It’s almost time for Amazon (NASDAQ:AMZN) to report 2Q23 earnings, with the company slated to release its latest financial statement once the market action comes to a halt on Thursday (Aug 3).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Like for many of its Big Tech brethren, it’s been a good year so far for the ecommerce giant, with shares up by 53% year-to-date.

The positive market sentiment is acknowledged by Wedbush analyst Michael Pachter, who expects a “solid print for Q2 and a good guide for Q3.” Pachter, though, brings attention to the recent strong share price action, and therefore says his share price appreciation expectations “are capped.”

Nevertheless, Pachter has raised his price target on AMZN to $146 (from $129), indicating the stock has room for further growth of ~14% from current levels. Pachter’s rating stays an Outperform (i.e., Buy). (To watch Pachter’s track record, click here)

As for what to anticipate in the readout, the analyst expects Amazon to reap the benefits of an increase in overall macro sentiment during Q2, particularly in its advertising, online stores, and subscriptions segments. Meanwhile, AWS is predicted to remain flattish.

Numbers wise, Pachter sees Q2 revenue hitting $131 billion, up from $127 billion in Q1 and above the midpoint of the guide ($127 – 133 billion). The consensus estimate aligns closely at $131.5 billion.

Pachter thinks there could be over $2.2 billion in combined growth for online stores (at around $300 million), physical stores ($300 million), and third-party seller services ($1.6 billion), based on “recent sequential trends combined with an improving macro environment and upward pricing pressure.”

Further growth of $800 million should come from ad services, while subscription services could post growth of $300 million. On the other hand, impacted by “market maturity,” other incumbents “buying market share,” and Amazon’s countering decision to cut pricing so to stay competitive, Amazon Web Services (AWS) will most probably “grow slowly.”

As for the third quarter, Pachter sees the record sales notched during this year’s Prime Day event ensuring the guide could come in near to the Street’s expectations of $138 billion, which is just above Pachter’s Q3 forecast for revenue of $137 billion.

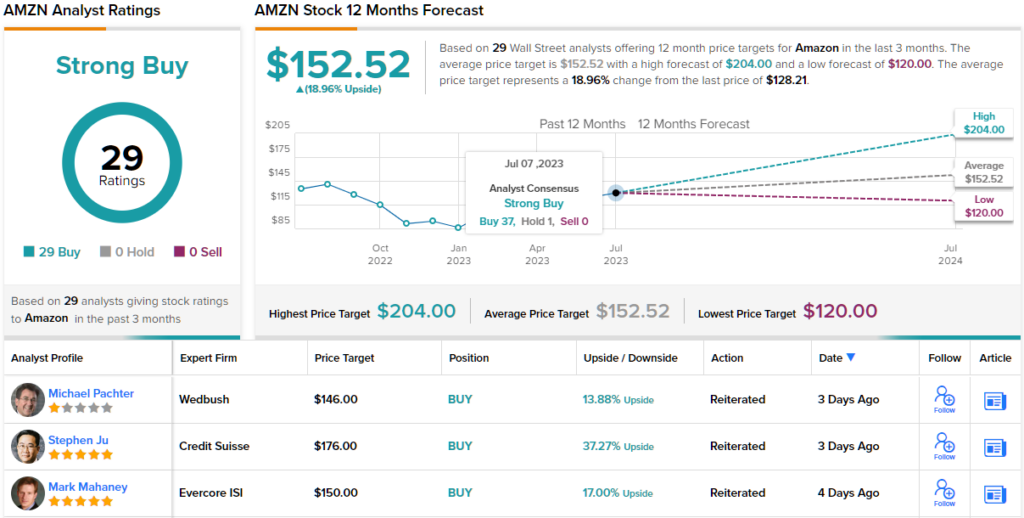

Turning now to the rest of the Street, where Amazon is that rare beast – a stock with plenty of coverage and all of it positive. The stock’s Strong Buy consensus rating is based on a unanimous 29 Buys. The average target stands at $152.52, representing one-year gains of ~19% from current levels. (See Amazon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.