Here come the tech giants. Many of the market leaders will be delivering their latest quarterly statements this week, and after the closing bell today, Alphabet (NASDAQ:GOOGL) will step up to announce its Q3 results.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Ahead of the print, J.P. Morgan analyst Doug Anmuth notes that compared to other big names, when talking to investors, GOOGL comes up the least in conversations. This could be due to its lower level of controversy (as third-party data isn’t as significant a concern as it is for Amazon) and the fact that it has given very limited guidance for the future in its earnings reports (for example, it hasn’t provided any expense or capital expenditure guidance for 2024, unlike Meta).

At the same time, since the Q2 report, GOOGL shares are up by 11%, a far better performance than the S&P 500’s 7.5% retreat. That positive investor sentiment is echoed by Anmuth, who is upbeat about what might be coming next.

“We came away from 2Q earnings incrementally positive on GOOGL, and despite the outperformance of shares, we believe the setup is good as GOOGL should continue to have accelerating growth into 2024 & potential for greater leverage in year 2 of re-engineering the cost structure,” says the 5-star analyst. “Gen AI updates should also prove incrementally positive across Search and Cloud, w/AI model Gemini to be released.”

As for the quarterly update, Anmuth thinks the online advertising market performed well in Q3. This, coupled with more favorable comps, is expected to result in an increase in Search revenue growth to around 10% year-over-year, up from the 5% growth seen in the second quarter. Additionally, the analyst expects YouTube ad revenue growth to reach around 9% YoY, marking an improvement from the 4% growth observed in Q2. On the other hand, due to “ongoing industry-wide spend optimization,” Anmuth anticipates Google Cloud revenue growth will decelerate from the +28% seen in Q2 to +25% YoY in Q3.

In total, Anmuth is calling for revenue to grow by 9.6% YoY FXHN (FX and hedging neutral) to $75.4 billion (in line with consensus at $75.5 billion) and EPS of $1.46, slightly higher than the Street’s forecast of $1.44.

So, what does this ultimately mean for investors? Anmuth maintained an Overweight (i.e., Buy) rating on the shares, backed by a $150 price target. There’s potential upside of 8% from current levels. (To watch Anmuth’s track record, click here)

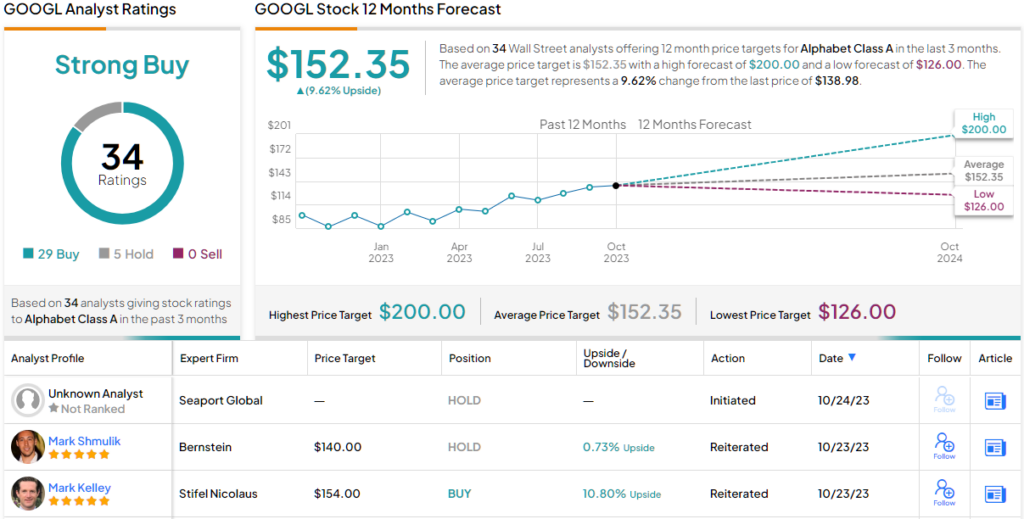

How does Anmuth’s bullish forecast echo against the word of the Street? Quite positively, it seems, as TipRanks analytics exhibit GOOGL as a Strong Buy. Based on 34 analysts polled by TipRanks in the last 3 months, 29 rate the stock a Buy, while 5 maintain a Hold. (See Alphabet stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.