Big Tech earnings are coming thick and fast, with Meta Platforms (NASDAQ:META) up next. After the close today, the social media giant will dial in its Q2 report.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The stock has been a major beneficiary of tech’s comeback this year with the shares having gained 136% since the onset of 2023. There could be room for further growth, according to JMP analyst Andrew Boone, who believes that heading into the print, the company is well set up for continued success.

“We believe Meta is in the early stages of benefiting from multiple product catalysts, including Reels, AI, and cost discipline,” Boone said. “Specifically, Reels and improved recommendation algorithms are driving greater user engagement, and with models still improving, we expect Facebook and Instagram to continue to take share of user time. For ads, Advantage+ is seeing increased adoption, while we believe AI is improving targeting and attribution.”

Per Sensor Tower data, 2Q23 Facebook and Instagram time spent increased by 5% year-over-year and 26%, respectively, and Boone is of the mind Reels is “adding incremental time and impression growth.” Here, Boone thinks Meta’s AI investments have benefited Reels engagement, given that since the launch of Reels, improved recommendations have been responsible for a 24% uptick in time spent on Instagram (as of 1Q23). The upshot from that should be more Reels revenue.

AI model improvements are also benefiting ad performance. This is evident from the increased usage of the Advantage+ shopping campaigns tool. In May, 27.5% of monthly budgets were using Advantage+, rising from 26.6% in April and ~1% last August, when Advantage+ first became available.

Elsewhere, Boone is also expecting Meta to once again lower its 2023 expense guide. In fact, with the 1Q23 cost measures already acting as a “tailwind to profitability,” and comps set to ease over the next several quarters,” Boone thinks his overall estimates “remain conservative” and he continues to believe the shares can push higher.

How much higher? By another ~17% from current levels, considering his $350 price target. Boone’s rating stays a Market Outperform (i.e., Buy). (To watch Boone’s track record, click here)

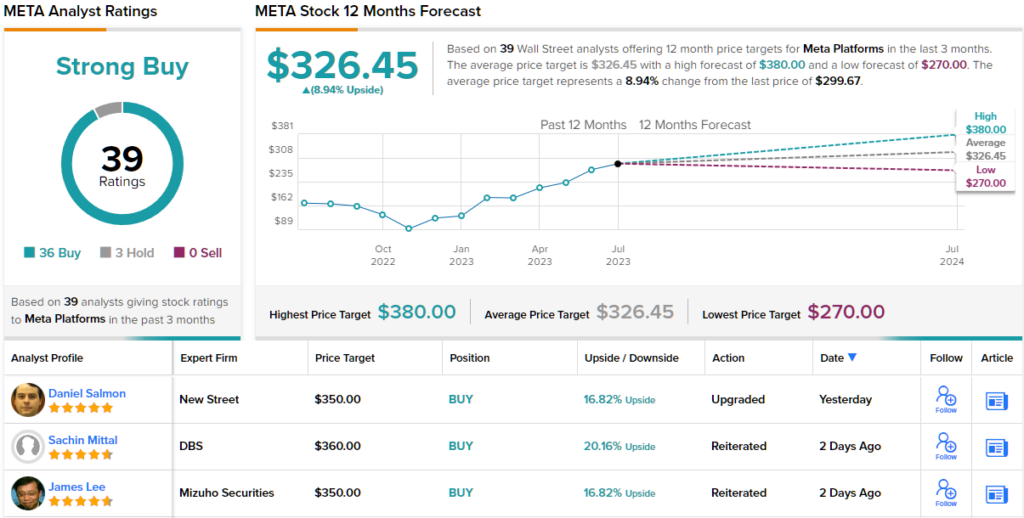

Overall, 39 analysts have submitted META reviews over the past 3 months, and these break down into 36 Buys and 3 Holds, all culminating in a Strong Buy consensus rating. The average target stands at $326.45, implying shares will post growth of 9% in the months ahead. (See Meta stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.