With earnings season in full swing, a number of interesting earnings reports are on deck. One notable company scheduled to report its latest quarterly earnings on Thursday (April 27) is Amazon (NASDAQ:AMZN).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With shares of the tech giant climbing about 26% this year, now’s a great time to take a closer look at what we should expect.

Heading into the print, Wedbush analyst Michael Pachter predicts that Amazon will hit analyst revenue and earnings targets for Q1 2023, but expects ‘wimpy’ guidance for no more than single-digit sales gains (and potentially no gains at all) for Q2.

As Pachter explains, right now analysts on average are forecasting a $125 billion revenue quarter for Amazon in Q1, or about 8% year over year growth, with operating profits down 19% at $3 billion. Pachter himself is more optimistic about both numbers, predicting Amazon will eke out a small win on sales — $126 billion — and a much bigger win on the earnings front — $3.6 billion in operating profit.

But it’s not Q1 that’s the problem. It’s Q2, Q3, and even Q4 that investors should probably be worrying about.

Warning of weakness in Amazon’s core retail business, only partially offset by continuing layoffs among its workforce, Pachter sees Amazon guiding significantly below what other investors expect, when earnings come out after close of trading this Wednesday. Pachter indicates that the consensus on Wall Street is that Amazon will grow sales sequentially to $130 billion in Q2, and boost its profits even higher, to $4.3 billion. But Pachter’s not at all on board with this thesis, predicting instead that both numbers will “fall well below Q2:23 consensus estimates.”

Prime subscriptions, advertising revenues, and AWS cloud services all remain growth markets for Amazon, in this analyst’s opinion, but Amazon is not immune to the “tough times” facing other retail businesses right now. (Cough, cough, Bed Bath & Beyond). Even with Amazon currently having a “quite large” workforce in retail (read: “too large”), permitting it to undertake layoffs “with little impact on revenue growth” and potentially benefitting profit margins, the overall retail environment isn’t great right now, and that’s not great news for Amazon’s highest profile division.

In Pachter’s view, it’s probably not going to be until the long-awaited recession arrives, runs its course, and goes away again — “likely later in 2023” — before the retail business begins to noticeably re-accelerate. And indeed, it’s unlikely that Amazon would be laying off retail employees now if it expected the retail biz to perk back up in short order, at which point it would just have to hire those employees right back again! Thus, the fact that Amazon is still laying off workers suggests that Pachter is probably right about a better retail environment still being at least a couple quarters away — and possibly more than a couple.

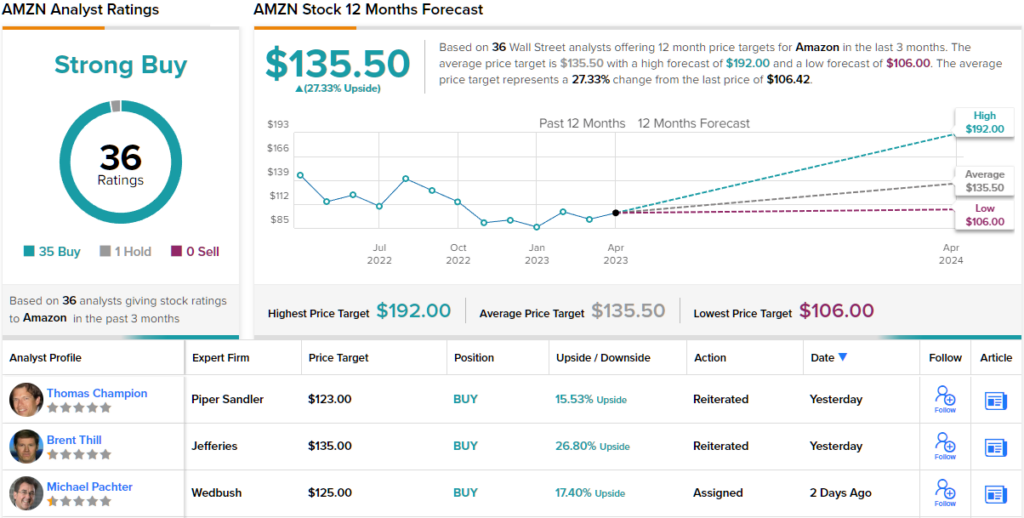

Overall, Pachter rates AMZN shares an Outperform (i.e. Buy) along with a $125 price target, which implies ~17% upside from current levels. (To view Pachter’s track record, click here)

So, that’s Wedbush’s outlook, but what does the rest of the Street have in mind for the tech giant? About the same, as it happens. The analyst consensus rates this stock a Strong Buy, based on 35 Buys vs. 1 Hold. There’s decent upside in the cards too; going by the $135.50 average price target, shares will appreciate ~27% over the coming months. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.