn and worsening macro challenges. However, the majority of the analysts covering Alphabet stock continue to be optimistic about the company’s long-term potential.

Alphabet’s Q2 Results Reflected Resilience

Alphabet’s Q2 earnings per share fell 11% to $1.21 due to higher costs and losses on certain investments. Meanwhile, revenue increased 13% year-over-year to $69.7 billion. The strength in the company’s Search and Cloud businesses led to top-line growth.

However, the revenue growth showed a notable deceleration from the prior-year quarter. Alphabet’s prior-year quarter benefitted from a spike in its advertising revenue due to the reopening of the economy following lockdowns. In addition to tough comparisons, Alphabet has also been facing the impact of macro challenges on ad spending. Also, YouTube’s revenues have been under pressure due to rising competition from TikTok.

Despite multiple headwinds, Alphabet’s search business displayed resilience in the second quarter. Google Search and other advertising revenues increased 13.5% to $40.7 billion, driven by travel and retail.

While Alphabet’s management cautioned investors about the economic uncertainty multiple times during the Q2 earnings call, the majority of analysts continued to be bullish on the company.

Analysts Remain Bullish on Alphabet Stock

Morgan Stanley analyst Brian Nowak increased his FY22 and FY23 EBITDA (Earnings before Interest, tax, depreciation, and amortization) estimates for Alphabet by nearly 4% and 3%, respectively, as he believes that Q2 results were “strong,” mainly in Search.

Nowak also opines that the performance of Google Search reflects resilience, and indicates that Snap’s (SNAP) Q2 weakness could be due to lower quality advertising dollars rather than macro headwinds. In line with his optimism, Nowak increased his price target for Alphabet stock to $145 from $140 and maintained a Buy rating.

Meanwhile, Truist Financial analyst Youssef Squali remains “constructive” on Alphabet based on the company’s resiliency and better-than-feared Q2 results. Squali stated, “We believe that Street expectations are getting to be more reasonable and achievable, paving the way for the stock to start working again.” Consequently, Squali reiterated a Buy rating on Alphabet stock, with a price target of $145.

Overall, Alphabet stock earns a Strong Buy consensus rating backed by 28 Buys and two Holds. The average price target for Alphabet stock reflects 23% upside potential from current levels.

Conclusion

Wall Street analysts remain bullish on Alphabet stock and are looking beyond the near-term challenges. Alphabet has strong fundamentals and enough cash to support its plans to capture further opportunities in Search, Artificial Intelligence, and Cloud, as well as drive revenue in its Other Bets unit.

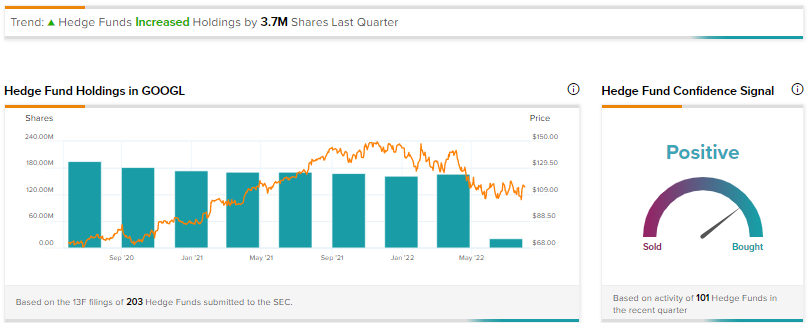

Additionally, as per TipRanks Hedge Fund Trading Activity Tool, hedge funds increased their holdings in Alphabet by 3.7 million shares in the last quarter. Overall, the Hedge Fund Confidence Signal for Alphabet is Positive.