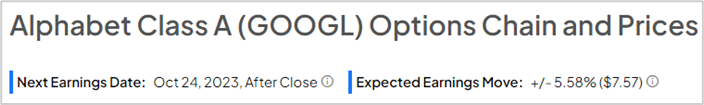

Tech behemoth Alphabet (NASDAQ:GOOGL) is scheduled to report its third quarter Fiscal 2023 results on October 24, after the market closes. The performance of Alphabet’s Google Search and Google Cloud and YouTube’s advertising revenue are anticipated to be the key focus areas in the upcoming earnings release. Wall Street is optimistic about Alphabet’s outperformance. Analysts expect Alphabet to post diluted earnings of $1.45 per share on revenues of $75.99 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

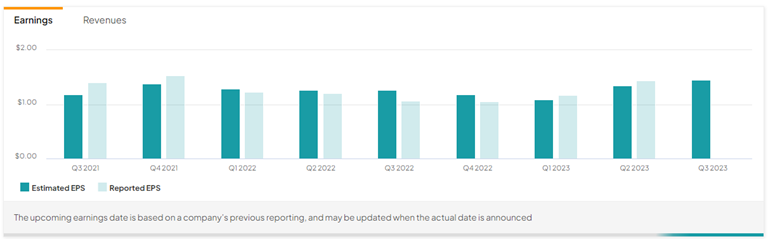

In the prior year period, the company reported diluted earnings of $1.06 per share on revenues of $69.09 billion. Alphabet has outpaced earnings estimates in four out of the past eight quarters.

Plus, the continuing frenzy around artificial intelligence (AI) tools could have boosted Alphabet’s Q3 results. Google’s generative AI chatbot Bard is already installed in most of its products, driving superior ad revenue for the tech giant.

Here’s What Analysts Expect from Alphabet’s Results

Ahead of the Q3 print, Jefferies analyst Brent Thill reiterated a Buy rating and $165 (21.7% upside) price target on GOOGL stock on October 17. Thill expects Alphabet to report a slight Q3 beat coupled with a continued rise in the stock price. As per Thill, some of the tailwinds supporting Alphabet’s performance include modest acceleration in ad revenue growth, strength in Search, the popularity of video-first format that boosts YouTube, the dominance of Google Cloud, and the ongoing AI boom.

Similarly, Monness analyst Brian White maintained his Buy rating and $160 (18% upside) price target on GOOGL stock on October 19. White believes that Alphabet is set to capitalize on digital transformation and the momentum built in advertising trends, Cloud growth, AI innovations, and a streamlined cost structure. Even so, the five-star analyst is cautious about the regulatory headwinds, which could get uglier in the days ahead.

Additionally, TD Cowen analyst John Blackledge reiterated a Buy rating on GOOG stock and lifted the price target to $160 (17% upside) from $150 on October 13. Based on his firm’s expert survey results, Blackledge expects YouTube to return to double-digit growth in Q3. Plus, Google Search spend growth is expected to accelerate, thanks to better pricing. The analyst is also encouraged by Google’s Cloud franchise, which is one of the most favored service providers in the space.

What is the Price Target of GOOGL Stock?

On TipRanks, the average Alphabet Class A price target of $151.06 implies 11.4% upside potential to current levels. Furthermore, GOOGL stock commands a Strong Buy consensus rating based on 30 Buys versus four Hold ratings. Year-to-date, GOOGL stock has gained 52.2%.

Insights from Options Trading Activity

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 5.58% move on Alphabet’s earnings. GOOGL shares have averaged a negligible 0.03% move in the last eight quarters. In particular, the stock gained 5.78% in reaction to Q2 2023 results.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Ending Thoughts

Alphabet’s Q3 results are expected to exceed analysts’ expectations, at least modestly. The thriving Google Search unit, leading YouTube video business, and Google Cloud momentum are expected to support Alphabet’s performance in the to-be-reported quarter.