Once the market action comes to an end today, the curtains will raise on Disney’s (DIS) FQ1 earnings. This will be the first call since Bob Iger took hold of the reins again in November. Following the entertainment giant’s weak FQ4 results, Iger – who is largely seen as the driving force behind the modern Disney we know today – assumed CEO duties once again, with his return sending shockwaves across the Street. His task is to put the company back on the path to growth again.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Heading into the F1Q earnings call, Morgan Stanley’s Benjamin Swinburne would like to get some answers from Iger on various issues, including an assessment of the company’s creative health, and his view on the streaming endeavors.

As for Swinburne’s take, he offers a rosy view of the future. “We continue to believe Disney can deliver significant earnings growth over the next several years,” he opined. “This growth is expected to come through continued growth at its Parks & Experiences businesses (DPEP) and a return to growth for its Media & Entertainment businesses (DMED) in F24.” Between F22 through F25, Swinburne’s forecast calls for adjusted EPS growth at a CAGR (compound annual growth rate) of 20%+.

More in the here and now, the shares have put in a strong year-to-date performance – up by 28% – and Swinburne thinks that is down to “two recent shifts in sentiment.” One is due to a “less bearish view” regarding Disney’s cyclical revenue streams. Mostly this pertains to the US Parks (which should account for roughly 25% of F23 revenues) and advertising (15%). Secondly, Swinburne also thinks Disney has benefitted from streaming leader Netflix’ recent strong results, a display that reminded investors streaming “can be nicely FCF generative at scale.” This is important, as a key element of Swinburne’s $150 share price bull case is based on a growing contribution from the Media segment via “improving monetization and lowering costs.”

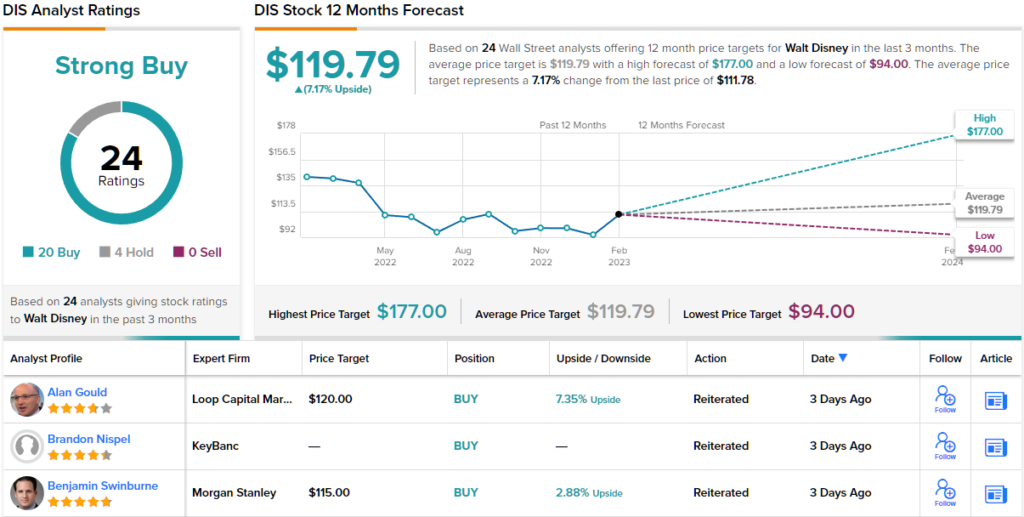

For now, however, Swinburne’s base case price target stands at $115, suggesting the shares will barely move higher in the year ahead. Swinburne’s rating stays at Overweight (i.e., Buy). (To watch Swinburne’s track record, click here)

Most analysts are thinking along the same lines; based on 20 Buys vs. 4 Holds, the experts’ view is that this stock is a Strong Buy. Going by the $119.79 average target, investors will be sitting on modest returns of ~7% from current levels. (See Disney stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.