With a robust schedule of planned releases for the rest of the year and the entirety of 2023, theatrical exhibition is on the road back to normality. Nevertheless, the amount of content has not yet recovered to its pre-pandemic levels, and production delays from the previous year are mostly to blame for release schedule gaps from August through October.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

With its extensive network of premium large format screens, Wedbush analyst Alicia Reese believes AMC Entertainment (AMC) is “well-positioned” for a strong Q422 and 2023 while also having the cash required to “weather the slump.” “Additionally,” notes the analyst, “AMC is expanding its global network and upgrading theaters in Europe in the coming quarters.”

These upbeat comments come ahead of AMC’s Q3 report, which is set to be delivered following the market’s close today.

Based on 21% domestic market share of the North American box office which increased 41% year-over-year, and an “estimated” 16% year-over-year uptick seen from international admissions’ revenue per screen, Reese sees Q3 revenue hitting $958 million, a touch below consensus at $961 million.

Due to “higher operating expenses” on account of inflation (especially in the UK and Europe) and to a lesser degree, due to “higher” film rent, Reese now expects Q3 adjusted EBITDA of $(13) million compared to her prior forecast of $8 million. The Street has this figure at $(18) million.

All told, despite the positive comments noted above, they are ultimately not enough to alter Reese’s bearish take.

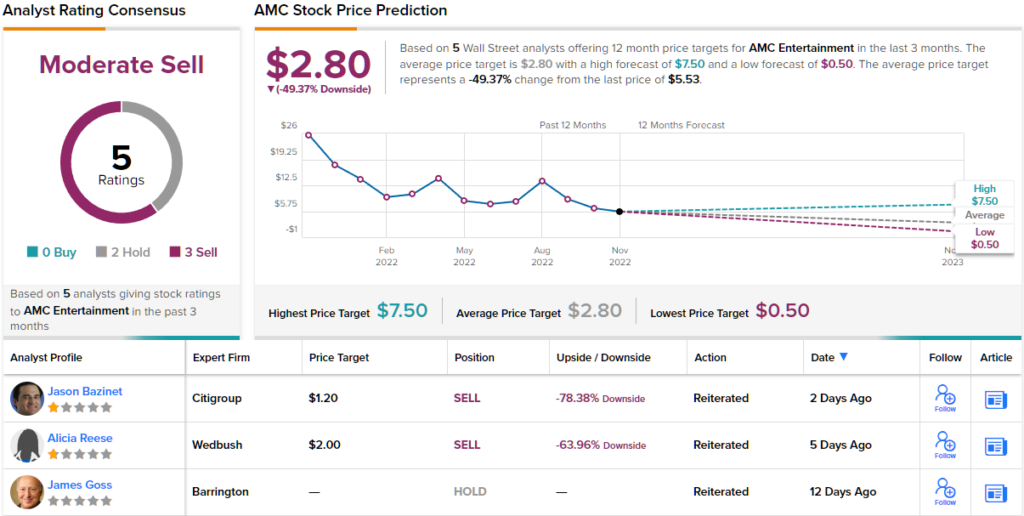

Given AMC shares are still trading above the analyst’s price target, Reese has an Underperform (i.e., Sell) rating for the shares to go along with a $2 price target. With the stock down by 65% on a year-to-date basis, the figure suggests it will slide by a further 64% over the coming months. (To watch Reese’s track record, click here)

Overall, 4 other analysts have chimed in with AMC reviews, of which 2 say Hold while the others implore to Sell, all resulting in a Moderate Sell consensus rating. The average price target stands at $2.80, suggesting the shares will be changing hands for ~49% discount a year from now. (See AMC stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.